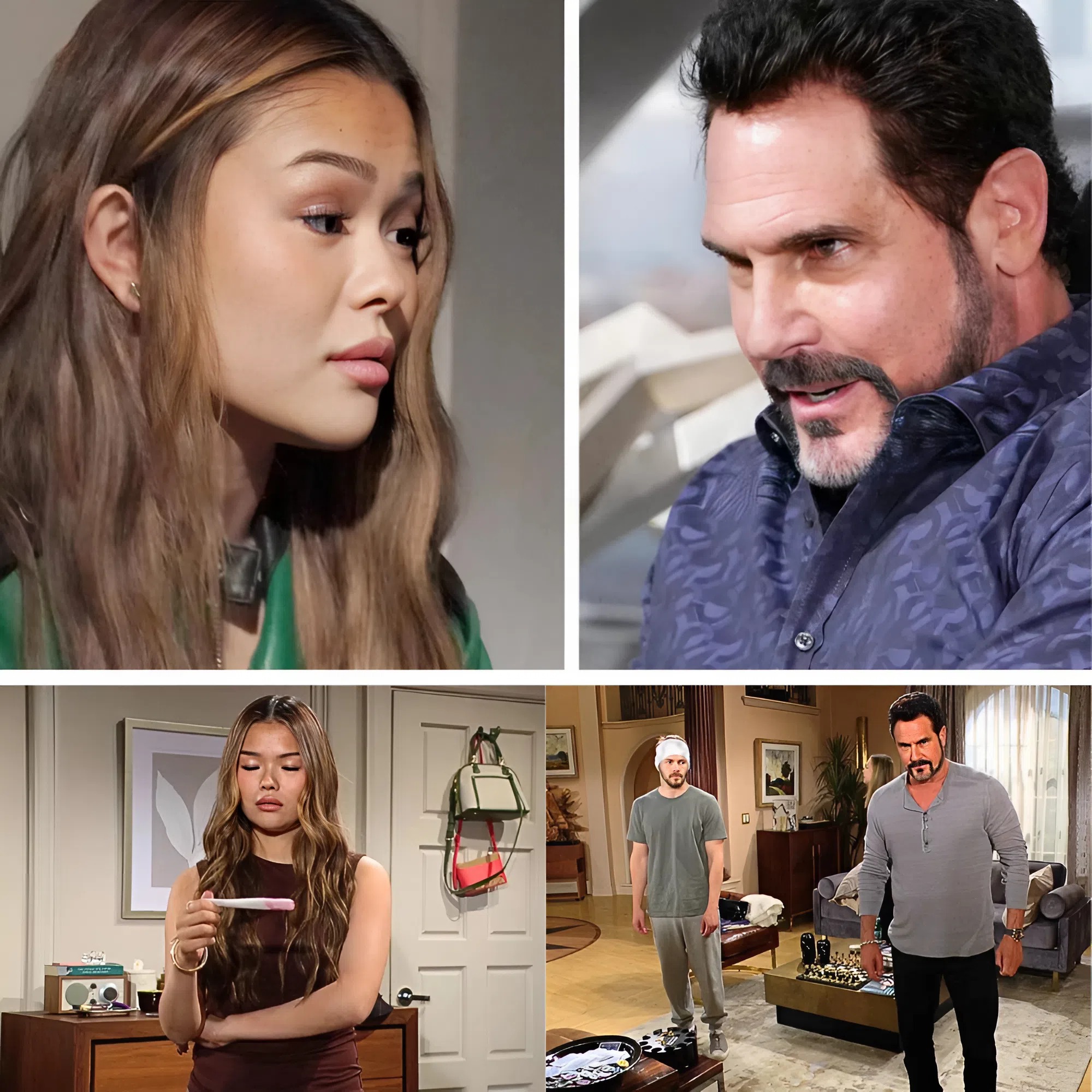

Liam Becomes Will’s Protector

Liam Spencer is stepping into detective mode as he helps his younger brother, Will, piece together the fragments of a confusing and painful night. Fans recall Luna Nozawa cleverly manipulated Will by getting him intoxicated, disguising herself as Electra Forrester, and taking advantage of him.

Now Will is plagued by cryptic texts from a “secret admirer.” Each message carries eerie clues, including a photo of the mask Luna wore that night. Unable to ignore the torment, Will turns to Liam. Drawing on his old tech skills, Liam traces the digital trail and narrows the source to a luxury high-rise. The results point toward just three possible apartments—one of which belongs to Luna.

The Confrontation at Luna’s Doorstep

Armed with Liam’s findings, Will storms into the building. To his shock, he finds Luna’s door ajar. Inside, the loft is filled with sketches, fashion notes, and even signs of obsession with Will himself.

Caught off guard, Luna must choose: confess the truth or keep spinning lies. This pivotal moment could expose her schemes and shake up her already fragile relationships with the Spencers and Forresters. Fans can expect high drama as Luna struggles to explain whether the texts were desperate cries for attention or part of a darker game.

Family Feuds Explode: Thomas vs. Brooke

Meanwhile, tensions are boiling over in the Forrester mansion. Thomas Forrester unleashes years of resentment against Brooke Logan. He blames her for tearing his family apart and dredges up painful memories—from Douglas’ custody battles to past betrayals.

Brooke, never one to back down, stands her ground. But Thomas’ fury is raw, personal, and relentless. With family portraits surrounding them, their fight underscores the decades of turmoil between the Forresters and Logans. Spoilers hint Thomas could even uncover childhood memories or written confessions that intensify his anger, making reconciliation nearly impossible.

Ridge Breaks Taylor’s Heart

At the same time, Ridge Forrester leaves Taylor Hayes reeling. Just days ago, the couple was planning a wedding filled with roses and promises of a future together. But Ridge pulls the plug, admitting he cannot set a date or commit fully.

Taylor pleads with him, reminding Ridge of their history and deep emotional connection. Her words are powerful, but Ridge seems torn by doubts and distractions. This heartbreaking twist puts their engagement in jeopardy and raises the question—has Taylor lost him forever?

Poppy and Lee’s Explosive Showdown

Away from the romance chaos, the Nozawa family erupts. Poppy Nozawa discovers that her sister, Lee Finnegan, faked Luna’s death in order to protect her from scandal and prison. Furious, Poppy lashes out, accusing Lee of betraying her moral code as a doctor.

Their confrontation crackles with years of sibling rivalry. Poppy claims Lee’s protective instincts will backfire, warning her: “You’re going to regret this.” With Luna still reckless and scheming, Poppy predicts more chaos ahead—chaos that could drag both sisters and the Forresters into a storm of betrayal and heartbreak.

What’s Next on The Bold and the Beautiful

As September 8–12 unfolds, the soap delivers classic twists—family loyalty tested, secrets on the verge of exploding, and romances pushed to breaking point.

- Liam and Will team up in an emotional brotherly bond, chasing down the truth about Luna’s betrayal.

- Thomas wages a bitter war of words with Brooke, reopening old wounds.

- Ridge devastates Taylor by calling off their future together.

- Poppy and Lee ignite an unforgettable family feud over Luna’s fate.

Viewers can expect explosive confrontations, shocking revelations, and ripple effects that will rock the Spencers, Logans, Forresters, and Nozawas alike.

Your Blueprint for Buying Right: 10 Critical Mistakes First-Time Homebuyers Must Avoid in 2025

The American dream of homeownership remains vibrant, but the path to achieving it has grown increasingly complex. As a seasoned real estate expert with over a decade navigating the ebbs and flows of the U.S. market, I’ve witnessed countless first-time homebuyers make preventable missteps that cost them time, money, and peace of mind. In 2025, with fluctuating interest rates, competitive markets, and evolving financial landscapes, being prepared is not just an advantage—it’s a necessity.

This isn’t just a transaction; it’s one of the most significant financial investments of your life. My goal is to equip you with the foresight to sidestep these common pitfalls, ensuring your journey into homeownership is as smooth and successful as possible. Let’s dive into the ten critical mistakes to avoid.

Mistake #1: Skipping the Crucial Pre-Approval Process

Many aspiring homeowners jump straight into browsing Zillow listings, envisioning themselves in charming bungalows or modern condos. This is a common, yet fundamental, error. Before you even set foot in an open house, mortgage pre-approval is non-negotiable. It’s more than just a piece of paper; it’s your financial passport in the competitive 2025 housing market.

The 2025 Reality: In a market where multiple offers are still common in desirable areas, sellers and their agents prioritize pre-approved buyers. Without it, you’re often not taken seriously, and any offer you make can be dismissed out of hand.

Why It Matters:

Realistic Budgeting: A pre-approval letter clearly defines your borrowing power, giving you a firm upper limit. This helps you focus your search on properties you can genuinely afford, preventing emotional attachment to homes outside your mortgage qualification.

Competitive Edge: It signals to sellers that you are a serious, qualified buyer. This can be the decisive factor in a bidding war, potentially saving you thousands by strengthening your negotiation position.

Faster Closing: Having your financial ducks in a row streamlines the underwriting process once you’re under contract, leading to a quicker closing. This is appealing to sellers eager to finalize a sale.

Identify Credit Issues Early: The pre-approval process involves a thorough review of your credit history, income, assets, and debts. This can unearth any potential credit report inaccuracies or areas needing improvement (like high debt-to-income ratios) that could hinder your ability to secure a favorable mortgage rate 2025.

How to Secure Pre-Approval in the US:

Shop Around: Don’t just go with your current bank. Research and compare best mortgage lenders—local banks, credit unions, and online lenders—for their rates, fees, and customer service.

Gather Documents: Prepare essential financial paperwork:

Proof of Income: Pay stubs (last 30-60 days), W-2s (last two years), tax returns (last two years), and if self-employed, profit & loss statements and 1099s.

Asset Information: Bank statements (last 60 days) for checking and savings, investment account statements.

Debt Information: Statements for credit cards, auto loans, student loans, and any other outstanding debts.

Identification: Driver’s license or other government-issued ID.

Submit Your Application: Lenders will run a hard credit inquiry, which may temporarily dip your score slightly.

Receive Your Letter: Once approved, you’ll get a letter stating the maximum loan amount, estimated interest rate, and terms. Remember, this is conditional and subject to final underwriting and property appraisal.

Mistake #2: Underestimating the True Cost of Homeownership

The sticker price of a home is just the beginning. Many first-time buyers are blindsided by the myriad of additional expenses that accompany homeownership. Failing to budget for these can quickly lead to financial strain and buyer’s remorse.

The 2025 Reality: Inflationary pressures can impact property taxes, utility costs, and even maintenance services. A comprehensive understanding of your ongoing financial commitment is vital.

Hidden Costs Beyond the Purchase Price:

Closing Costs: These are fees paid at the close of a real estate transaction, typically ranging from 2% to 5% of the loan amount. They include lender fees (origination, underwriting), third-party fees (appraisal, title insurance, attorney fees, survey), and prepaid expenses (property taxes, homeowners insurance). Researching closing costs explained for your state is essential.

Property Taxes: These vary drastically by state, county, and even neighborhood, often recalculated annually. Unlike the original article’s focus on Indian states, in the US, property taxes can be a significant monthly burden, often bundled into your mortgage payment (escrow). For example, New Jersey and Illinois have some of the highest effective property tax rates, while Hawaii and Alabama boast some of the lowest. This is a critical factor in understanding your overall real estate investment costs.

Homeowners Insurance: Required by lenders, this protects against damage from fire, theft, natural disasters, and liability. Premiums depend on location, home value, and deductible. In disaster-prone areas (e.g., hurricane zones in Florida, earthquake zones in California), additional coverage like flood or earthquake insurance may be necessary and expensive.

Homeowners Association (HOA) Fees: If you buy a condo, townhouse, or a home in a planned community, HOA fees are mandatory monthly payments for maintaining common areas (landscaping, pools, clubhouses) and can also cover services like trash removal or water. These fees can range from under $100 to several hundred dollars per month and are subject to increases.

Utility Connections & Services: Expect costs for activating electricity, gas, water, internet, and cable. Beyond connection fees, budgeting for ongoing monthly utility bills (heating, cooling, water, sewer, garbage) is crucial.

Maintenance and Repair Expenses: This is often the most overlooked category. Experts recommend budgeting 1% to 3% of your home’s value annually for maintenance. For a $400,000 home, that’s $4,000 to $12,000 per year.

Annual Maintenance: HVAC servicing, gutter cleaning, pest control.

Periodic Big-Ticket Items: Roof replacement (every 20-30 years, $10,000-$30,000+), water heater replacement (every 10-15 years, $1,000-$3,000), major appliance repair/replacement, exterior painting (every 5-10 years, $3,000-$10,000+).

Emergency Repairs: Burst pipes, electrical failures, unexpected appliance breakdowns. Having an emergency fund specifically for these is paramount.

Actionable Steps: Use online calculators to estimate closing costs, property taxes, and insurance premiums for specific areas you’re considering. Factor in HOA fees and a realistic maintenance budget into your monthly expenses before making an offer.

Mistake #3: Neglecting In-Depth Neighborhood Research

It’s easy to fall in love with a house, but remember you’re also buying into a neighborhood. A beautiful home in the wrong location can quickly become a source of regret. Neighborhood research for home buyers is as important as the home inspection.

The 2025 Reality: Remote work trends have shifted priorities for some, but factors like school quality, local amenities, and future development continue to heavily influence property values and quality of life.

Factors to Consider Beyond the Property Line:

Safety and Crime Rates: Utilize local police department websites, neighborhood-specific crime mapping tools, and community forums.

School Districts: Even if you don’t have children, school district quality significantly impacts property value appreciation and future resale value factors. Websites like GreatSchools.org offer ratings and reviews.

Commute Times & Transportation: Assess proximity to your workplace, public transit options (bus, train, subway), and major highways. Traffic patterns can drastically impact daily life.

Amenities and Lifestyle: Evaluate access to parks, shopping centers, grocery stores, hospitals, restaurants, and entertainment. Does the neighborhood align with your lifestyle? Are there walking/biking trails, dog parks, or community events?

Noise and Traffic Levels: Visit the neighborhood at different times of day and on weekends to gauge noise levels from roads, businesses, or flight paths.

Community Demographics and Culture: Do you feel a connection to the local community? Are there local events or community groups that appeal to you?

Future Development Plans: Research local zoning laws, proposed infrastructure projects (new roads, public transit expansions), commercial developments, or revitalization initiatives. These can significantly impact property values, either positively or negatively, and influence real estate market trends 2025. A planned commercial strip could mean more traffic, but also more convenient amenities.

Actionable Steps: Talk to potential neighbors, visit at different times of day, and explore local businesses. Check municipal planning department websites for zoning and future development proposals.

Mistake #4: Overlooking the Importance of a Professional Home Inspection

Think of a home inspection as a physical for your potential home. Skipping it, or choosing an unqualified inspector, is akin to buying a used car without having a mechanic look under the hood. It’s an invitation to costly surprises down the road.

The 2025 Reality: Older homes, particularly prevalent in many desirable US markets, can harbor significant hidden issues. Even new construction can have defects. In a seller’s market, some buyers waive inspections to win bids, a risky strategy that often backfires.

What a US Home Inspection Covers:

A professional home inspection is a non-invasive visual examination of the physical structure and systems of a home, from the roof to the foundation. This includes:

Structural Components: Foundation, walls, ceilings, floors, roof structure.

Exterior: Roof, flashing, chimneys, gutters, downspouts, siding, trim, windows, doors, decks, driveways, grading.

Interior: Walls, ceilings, floors, windows, doors, stairways, railings, countertops, cabinets.

Plumbing System: Water supply and distribution system, drain, waste, and vent systems, water heaters, and drainage sumps.

Electrical System: Service entrance conductors, service equipment, main distribution panels, branch circuits, outlets, and fixtures.

HVAC Systems: Heating and cooling equipment, ductwork, and ventilation.

Built-in Appliances: Dishwasher, oven, garbage disposal (if present).

Attic, Basement, and Crawl Space: Insulation, ventilation, moisture intrusion.

Common Issues in US Homes:

Foundation Problems: Cracks, settling, water intrusion in basements or crawl spaces.

Roof Issues: Leaks, worn shingles, damaged flashing.

Plumbing Leaks: Hidden leaks can lead to water damage, mold, and rot.

Electrical Problems: Outdated wiring (e.g., knob-and-tube, aluminum), insufficient grounding, overloaded circuits.

HVAC Malfunctions: Inefficient or failing heating/cooling systems.

Drainage Issues: Improper grading leading to water accumulation around the foundation.

Pest Infestations: Termites, carpenter ants, rodents, or other pests.

Radon Gas: A naturally occurring radioactive gas found in some areas, requiring mitigation.

How to Find a Reliable Home Inspector:

Seek Referrals: Ask your real estate agent (a good one will have a list of reputable inspectors), friends, and family for recommendations.

Check Credentials: Look for inspectors certified by nationally recognized organizations like the American Society of Home Inspectors (ASHI) or the International Association of Certified Home Inspectors (InterNACHI). These certifications indicate adherence to rigorous standards and ongoing education.

Experience and Specializations: Inquire about their experience, especially with homes similar to the one you’re buying (e.g., historic homes, new construction). Some offer specialized inspections for mold, radon, or pests.

Review Sample Reports: A detailed report is crucial. Ask to see a sample to ensure it’s comprehensive, easy to understand, and includes photos.

Accompany the Inspector: Whenever possible, walk through the property with the inspector. This allows you to ask questions directly, understand findings, and learn about the home’s systems. This directly impacts your cost of home inspection ROI.

Mistake #5: Emptying All Savings for a Down Payment

A larger down payment can reduce your monthly mortgage payments and potentially eliminate Private Mortgage Insurance (PMI). However, depleting your entire savings for the down payment is a precarious strategy, especially in 2025. It leaves you vulnerable to unexpected financial shocks.

The 2025 Reality: High inflation and economic uncertainty mean that having an accessible emergency fund is more critical than ever for homeowners.

Balancing Down Payment with Emergency Funds:

Maintain a Robust Emergency Fund: Aim for at least 3 to 6 months of essential living expenses (including your new estimated mortgage payment, utilities, and other bills) readily available in a liquid savings account. This fund acts as a safety net for job loss, medical emergencies, or unexpected home repairs.

Budget for Unexpected Home Expenses: Beyond your emergency fund, allocate a separate pool for immediate post-purchase expenses (moving costs, new furniture, minor repairs/upgrades) and ongoing maintenance. You might need new appliances sooner than you think, or discover a repair missed by the inspection.

Government Schemes and Programs for First-Time Buyers in the US:

FHA Loans: Backed by the Federal Housing Administration, these offer low down payments (as little as 3.5%) and more flexible credit requirements, making them ideal for many first-time buyers. Understanding FHA loan requirements is key.

VA Loans: For eligible veterans, service members, and surviving spouses, VA loans offer 0% down payment, competitive interest rates, and no private mortgage insurance. Researching VA loan benefits is highly recommended if you qualify.

USDA Loans: Available for properties in designated rural areas, these also offer 0% down payment options.

State and Local Down Payment Assistance (DPA) Programs: Many states, counties, and cities offer grants, second mortgages with deferred payments, or forgivable loans to help first-time homebuyers cover down payments and closing costs.

First-Time Homebuyer Tax Credits: Periodically, federal or state governments may offer tax credits for first-time buyers, providing a direct reduction in tax liability.

Alternative Down Payment Sources (Use with Caution):

Gifts from Family Members: Many loan programs allow down payments to be gifted, but strict documentation is required to prove it’s a true gift, not a loan.

Employer Assistance Programs: Some employers offer housing benefits or financial assistance to help employees purchase homes.

401(k) Loans or Withdrawals: While tempting, borrowing from your retirement account or making a hardship withdrawal should be a last resort. You repay yourself with interest, but if you leave your job, the loan balance may become immediately due, and withdrawals can incur taxes and penalties. This can significantly impact your long-term real estate wealth building.

Mistake #6: Ignoring the Resale Value

Many first-time buyers focus solely on their immediate needs and preferences, overlooking how their home will perform as an asset in the future. Ignoring resale value factors is a short-sighted approach that can limit your financial growth.

The 2025 Reality: Even if you plan to stay long-term, life happens. Job changes, family growth, or unexpected moves mean most homeowners will eventually sell. Thinking ahead about what future buyers will want is crucial.

Factors Affecting Resale Value in the US Market:

Location, Location, Location: This timeless adage holds true. Proximity to desirable school districts, major employment hubs, popular amenities, transportation, and low crime rates significantly boosts maximizing home value.

Infrastructure Development: New highways, public transit expansions, or community improvements (parks, libraries) can increase accessibility and desirability, positively impacting real estate appreciation potential.

Neighborhood Trends: Is the area gentrifying, stable, or declining? Are comparable homes appreciating? Understanding real estate market trends 2025 specific to your micro-market is crucial.

Property Condition and Upgrades: Well-maintained homes with modern kitchens, bathrooms, and energy-efficient features command higher prices. Avoid overly personalized or quirky renovations that might deter a broad range of buyers.

Curb Appeal: First impressions matter. A well-landscaped yard, inviting exterior, and good overall presentation significantly contribute to a home’s attractiveness.

Layout and Functionality: Open-concept living spaces, multiple bathrooms, and dedicated home office areas are highly sought after by today’s buyers.

Quality of Construction/Builder Reputation: Homes built by reputable builders with solid construction often hold their value better.

Actionable Steps: Consider your current needs but also project 5-10 years into the future. Research comparable home sales (comps) in the area. Consult with your real estate agent about long-term market forecasts for the neighborhood.

Mistake #7: Falling in Love with a Home Beyond Your Budget

Emotional decisions are often the most costly. It’s easy to get swept away by a home’s charm, features, or staging, but allowing emotions to override financial prudence is a recipe for mortgage stress and potential foreclosure. This is where understanding how much house can I afford truly comes into play.

The 2025 Reality: The allure of a perfect home can lead to overbidding, especially in competitive markets. However, high interest rates mean even a small overpayment can significantly increase your monthly payment over 30 years.

Tips for Staying Within Budget During House Hunting:

Set a Strict Budget Line (and Stick to It): Before you start browsing, determine your absolute maximum purchase price based on your pre-approval, comfortable monthly payment, and the hidden costs discussed in Mistake #2. Use a mortgage affordability calculator to play with different scenarios.

Distinguish Needs from Wants: Create a “must-have” list and a “nice-to-have” list. Be prepared to compromise on some “wants” to stay within budget. Do you need granite countertops, or would functional laminate suffice for now?

Avoid “Lifestyle Creep”: Don’t let your ideal home vision inflate your budget beyond what’s sustainable. Remember that buying a home is a long-term commitment; financial stability should be your priority.

Leverage Online Tools Wisely: Use real estate platforms to filter properties strictly by your maximum price. This prevents you from seeing and falling for homes you can’t afford.

Get a Great Agent: A skilled real estate agent will understand your budget and help you focus on suitable properties, even gently steering you away from temptations.

Mistake #8: Not Understanding the Legal Aspects of Real Estate

The US real estate market is governed by complex federal, state, and local laws. Ignorance of these legal intricacies can lead to significant headaches, costly litigation, or even jeopardize your ownership.

The 2025 Reality: Digital real estate transactions are increasingly common, but the underlying legal frameworks remain robust. Understanding your rights and responsibilities is paramount.

Common Legal Issues in US Real Estate:

Unclear or Defective Land Titles: This is arguably the most critical. A “cloud on title” means there’s an unresolved claim or dispute regarding ownership. This could stem from unreleased liens, undisclosed heirs, forged documents, or errors in public records. Title insurance importance cannot be overstated here; it protects you and your lender against future claims on the property’s title.

Property Liens: Unpaid debts (e.g., property taxes, contractor bills, child support) can result in a lien being placed on the property. These must be satisfied before clear title can be transferred.

Boundary Disputes: Discrepancies regarding property lines with neighbors can lead to protracted legal battles. A professional survey can identify these issues.

Easements and Encroachments: An easement grants someone else the right to use a portion of your property (e.g., utility companies, shared driveways). Encroachments occur when a neighbor’s structure or property extends onto your land. Both can limit your property use.

Lack of Proper Disclosures: Sellers are legally required to disclose known material defects of the property. Failing to do so can lead to legal action.

Contractual Issues: Real estate purchase agreements are complex legal documents. Misunderstanding contingencies, timelines, or specific clauses can lead to losing your earnest money or being forced into an unfavorable deal.

Zoning and Land Use Restrictions: Local ordinances dictate how property can be used (residential, commercial), building height limits, setbacks, and other restrictions. Violating these can lead to fines or forced demolition.

Actionable Steps:

Hire an Experienced Real Estate Agent: Choose an agent knowledgeable about local laws and practices.

Utilize a Real Estate Attorney: While not always mandatory in every state for closing, consulting a real estate attorney is highly advisable. They can review contracts, title reports, and disclosure documents, protecting your interests. This can be a worthwhile real estate attorney cost.

Understand Your Purchase Agreement: Read every clause carefully, especially contingencies (e.g., inspection, appraisal, financing).

Invest in Title Insurance: This is a one-time fee that protects you against future claims on the property’s title, a vital safeguard.

Mistake #9: Rushing the Decision

The excitement of finding “the one” can lead to impulsive decisions. However, buying a home is a complex process requiring careful due diligence in real estate. Rushing often leads to missed red flags, overlooked details, and significant regret.

The 2025 Reality: In fast-paced markets, sellers may push for quick closings. While efficiency is good, speed should never compromise thoroughness.

When to Walk Away from a Deal:

Undisclosed Property Concerns: If the home inspection reveals significant, costly, or dangerous issues that the seller is unwilling to address or negotiate on, it’s a strong signal to reconsider.

Seller’s Lack of Transparency: A seller who is evasive, unwilling to provide requested documents, or appears to be hiding information is a major red flag.

Unfair Bargaining Practices: If a seller or their agent employs high-pressure tactics, makes unreasonable demands, or repeatedly changes terms, step back.

Altered Personal Financial Circumstances: A job loss, unexpected medical expense, or change in interest rates (if your pre-approval window closes) can alter your financial capacity. If your budget tightens, it’s smarter to walk away than overextend yourself.

Ignoring Your Gut Feeling: Sometimes, despite everything checking out on paper, a deal just doesn’t feel right. Trust your instincts. There will always be another home.

Contingencies Aren’t Met: If critical contingencies in real estate (like a successful home inspection or a favorable appraisal) are not met to your satisfaction, you should be prepared to exercise your right to terminate the contract.

Actionable Steps: Take your time during showings. Don’t be afraid to ask questions. Empower yourself with knowledge, and don’t let external pressure dictate your timeline. A good agent will advise you on when to walk away from a deal.

Mistake #10: Neglecting to Plan for the Future

A home is more than just a place to live; it’s a long-term asset and a cornerstone of your future. Many first-time buyers focus solely on the immediate purchase, failing to consider how their home will align with their evolving life circumstances.

The 2025 Reality: Life trajectories are less linear than ever. Your home should ideally support, not constrain, your future plans.

Considering Long-Term Family Needs:

Family Growth or Shrinkage: Will your family expand with children, or will aging parents potentially move in? Does the home offer enough bedrooms, bathrooms, and living space to accommodate these changes?

Lifestyle Changes: Do you anticipate needing a dedicated home office, a space for hobbies, or a larger yard for pets?

Accessibility: Consider future mobility needs. Are there stairs that might become an issue later in life? Is the home adaptable for aging in place?

Access to Schools and Services: If you plan on having children, research not just current school districts, but also future educational opportunities. Proximity to hospitals, senior care facilities, and community resources can become more important over time.

Financial Flexibility: Does your home ownership allow for future financial goals like saving for college, retirement, or starting a business? Overburdening yourself with a mortgage can stifle other important financial planning for homeowners.

Actionable Steps: Envision your life 5, 10, even 20 years down the line. Discuss these considerations with your partner and real estate agent. Choose a home that offers some flexibility or room for growth. A home that requires significant renovations might be fine if you have the budget, but one that is inherently restrictive could become a burden.

Your Journey Starts Now

Navigating the American housing market in 2025 as a first-time buyer requires diligence, patience, and expert guidance. By proactively addressing these ten common mistakes, you’ll not only protect your significant real estate investment but also lay a strong foundation for your financial future and long-term happiness.

Don’t let the excitement overshadow the importance of sound decision-making. Are you ready to take the next step toward smart homeownership? Reach out today for a personalized consultation to help chart your course and ensure your first home purchase is a resounding success.