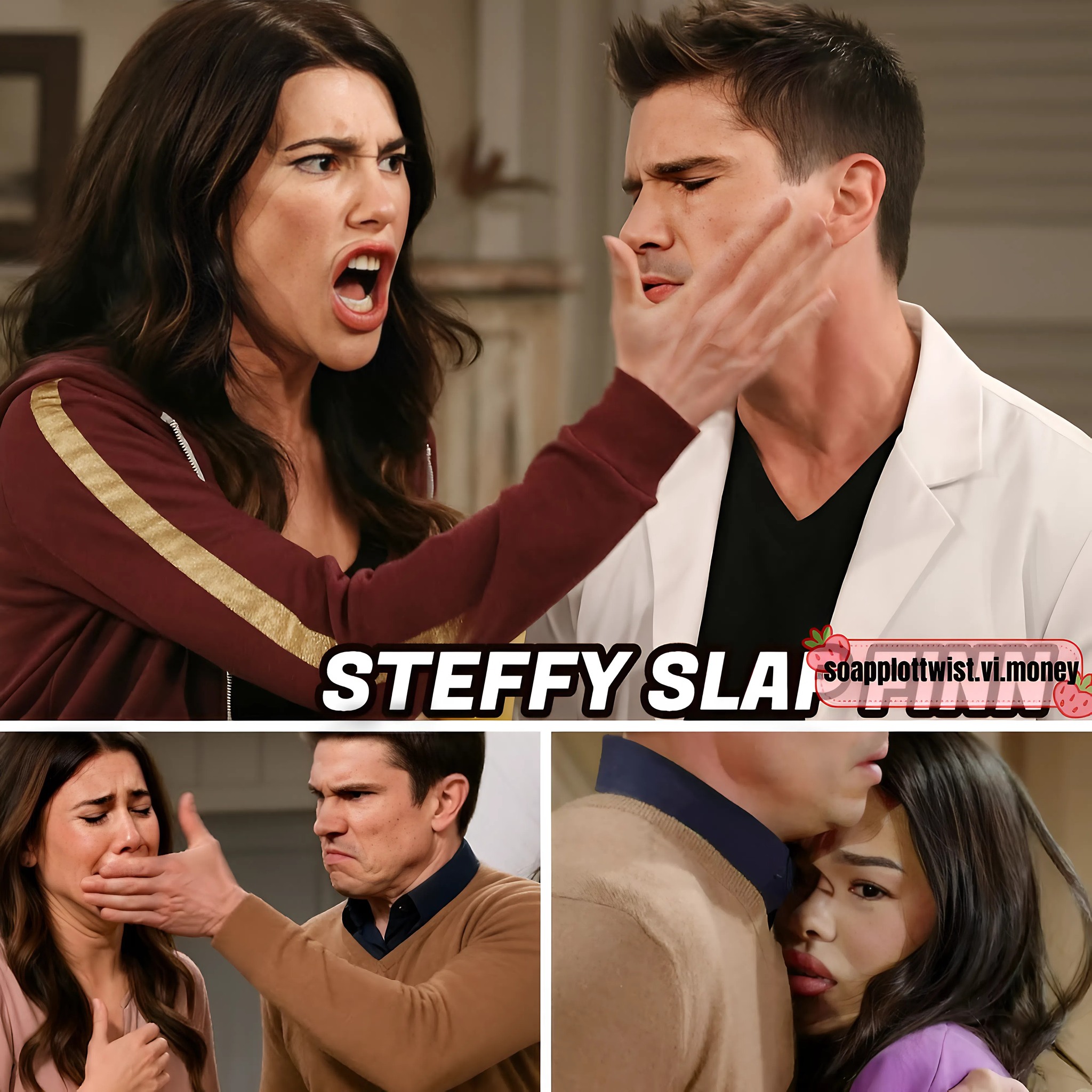

In a shocking twist that’s left The Bold and the Beautiful fans reeling, the world of Steffy Forrester and Dr. John “Finn” Finnegan has imploded in dramatic fashion. What was meant to be a heartfelt homecoming turned into a brutal reckoning, as deep betrayals, long-buried secrets, and impossible choices pushed this once-golden couple to the brink — and beyond.

Steffy’s return from Europe was meant to mark a new beginning. Instead, it brought the end of everything.

A Jet-Set Return to Chaos

As the golden California sun set over the Forrester estate, Steffy stepped off her private jet with a hopeful heart and designer luggage in tow. She had spent weeks abroad, seeking healing after a harrowing ordeal that left her scarred both physically and emotionally. Her sabbatical in the serene European countryside was a deliberate attempt to process the trauma inflicted by Luna Nozawa — a woman Steffy believed was dead and buried in the rubble of her past.

But in true Bold and the Beautiful fashion, the dead rarely stay dead — and secrets never stay buried.

From the moment she entered the cliff house, Steffy sensed something was off. The warmth in Finn’s eyes had been replaced with tension. His body language screamed guilt. And when she demanded the truth, what she received shattered her like fine crystal dropped from a rooftop.

“Luna’s alive,” Finn confessed, voice heavy with dread. “She survived… and she’s pregnant with Will Spencer’s baby.”

Luna’s Return — And A Pregnancy That Changes Everything

To Steffy, it was the ultimate betrayal. Luna Nozawa, the woman who had tried to kill her — twice — was not only alive, but now a permanent fixture in the Forrester and Spencer web thanks to her unborn child. The gravity of it all was almost too much to bear. Steffy had barely begun healing from the nightmares Luna left in her wake: drugging her, trapping her in a condemned building, attempting to erase her from existence.

Now, that very woman was carrying the heir of the powerful Spencer family.

“How long have you known?” Steffy asked, barely above a whisper. Finn’s silence spoke volumes. Her heart broke again — not because of Luna’s return, but because the man she loved and trusted most had kept this devastating truth from her.

But the pain was far from over.

Finn Crosses the Line

As if the revelation of Luna’s survival and pregnancy wasn’t catastrophic enough, Finn delivered the coup de grâce — a declaration that brought their marriage to its knees.

“I want to help raise the baby,” he said, his voice shaking. “She’s scared and alone. This child is innocent. I just… I can’t turn my back.”

The words hit Steffy like a punch to the chest. The slap that followed was swift, brutal, and symbolic — the sound of love breaking. Her palm struck his cheek with a thunderclap, but the deeper wound was invisible, buried beneath years of trust, now obliterated.

“Are you out of your mind?” Steffy cried, tears welling in her eyes. “She tried to murder me. Drugged me. Left me to die. And now you want to help her?”

The Cliff House Becomes a War Zone

What followed was one of the most emotionally charged arguments in B&B history. Finn pleaded for compassion, reminding Steffy that the unborn child had done nothing wrong. He insisted he wasn’t choosing Luna, but rather, trying to do what he believed was right.

But to Steffy, his intentions didn’t matter. All she saw was a pattern.

“You chose Sheila over us. And now Luna,” she shouted. “It’s always the same. Your loyalty lies with the people who hurt our family!”

The air between them crackled with tension. Neighbors reportedly heard the shouting from down the beach, as what was once a home filled with love dissolved into accusations, disbelief, and heartbreak.

Steffy’s Breaking Point

As dusk fell and silence finally replaced the shouting, Steffy stood in the doorway of the cliff house, her silhouette bathed in amber light.

“I can’t do this anymore,” she said, her voice drained of anger but full of resolve. “I won’t be married to someone who defends the woman who tried to kill me. I want a divorce.”

The words landed like a death knell. Finn tried to reach for her, but she stepped back, a symbolic — and final — retreat. The walls they’d built together crumbled in seconds, and the future they’d envisioned evaporated before their eyes.

The Fallout: Families at War

The aftermath was swift, severe, and far-reaching.

Ridge Forrester was incensed. Already wary of Finn due to past alliances with Sheila Carter, Ridge exploded upon learning that Finn wanted to take on a paternal role in Luna’s child’s life. To him, it wasn’t just a betrayal — it was a confirmation of every fear he’d had about Finn’s judgment.

At the Spencer mansion, tensions were even higher. Bill Spencer and Katie Logan were grappling with the shocking news that their son, Will, might be tied to Luna forever. Bill’s fury grew by the hour, threatening legal and personal retaliation against Luna — and possibly Finn for involving himself in Spencer business.

Even Taylor Hayes and Brooke Logan found common ground, united in concern for Steffy’s well-being. Their shared history with Finn and Luna — not to mention their deep-rooted maternal instincts — made it clear: Luna was a danger, pregnancy or not.

Finn Left Alone — And Haunted

As Steffy packed up their life together, Finn was left in the ruins of their love. He tried to convince himself he had done the right thing — that helping a child was never wrong. But the cost was staggering.

When the divorce papers arrived, he stared at Steffy’s signature — once etched in love notes, now etched in heartbreak — and felt a hollow ache settle in his chest.

His medical oath, his compassion, and his stubborn need to fix broken things had come at the price of the one relationship he vowed never to lose. Now, he was alone.

Top 10 Cities for Multifamily Real Estate Investment: An Expert’s 2025 Outlook

As a seasoned professional with over a decade immersed in the trenches of multifamily real estate, I’ve witnessed market cycles ebb and flow, identified emerging trends before they hit the mainstream, and guided countless investors toward lucrative opportunities. The past few years have certainly presented their share of unique challenges for the multifamily sector, with supply-demand dynamics creating some headwind. However, as we look ahead to 2025, the landscape is not just stabilizing—it’s brimming with renewed potential. Experts across the board are forecasting a healthy realignment of supply and demand, paving the way for sustained positive rent growth and robust investor returns.

For those contemplating real estate investment or looking to expand their multifamily property acquisition strategy, 2025 offers a compelling entry point. The sector is poised for a significant rebound, making it an opportune moment to secure cash flow properties and diversify your real estate portfolio. But the critical question, as always, is where to invest. Not all markets are created equal, and pinpointing the best cities for real estate investment requires a meticulous deep dive into economic fundamentals, demographic shifts, and local market nuances.

This comprehensive guide, born from extensive data analysis and hands-on market experience, unveils the top 10 cities primed for multifamily real estate investing in 2025. We’ll explore the underlying drivers, dissect key metrics like occupancy rates, cap rates, and price-to-rent ratios, and provide you with the insights needed to make informed, strategic decisions. My goal is to equip you with the knowledge to identify high yield real estate investments and capitalize on the next wave of growth in the multifamily market.

Why Multifamily in 2025? A Deeper Dive into Market Fundamentals

Before we unveil the list, let’s briefly reinforce why multifamily remains an attractive asset class, particularly heading into 2025. This isn’t just about chasing capital appreciation properties; it’s about building a resilient portfolio.

Inflation Hedge: Real estate, especially income-generating assets like multifamily, historically serves as a strong hedge against inflation. Rents tend to rise with the cost of living, protecting your purchasing power.

Steady Demand Drivers: Despite economic fluctuations, the fundamental need for housing persists. Population growth, evolving household formation patterns, and a significant portion of the population choosing to rent (driven by affordability challenges in the single-family market) ensure a consistent rental demand. This underpins passive income real estate strategies.

Economic Resilience: Multifamily often demonstrates greater resilience during downturns compared to other commercial real estate investment opportunities. People always need a place to live, making it a defensive play.

Favorable Demographics: Millennial and Gen Z cohorts, now forming the largest segments of the workforce, are increasingly opting for rental living due to lifestyle choices, student loan debt, and delayed homeownership. This fuels urban development investments and suburban apartment growth.

Diversification & Risk Mitigation: Adding multifamily assets can significantly diversify an investor’s portfolio, mitigating risks associated with over-reliance on a single asset class.

Potential for Value-Add: Many properties offer opportunities for strategic renovations, operational improvements, and amenity upgrades, allowing investors to boost return on investment (ROI) and create significant equity.

The real estate market trends 2025 point towards a return to more normalized conditions, but with persistent demand for quality rental housing. Understanding these foundational elements is crucial for any serious investor in the multifamily space.

Our Methodology: Identifying Tomorrow’s Top Markets

Pinpointing the top investment cities isn’t a dart-throwing exercise. It requires a robust analytical framework that goes beyond surface-level statistics. My team’s approach combines quantitative data with qualitative market intelligence, assessing a multitude of factors to identify areas ripe for multifamily investment.

Key metrics and considerations include:

Population Growth: A strong indicator of future rental demand. We look for sustained inbound migration and household formation.

Job Market Strength & Diversity: Cities with robust and diversified economies are less susceptible to single-industry downturns, ensuring residents have stable income to pay rent.

Affordability & Price-to-Rent Ratio: This metric highlights markets where renting remains a more viable option than buying, driving sustained rental demand. A lower ratio often indicates a healthier cash flow environment for investors.

Occupancy Rates: High and stable occupancy rates signify strong demand relative to supply, translating to consistent rental income for investors.

Cap Rates (Capitalization Rates): A crucial measure of a property’s potential return on investment. Higher cap rates often suggest greater immediate cash flow.

Supply Pipeline: Understanding the volume of new construction entering the market is essential to assess potential oversupply risk.

Infrastructure & Quality of Life: Investment in infrastructure, good schools, cultural amenities, and recreational opportunities attracts residents and businesses.

Regulatory Environment: Favorable landlord-tenant laws and predictable zoning can significantly impact an investor’s experience and profitability.

With these considerations at the forefront, let’s explore the cities poised to deliver exceptional opportunities in real estate investing 2025.

The 10 Best Cities for Multifamily Investing in 2025

Las Vegas, Nevada: The Resilient Oasis of Opportunity

Las Vegas, a market I’ve personally been deeply involved in for over a decade, continues to defy expectations and rank among the best cities for real estate investment in 2025. Far from being solely reliant on tourism, the city has successfully diversified its economy, attracting tech companies, manufacturing, and logistics. This economic evolution fuels sustained population growth and a constant influx of new residents seeking affordable housing opportunities relative to coastal California markets. The lack of state income tax is a massive draw for both businesses and individuals, enhancing the appeal of rental income properties.

The market’s occupancy rate consistently hovers in the low 90s, a testament to robust demand. While the median property price has appreciated, the cap rates between 5.5-6% still offer attractive entry points for multifamily property acquisition. The price-to-rent ratio of 19.2 indicates that renting remains a strong option, supporting a healthy rental demand even amidst rising property values. Investors here benefit from strong fundamentals and a pro-business environment, positioning Las Vegas as a top-tier option for high yield real estate investments.

Median Property Price (Multifamily Average): $417,000

Occupancy Rate: 91% (Q3 2024, projected for 2025 stability)

Cap Rate: 5.5-6%

Price-to-Rent Ratio: 19.2

Average Rent: $1,800

Key Drivers: Economic diversification, no state income tax, continued inbound migration from California.

Atlanta, Georgia: The Southern Economic Powerhouse

Atlanta’s multifamily market is nothing short of dynamic. The metropolitan area boasts a booming, diversified job market strength spanning tech, film, logistics, and healthcare, drawing thousands of new residents annually. This relentless population growth is the primary engine behind its strong rental demand. Even with a healthy pipeline of new construction, Atlanta’s ability to absorb units quarter after quarter speaks volumes about its underlying economic vitality. For investors, this translates into reliable cash flow properties and significant long-term appreciation potential.

The slightly lower occupancy rate of 88% reflects recent supply additions but is still very healthy given the absorption rates. A cap rate of 5.6% provides an appealing return profile, especially when coupled with a competitive price-to-rent ratio of 16, which underscores the value proposition for renters. Atlanta offers a powerful combination of affordability, economic dynamism, and strategic location, making it a cornerstone for multifamily real estate investing in the Southeast.

Median Property Price (Multifamily Average): $400,000

Occupancy Rate: 88%

Cap Rate: 5.6%

Price-to-Rent Ratio: 16

Average Rent: $1,600

Key Drivers: Robust and diversified economy, rapid population growth, strong corporate relocations, affordability.

Charlotte, North Carolina: The Queen City’s Ascendant Multifamily Market

Charlotte continues its reign as a top-performing multifamily market in 2025, driven by formidable population growth and a thriving financial sector. It’s not just banks; the city is expanding into energy, tech, and healthcare, creating a broad base for job market strength. The high-growth Carolinas region benefits immensely from Charlotte’s urban appeal, attracting young professionals and families alike. This sustained influx directly translates into high demand for quality rental housing across all segments.

With an impressive occupancy rate of 92%, Charlotte demonstrates exceptional stability and strong rental demand. The cap rate of 5.5% is attractive, and the price-to-rent ratio of 17-18 indicates a balanced market where renting makes financial sense for a large segment of the population. Investors in Charlotte can expect a healthy blend of steady income from passive income real estate and long-term capital appreciation properties. Its continued trajectory makes it an ideal spot for real estate portfolio diversification.

Median Property Price (Multifamily Average): $375,000-$400,000

Occupancy Rate: 92%

Cap Rate: 5.5%

Price-to-Rent Ratio: 17-18

Average Rent: $1,800

Key Drivers: Financial sector hub, diverse economy, exceptional population growth, appealing quality of life.

Tampa, Florida: Sunshine State’s Multifamily Gem

Florida’s pro-business climate, including zero state income tax and relatively moderate property taxes, makes it an enduring magnet for both residents and real estate investment capital. Tampa, in particular, stands out for its diversified economy encompassing healthcare, finance, tech, and tourism, which underpins its strong job market strength. Its rapid population growth is well-documented, with inbound migration contributing significantly to sustained rental demand. The long-term outlook for Tampa’s multifamily market remains overwhelmingly positive.

Tampa’s occupancy rate hovers around 90%, reflecting a healthy balance of supply and demand. The cap rate of 5.5% is appealing, but what truly distinguishes Tampa is its price-to-rent ratio of 14—one of the most favorable on this list. This low ratio suggests that buying remains relatively expensive compared to renting, thus bolstering the prospects for cash flow properties and strong rental income properties. For investors seeking a blend of growth and robust income in real estate investing 2025, Tampa offers a compelling proposition.

Median Property Price (Multifamily Average): $367,000

Occupancy Rate: 90%

Cap Rate: 5.5%

Price-to-Rent Ratio: 14

Average Rent: $1,800

Key Drivers: No state income tax, strong population growth, diversified economy, high quality of life, strong rental affordability.

Denver, Colorado: The Mile-High City’s Enduring Appeal

Denver’s multifamily market continues to exhibit strength in 2025, buoyed by a robust economy and consistent population growth. The city has become a hub for tech, aerospace, and outdoor recreation industries, attracting a highly educated and affluent workforce. This strong job market strength ensures high demand for quality housing, both for sale and for rent. Despite rising property values, Denver experiences high absorption rates for new multifamily property acquisition units, indicating persistent demand.

While Denver’s median property price is higher, reflecting its desirability, the occupancy rate of 89.5% remains strong. The cap rate of 5.2% is slightly lower than some other markets on this list, indicative of a more mature, lower-risk market. The price-to-rent ratio of 23 suggests that owning is significantly more expensive than renting, further reinforcing rental demand and the attractiveness of passive income real estate. Denver offers a blend of stability and continued growth, making it a solid choice for discerning investors seeking long-term capital appreciation properties.

Median Property Price (Multifamily Average): $586,000

Occupancy Rate: 89.5%

Cap Rate: 5.2%

Price-to-Rent Ratio: 23

Average Rent: $1,800

Key Drivers: High-income job growth, educated workforce, strong quality of life, limited developable land.

Nashville, Tennessee: Music City’s Harmony of Growth and Investment

Nashville has consistently been highlighted as one of the best cities for real estate investment for good reason, and 2025 is no exception. Beyond its iconic music industry, Nashville has diversified into healthcare, tech, and automotive manufacturing, creating a powerful economic engine. The city’s vibrant culture, burgeoning culinary scene, and lack of state income tax attract a steady stream of new residents, fueling significant population growth and robust rental demand. Investors I’ve worked with here have consistently seen strong returns on their multifamily property acquisition strategies.

With an occupancy rate of 88%, Nashville’s market handles new supply well. The cap rate of 5.5% provides attractive returns, and a price-to-rent ratio of 19 confirms that renting remains a sensible choice for many residents, bolstering cash flow properties. Nashville offers a unique blend of cultural appeal, economic vitality, and investor-friendly policies, making it a standout for those seeking high yield real estate investments in the Southeast.

Median Property Price (Multifamily Average): $455,000

Occupancy Rate: 88%

Cap Rate: 5.5%

Price-to-Rent Ratio: 19

Average Rent: $1,900

Key Drivers: Diverse economy, no state income tax, strong cultural appeal, consistent population influx.

San Diego, California: Coastal Rarity with Enduring Demand

San Diego’s multifamily market operates under a unique set of circumstances that make it exceptionally appealing: limited supply coupled with persistent, strong demand. Strict zoning laws and geographical constraints severely restrict new development, creating an inherent supply shortage. Meanwhile, the region’s desirable climate, robust biotech and tech sectors, and significant military presence continue to drive population growth and attract high-income earners. This dynamic ensures incredibly strong rental demand for luxury multifamily and affordable housing opportunities alike.

The standout metric here is the incredibly high occupancy rate of 95%, which speaks volumes about the scarcity of available units. While the median property price is significantly higher, reflecting the premium of coastal California, the cap rate of 4.6% is reflective of a very stable, low-risk market with strong capital appreciation properties. The price-to-rent ratio of 24 further emphasizes the cost advantage of renting over buying, securing the future of rental income properties. For investors focused on long-term wealth preservation and appreciation, San Diego is a unique, albeit expensive, opportunity among top investment cities.

Median Property Price (Multifamily Average): $876,000

Occupancy Rate: 95%

Cap Rate: 4.6%

Price-to-Rent Ratio: 24

Average Rent: $2,500-$3,000

Key Drivers: Limited supply, strong demand, high-income job base, exceptional quality of life, coastal desirability.

Salt Lake City, Utah: Mountain West’s Ascending Star

Salt Lake City has emerged as a formidable player in the multifamily real estate investing landscape, a testament to its burgeoning tech sector (“Silicon Slopes”) and unparalleled natural beauty. The region attracts businesses and residents with its strong economy, affordable housing opportunities relative to coastal hubs, and excellent quality of life. Population growth here has been robust, driven by both inbound migration and a high birth rate, ensuring a steady increase in rental demand.

With a remarkable occupancy rate of 94%, Salt Lake City showcases an extremely tight market, indicating high demand for investment property. The cap rate of 5.5% offers attractive returns, while the price-to-rent ratio of 25-26 signals that owning is significantly more expensive than renting. This dynamic strongly favors passive income real estate and strengthens the viability of cash flow properties. Salt Lake City embodies a balanced growth story, making it an excellent candidate for real estate portfolio diversification in 2025.

Median Property Price (Multifamily Average): $526,000

Occupancy Rate: 94%

Cap Rate: 5.5%

Price-to-Rent Ratio: 25-26

Average Rent: $1,700

Key Drivers: Tech boom (“Silicon Slopes”), strong demographic trends, high quality of life, relative affordability.

Columbus, Ohio: Midwest’s Surprising Growth Engine

Columbus is an often-underestimated powerhouse in the Midwest, offering a compelling blend of solid economic growth and impressive affordability, making it a prime target for multifamily real estate investing in 2025. The state capital boasts a diverse economy with strengths in education (Ohio State University), healthcare, tech, and logistics. This economic diversity translates into stable job market strength and consistent population growth, ensuring steady rental demand.

What makes Columbus particularly attractive for investment property is its stellar cap rate of 6.8%—one of the highest on this list. This indicates excellent potential for immediate cash flow properties and strong return on investment. With an occupancy rate of 92% and a highly favorable price-to-rent ratio of 15, Columbus offers an exceptional balance of strong returns and lower entry costs. For investors seeking high yield real estate investments without the higher price tags of coastal markets, Columbus is a clear standout.

Median Property Price (Multifamily Average): $277,000

Occupancy Rate: 92%

Cap Rate: 6.8%

Price-to-Rent Ratio: 15

Average Rent: $1,530

Key Drivers: Diversified economy, major university presence, strong affordability, robust job creation.

Dallas, Texas: The Megacity’s Multifamily Dominance

Rounding out our list of best cities for real estate investment is Dallas, a titan in the national apartment market. As part of the sprawling DFW Metroplex, Dallas benefits from unparalleled corporate relocation activity, strong job market strength across diverse sectors (finance, tech, energy, logistics), and a consistent influx of new residents. The absence of state income tax in Texas is a perpetual draw, accelerating population growth and fueling relentless rental demand across all segments, from luxury multifamily to more affordable housing opportunities.

Dallas maintains a healthy occupancy rate of 89%, a remarkable feat given the sheer scale of its market and ongoing development. Cap rates typically range from 5-5.5%, providing solid returns, and a price-to-rent ratio of 18 underscores the economic viability of renting. The sheer volume and liquidity of the Dallas multifamily market make it a stable and attractive environment for large-scale multifamily property acquisition and real estate portfolio diversification. Its economic engine shows no signs of slowing down, solidifying its position as a top choice for real estate investing 2025.

Median Property Price (Multifamily Average): $390,000

Occupancy Rate: 89%

Cap Rate: 5-5.5%

Price-to-Rent Ratio: 18

Average Rent: $1,800

Key Drivers: Massive job growth, corporate relocations, no state income tax, diverse economy, major transportation hub.

Beyond the List: Strategic Principles for 2025 Multifamily Success

Identifying the top investment cities is merely the first step. True success in multifamily real estate investing hinges on adhering to sound investment principles, especially in an evolving market.

Rigorous Due Diligence: Never cut corners. Thoroughly vet every investment property – analyze financials, conduct comprehensive property inspections, review leases, and understand local regulations. This protects your return on investment and mitigates unforeseen risks.

Understand Market Cycles: While 2025 looks promising, markets are cyclical. A long-term perspective, coupled with an understanding of where a market stands in its cycle (growth, maturity, correction), is critical for sustainable capital appreciation properties.

Leverage Wisely: Financing is a powerful tool, but over-leveraging can amplify risks. Optimize your debt structure to ensure healthy cash flow properties even under varying market conditions. Explore various loan products and find the right fit for your multifamily property acquisition.

Effective Property Management: A good property manager is an invaluable asset. They ensure high occupancy rates, maintain tenant satisfaction, and preserve property value, directly impacting your passive income real estate returns.

Focus on Value-Add: Look for opportunities to enhance property value through strategic renovations, amenity upgrades, or improved operational efficiencies. This can significantly boost your return on investment beyond simple market appreciation.

Diversify Your Portfolio: Even within multifamily, consider diversifying by property type (e.g., Class A, B, C), submarket, and geographic location. This reduces overall real estate portfolio diversification risk.

The real estate market trends 2025 are signaling a positive shift, but an expert approach, grounded in data and experience, will differentiate successful investors.

Seize Your Opportunity in the 2025 Multifamily Market

The outlook for multifamily real estate investing in 2025 is bright, with many markets demonstrating robust fundamentals and strong growth trajectories. The cities highlighted in this article represent compelling opportunities for investors seeking to generate high yield real estate investments, build passive income real estate streams, and achieve substantial capital appreciation properties.

Navigating these dynamic markets, however, requires more than just a list of promising locations; it demands a deep understanding of market intricacies, a keen eye for value, and strategic execution. Don’t let opportunity pass you by. If you’re ready to explore how these top-tier markets can fit into your real estate portfolio diversification strategy, or if you need expert guidance on your next multifamily property acquisition, connect with a trusted advisor today. Let’s transform these insights into tangible success for your investment future.