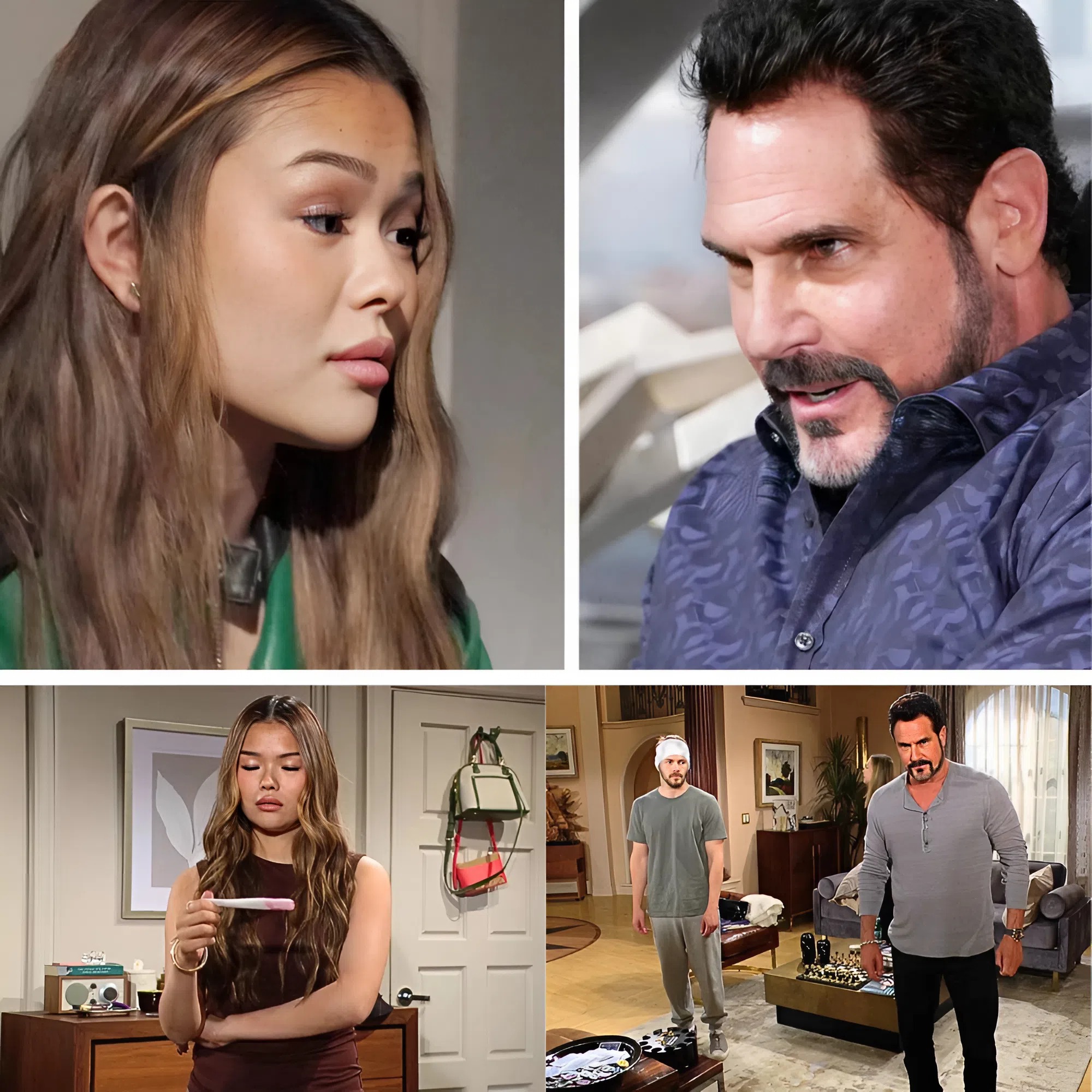

Bill’s Past Mistakes Come Back to Haunt Him

Bill Spencer has been quieter than usual on The Bold and the Beautiful, but his luck may finally run out. After years of questionable choices, he could soon face the ultimate test: Luna’s twisted plan to trap his son Will. Viewers know Bill once pulled strings to get Luna pardoned, a move that shocked fans considering her violent past. At the time, he believed he was showing compassion. Instead, he may have unleashed chaos into his family’s future.

Bill has faced betrayal and manipulation before, but Luna is playing an entirely different game. She isn’t just after power or money — she’s plotting to tie herself to the Spencer family forever. The question is, will Bill let it happen, or will he rediscover the ruthless side that once made him one of soap’s most feared titans?

Luna’s Shocking Plan Revealed

This week, Luna secretly took a pregnancy test, convinced she’s carrying Will’s child. The truth is horrifying: she drugged and disguised herself as Electra, then forced herself on Will while he was too drunk to consent. Now she plans to reveal her identity at the worst possible moment, announcing both the pregnancy and her connection to the Spencer heir.

Her scheme is simple but chilling. As the mother of a Spencer baby, she believes she’ll have permanent access to the wealth, status, and influence she has always craved. For Luna, Will isn’t a person — he’s a means to an end. She even hints that she sees Bill as part of her future, not as a father figure, but as a father-in-law. It’s manipulative, dangerous, and enough to send shockwaves through the entire Spencer family.

Where Is the Old Dollar Bill?

Fans have long wondered what happened to “Dollar Bill,” the bold, calculating man who once controlled Los Angeles with a ruthless hand. Years ago, Bill plotted to push Amber off a cliff and had Justin dump Ridge out of a helicopter. He was a master strategist who wouldn’t let anyone threaten his family or his empire.

But in recent years, Bill has softened. He’s shown compassion, forgiveness, and even vulnerability. While growth is admirable, it also left him open to manipulation. Both Grace Buckingham and Luna exploited his softer side, costing him money, trust, and peace of mind. The current storyline gives Bill the perfect chance to reclaim his legacy. He doesn’t need to resort to violence, but he must channel that fire again if he hopes to stop Luna.

Bill Must Correct His Mistake

At the heart of this story is Bill’s error in judgment. By securing Luna’s release, he put his son in danger. Fans haven’t forgotten how outrageous it was to watch him defend a woman who caged Steffy and killed twice. Now, he must take responsibility for his choice. Protecting Will from Luna isn’t just about stopping her plan; it’s about restoring his role as the patriarch who shields his family at all costs.

If Bill fails, Luna could manipulate her way into the Spencer dynasty, potentially using a baby as leverage. If he succeeds, he may finally silence critics who say he’s lost his edge. Either way, his next move will define his future.

Will Bill Rise to the Challenge?

The drama is heating up, and fans are eager to see whether Bill finally steps back into the spotlight. Will he expose Luna before her plan unfolds? Can he rebuild his image as the bold, untouchable Dollar Bill? Or will Luna outsmart him and entangle the Spencers in yet another scandal?

One thing is certain: Bill can’t afford to stay quiet any longer. Luna is dangerous, and she’s coming for everything he holds dear. The Bill Spencer of old wouldn’t wait around — he would strike first, and he would strike hard. For the sake of his family, it’s time that side of him makes a comeback.

Mastering Your First Home Purchase: 10 Critical Mistakes to Avoid in the 2025 US Market

Navigating the US housing market as a first-time buyer in 2025 is an exhilarating, yet often overwhelming, journey. With fluctuating interest rates, evolving inventory, and a dynamic economic landscape, the dream of homeownership requires more than just enthusiasm – it demands strategic insight and meticulous planning. As a real estate expert with over a decade of experience guiding countless individuals through this intricate process, I’ve witnessed firsthand the common pitfalls that can turn a dream into a daunting financial burden.

My goal in this comprehensive guide is to empower you with the knowledge to sidestep these costly errors. We’ll delve deep into ten critical mistakes that frequently trip up novice buyers, arming you with expert advice tailored for the 2025 market. From securing the right financing to understanding the nuanced legalities, consider this your essential playbook for a successful and stress-free entry into homeownership. Let’s ensure your first home isn’t just a place to live, but a cornerstone of your long-term financial prosperity.

Mistake #1: Skipping the Mortgage Pre-Approval Process

In today’s competitive real estate landscape, failing to obtain mortgage pre-approval is akin to entering a marathon without proper training. It’s a foundational step that many first-time buyers either underestimate or outright skip, often leading to disappointment and missed opportunities.

What is Mortgage Pre-Approval and Why Does it Matter Now More Than Ever?

Mortgage pre-approval is a formal commitment from a lender, based on a thorough review of your financial standing, indicating the maximum loan amount you qualify for. Unlike a mere pre-qualification, which is a quick, superficial estimate, pre-approval involves a hard credit pull and verification of your income, assets, and debts. For the 2025 market, where inventory can still be tight in desirable areas, a pre-approval letter is your golden ticket. It demonstrates to sellers that you are a serious, qualified buyer, giving you a significant edge over those who are merely pre-qualified or haven’t initiated the process at all.

The Undeniable Benefits of Being Pre-Approved

Realistic Budgeting: In my decade of experience, I’ve seen hopeful buyers fall in love with homes far beyond their financial reach. Pre-approval provides a clear, realistic price range, allowing you to focus your search on properties you can genuinely afford. This prevents emotional overspending and sets a firm foundation for your home affordability analysis.

Enhanced Negotiating Power: When presenting an offer, a robust pre-approval letter signals to sellers that your financing is secured. This often translates to a stronger negotiating position, especially in multi-offer scenarios. Sellers, particularly those motivated by a quick sale, favor offers from pre-approved buyers, often leading them to accept slightly lower bids knowing the deal is more likely to close smoothly.

Expedited Closing Process: A significant portion of the loan underwriting is completed during pre-approval. This pre-emptive effort can drastically reduce the time from accepted offer to closing costs settlement, a crucial factor when sellers are evaluating competing offers.

Early Identification of Credit Issues: The pre-approval process forces you to confront your FICO score and debt-to-income ratio head-on. This early review allows you to identify and rectify any credit report inaccuracies or improve your financial standing before you’re in a time-sensitive situation, saving you from last-minute loan rejections.

Navigating the Pre-Approval Process in 2025

The process for obtaining pre-approval in the US remains largely consistent but requires attention to detail.

Research and Compare Lenders: Don’t just go with your current bank. Explore different mortgage lenders – traditional banks, credit unions, and online lenders. Compare their mortgage rates 2025, fees, and available loan programs (FHA, VA, USDA, conventional).

Gather Essential Documents: Be prepared. Lenders will require:

Proof of Identity: Driver’s license, Social Security card.

Income Verification: W-2s for the past two years, recent pay stubs (30-60 days), two years of federal tax returns, proof of any other income (bonuses, commissions, child support).

Asset Information: Bank statements (two months), investment account statements.

Debt Documentation: Statements for credit cards, auto loans, student loans.

Submit Your Application: This can often be done online or in person. Be truthful and comprehensive.

Credit Check: The lender will perform a hard inquiry on your credit report. Don’t worry about multiple inquiries for a mortgage within a short window (typically 14-45 days); they usually count as one for your credit score.

Underwriter Review & Verification: An underwriter will scrutinize your financial documents. They may ask for additional information or clarification.

Receive Your Pre-Approval Letter: This letter will state the maximum loan amount, an estimated interest rate (subject to change), and any conditions. It’s valid for a specific period, usually 60-90 days, so be mindful of its expiration.

Mistake #2: Underestimating the True Cost of Homeownership

Many first-time buyers fixate solely on the listed purchase price and the monthly mortgage payment. However, in my experience, this tunnel vision is a recipe for financial strain. The total cost of homeownership extends far beyond principal and interest, especially with 2025’s economic realities.

The Hidden Costs Beyond the Purchase Price

Closing Costs: These are the one-time fees paid at the close of the transaction. They typically range from 2% to 5% of the loan amount and include:

Lender Fees: Loan origination fees, underwriting fees, discount points (optional).

Third-Party Fees: Appraisal fees, credit report fees, survey fees, attorney fees (in some states), title search fees, title insurance (lender’s and owner’s), escrow fees.

Government Fees: Recording fees, transfer taxes (vary significantly by state/county).

Property Taxes: These vary dramatically by location, often making up a significant portion of your monthly housing expense. They are typically collected by your lender and held in an escrow account as part of your monthly PITI (Principal, Interest, Taxes, Insurance) payment. Researching property tax rates by state and even specific municipalities is crucial.

Homeowners Insurance: Protecting your investment against fire, theft, and natural disasters is non-negotiable. Homeowners insurance premiums vary based on location, home value, and deductible. If your down payment is less than 20%, you’ll also likely pay private mortgage insurance (PMI) on a conventional loan, or mortgage insurance premium (MIP) on an FHA loan, until you reach sufficient equity.

Homeowners Association (HOA) Fees: If you’re buying a condo, townhouse, or a home in a planned community, HOA fees are mandatory monthly or annual charges. These cover maintenance of common areas, amenities, and sometimes utilities or external building repairs. Failing to budget for these can be a rude awakening.

Utility Connections & Deposits: Moving into a new home often means setting up new utility accounts (electricity, gas, water, internet). Many providers require initial deposits, which can add up.

Brokerage Fees: While typically paid by the seller, understanding how buyer’s agent commission works is important. In some unique scenarios or distressed sales, you might encounter a situation where a buyer’s agent fee is structured differently. Always clarify this.

Budgeting for Maintenance and Unexpected Repairs

Even a brand-new home will incur maintenance costs. Experienced homeowners often advise setting aside 1% to 4% of the home’s value annually for maintenance and repairs. For a $400,000 home, that’s $4,000 to $16,000 a year!

Annual Maintenance: HVAC servicing, gutter cleaning, landscaping, pest control.

Periodic Expenses: Exterior painting (every 5-10 years), roof replacement (every 15-30 years), appliance repair/replacement, major system upgrades (water heater, furnace, AC).

Emergency Fund: Beyond general maintenance, always maintain an emergency fund specifically for home-related emergencies like a burst pipe, a leaking roof, or an unexpected appliance failure.

Mistake #3: Neglecting In-Depth Neighborhood Research

The house itself is just one piece of the puzzle; the neighborhood is equally, if not more, important. I often tell my clients, “You can change the house, but you can’t change its location.” Overlooking thorough neighborhood research is a mistake that can lead to daily frustrations and significantly impact your resale value.

Key Factors to Evaluate in a Locality

Safety and Crime Rates: Utilize online resources like local police department websites, NeighborhoodScout, or City-Data.com to assess neighborhood safety and crime statistics. Drive through the area at different times of day and night.

Accessibility and Commute: Map out your typical commute to work, schools, and frequently visited locations. Consider traffic patterns in 2025. Is there access to reliable public transport access?

Schools and Education: Even if you don’t have children, school districts profoundly influence property value appreciation. Websites like GreatSchools.org provide ratings and reviews.

Local Amenities: Evaluate proximity to grocery stores, hospitals, parks, recreational facilities, restaurants, and entertainment. Are these local amenities aligned with your lifestyle?

Community Demographics and Culture: Does the community vibe resonate with you? Attend local events, visit community centers, or join local social media groups to get a feel for the culture.

Noise and Traffic: Pay attention during different times. Is the home near a busy road, airport flight path, or industrial area?

Future Development Plans and Their Impact

A truly savvy buyer looks beyond the present. Researching future development plans can reveal potential boons or busts for your property’s value.

Municipal Development Plans: Check local city planning department websites for zoning changes, proposed infrastructure projects (new highways, light rail, community centers), or significant commercial developments.

Zoning Laws: Understand how zoning laws affect your area. Are there plans for new commercial buildings near residential zones? Could an empty lot next door become a high-rise?

Economic Outlook: Is the area attracting new businesses, leading to job growth? This can positively impact demand and property value. Conversely, industries leaving an area can depress values.

Mistake #4: Overlooking the Importance of a Professional Home Inspection

In a seller’s market, tempting as it may be to waive contingencies to make your offer more attractive, sacrificing a professional home inspection is one of the riskiest mistakes a first-time buyer can make. I’ve seen buyers inherit tens of thousands of dollars in repairs because they skipped this vital step.

What Does a US Home Inspection Cover?

A thorough home inspection is a non-invasive visual examination of the physical structure and systems of a house, from the foundation to the roof. A qualified inspector will typically evaluate:

Structural Integrity: Foundation, grading, roof, walls, ceilings, floors.

Exterior: Siding, windows, doors, trim, driveway, walkways.

Interior: Walls, ceilings, floors, doors, windows, fireplace/chimney.

Roof: Covering, flashing, chimneys, gutters, downspouts.

Plumbing System: Water supply, drainage, water heater, fixtures.

Electrical System: Service panel, wiring, outlets, switches.

HVAC System: Furnace, air conditioning, ductwork, thermostat.

Attic, Basement, Crawl Space: Ventilation, insulation, moisture issues.

Appliances: Built-in dishwasher, oven, microwave (if included).

Safety Issues: Carbon monoxide detectors, smoke detectors, railings.

They will identify major defects, safety hazards, and areas that may require significant repair.

Common Issues Found in US Homes

Even seemingly pristine homes can harbor hidden issues. Common problems include:

Foundation Problems: Cracks, settling, water penetration, often linked to soil movement or poor drainage.

Roofing Issues: Leaks, damaged shingles, inadequate flashing, past-due replacement.

HVAC System Failures: Older units, improper installation, poor maintenance leading to inefficient heating/cooling.

Electrical Wiring Concerns: Outdated knob-and-tube wiring, insufficient amperage, exposed wiring, GFI/AFCI deficiencies – potential fire hazards.

Plumbing Leaks: Hidden drips under sinks, corroded pipes, slow drains, or issues with the water heater.

Water Intrusion/Mold: Especially in basements or attics, due to poor drainage, roof leaks, or inadequate ventilation.

Pest Infestations: Evidence of termites, rodents, or other pests that can cause significant structural damage.

How to Find a Reliable Home Inspector

Seek Referrals: Ask your real estate agent (a good agent will have a list of reputable inspectors), friends, or colleagues for recommendations.

Check Credentials: Look for inspectors certified by reputable organizations like the American Society of Home Inspectors (ASHI) or the International Association of Certified Home Inspectors (InterNACHI). These certifications indicate adherence to professional standards and ongoing education.

Review Sample Reports: A detailed report is key. Ask for a sample report to see the level of detail and clarity.

Confirm Insurance: Ensure the inspector carries professional liability (Errors & Omissions) insurance.

Interview Potential Inspectors: Ask about their experience, what they include in their inspection, and how long it typically takes.

Attend the Inspection: Always be present during the inspection. This allows you to ask questions directly, learn about the home’s systems, and see any issues firsthand. This is also a good time to understand potential negotiating repairs with the seller.

Mistake #5: Draining Your Entire Savings for a Down Payment

While a larger down payment can reduce your monthly mortgage payments and potentially eliminate PMI (Private Mortgage Insurance), sacrificing your entire financial safety net for it is a critical misstep. I’ve seen buyers left vulnerable to unexpected life events or immediate home repair needs because their emergency funds were depleted.

Balancing Down Payment with Emergency Funds

The common advice for a substantial down payment (20% to avoid PMI) is sound in theory, but not if it leaves you broke. A more practical approach balances your down payment amount with maintaining a robust emergency fund.

Emergency Fund Rule: Aim to have at least 3-6 months of essential living expenses (rent/mortgage, utilities, food, transportation, insurance) saved in an easily accessible account. This acts as a buffer against job loss, medical emergencies, or other unforeseen financial shocks.

Home Repair Buffer: Beyond your personal emergency fund, allocate a separate buffer specifically for home repairs and maintenance (as discussed in Mistake #2). Furnishing costs and immediate post-move expenses (e.g., locksmith, cleaning, minor fixes) also need to be considered.

Post-Closing Liquidity: You’ll need funds for utilities, moving costs, and potentially buying new furniture or appliances. Don’t underestimate these expenses.

Government Schemes and Down Payment Assistance Programs

The good news for first-time buyers in 2025 is the availability of various programs designed to make homeownership more accessible without demanding 20% down.

FHA Loans: Federal Housing Administration (FHA) loans require as little as 3.5% down, making them popular for buyers with limited savings or lower FICO scores. However, they come with mandatory mortgage insurance premium (MIP) for the life of the loan in most cases.

VA Loans: For eligible veterans, service members, and surviving spouses, VA loans offer 0% down payment and competitive rates. There’s no ongoing mortgage insurance, but a funding fee usually applies.

USDA Loans: US Department of Agriculture (USDA) loans also offer 0% down for eligible low-to-moderate income borrowers purchasing homes in designated rural areas.

State and Local Down Payment Assistance Programs: Many states, counties, and cities offer grants, second mortgages (often forgivable), or tax credits to help first-time buyers with down payments and closing costs. Research what’s available in your specific area.

Alternative Down Payment Sources

While not always ideal, these can be options when used cautiously:

Gifts from Family Members: Many loan programs allow down payments to be gifted by family. Be aware of IRS gift funds for down payment rules and ensure proper documentation (a gift letter from the donor stating no repayment is expected).

Employer Assistance Programs: Some companies offer home-buying assistance as an employee benefit.

401(k) Loans: You can borrow from your 401(k) without penalty, but it comes with significant risks. If you leave your job, the loan often becomes due immediately. If you default, it’s considered a taxable distribution. This should be a last resort.

Home Equity Line of Credit (HELOC) or Reverse Mortgage: These are for future financial leveraging, not typically for first-time buyers’ down payments, but good to know as potential benefits of building home equity.

Mistake #6: Ignoring the Long-Term Resale Value

A home isn’t just a place to live; it’s often your largest financial asset. My decade of guiding buyers has shown that being short-sighted about resale value is a major mistake. While you might love a quirky feature or a unique location, will future buyers feel the same?

Key Factors Affecting Resale Value in the US Market

Location, Location, Location: This timeless mantra remains paramount. Proximity to good schools, employment centers, essential services, and attractive local amenities significantly boosts property appreciation.

Infrastructure Development: Future infrastructure projects like new highways, public transportation expansions (e.g., metro lines), or large-scale community developments can dramatically increase demand and value in an area. Conversely, a lack of investment can stifle growth.

Quality of Construction and Builder Reputation: A well-built home by a reputable builder (for new construction) tends to hold its value better and requires fewer major repairs, enhancing its long-term appeal.

Market Trends and Economic Forecast: Understanding the broader real estate market forecast 2025 is critical. Is the local economy robust? Is job growth positive? These factors impact future buyer pools.

Curb Appeal and Condition: While you can upgrade these, a home with good bones, attractive landscaping, and well-maintained systems inherently has higher return on investment (ROI) potential on improvements and is easier to sell.

Floor Plan and Functionality: Trends change, but generally, open-concept living, multiple bathrooms, and flexible spaces (e.g., a home office area for remote work setup) tend to have broader appeal.

Environmental Factors: Proximity to natural hazards (flood zones, wildfire risk) or environmental nuisances (highways, industrial areas) can negatively impact resale.

Mistake #7: Falling in Love with a Home Beyond Your Budget

The emotional pull of a beautiful home can be incredibly strong, often clouding rational financial judgment. I’ve witnessed too many first-time buyers push their financial limits for a dream home, only to face years of financial discipline and stress. Your budget isn’t just a suggestion; it’s a boundary for sustainable homeownership.

Tips for Staying Within Budget During House Hunting

Set a Strict, Realistic Budget Before You Start: Based on your pre-approval, but also considering your comfort level with monthly payments (PITI + other costs). Don’t just rely on the maximum loan amount you qualify for; determine what you can comfortably afford.

Differentiate Needs vs. Wants: Make a clear list. What absolutely non-negotiable features does your home need? (e.g., X bedrooms, specific commute time). What are luxuries you’d like but can live without or add later? (e.g., gourmet kitchen, large yard). Be prepared to compromise on wants.

Utilize Online Tools for Comparison: Leverage online mortgage calculators to understand how different purchase prices, interest rates, and down payments impact your monthly payments. Compare similar properties (comps) to gauge fair market value.

Avoid Bidding Wars You Can’t Afford: In competitive markets, bidding wars can quickly push prices beyond rational limits. Stick to your budget. Overpaying significantly may mean years to build equity, impacting your home equity for future leveraging. There will always be another house.

Factor in Lifestyle Costs: Don’t forget that a more expensive home often comes with higher property taxes, insurance, and potentially higher utility bills. Ensure your overall lifestyle isn’t severely impacted by your housing costs.

Mistake #8: Not Understanding the Legal Aspects of Homeownership

The US real estate transaction is a legally binding process involving significant contracts and disclosures. As an expert, I’ve seen how a lack of understanding of these legal facets can lead to costly disputes, delays, or even loss of the property. “Buyer beware” still holds weight.

Common Legal Issues in US Real Estate

Purchase Agreement: This is the most crucial document. It outlines the terms of the sale, contingencies (e.g., inspection, financing, appraisal), closing date, and what happens if either party defaults. Understand every clause, especially contingency clauses.

Seller Disclosures: Most states require sellers to provide a seller’s disclosure statement revealing known defects or issues with the property (e.g., past water damage, lead paint, previous repairs). While not a guarantee, it’s a vital information source.

Title Issues: A title search is conducted to ensure the seller has the legal right to sell the property and that there are no hidden claims, property liens, or encumbrances (easements, judgments) against the property. Title insurance protects both the lender and the buyer against future claims to ownership.

Property Boundaries and Easements: Clarify exact property boundaries to avoid future disputes with neighbors. Understand any easements (e.g., utility companies having access to a portion of your land) or encroachments.

Homeowners Association (HOA) Covenants, Conditions, and Restrictions (CC&Rs): If applicable, thoroughly review these documents. They dictate what you can and cannot do with your property (e.g., fence height, exterior paint colors, pet rules). Ignoring HOA covenants can lead to fines or legal action.

Unpermitted Work: Be wary of additions or modifications to the home that were done without proper permits. This can lead to safety hazards, insurance complications, and difficulties when reselling.

The Importance of Legal Counsel (Where Applicable)

While real estate agents are licensed professionals, their role is not to provide legal advice. In some states, a real estate attorney is typically involved in every transaction to review documents and ensure legal compliance. Even in states where it’s not mandatory, consulting an attorney for complex issues or concerns about the purchase agreement is a wise investment.

Mistake #9: Rushing the Decision to Purchase

The pressure to buy, whether from a hot market, a persistent agent, or simply the desire to settle, can lead to impulsive and regrettable decisions. I’ve seen buyers suffer from buyer’s remorse because they didn’t take the time for proper due diligence. A home is a long-term commitment; treat it with the deliberation it deserves.

When to Walk Away From a Deal

Knowing when to step back is as important as knowing when to move forward.

Undisclosed Property Concerns: If the home inspection reveals significant, costly issues that the seller is unwilling to address or credit, and these issues outweigh your enthusiasm for the property, it’s a clear sign to reconsider.

Seller’s Unfair Practices: If the seller or their agent engages in manipulative tactics, refuses reasonable negotiations, or withholds information, it’s a red flag. A transparent and fair transaction is paramount.

Altered Personal Financial Circumstances: A job loss, unexpected medical expense, or change in income can drastically alter your home affordability. If your financial situation changes before closing, it’s prudent to reassess your ability to commit.

Coercive Strategies: Never feel pressured by your agent, the seller, or anyone else to make an offer or sign a contract before you’re completely ready and understand all terms. A reputable agent will support your informed decision.

Financing Falls Through: If, for any reason, your loan approval is revoked or the appraisal comes in significantly lower than the agreed-upon price (and the seller won’t renegotiate), you may have a valid reason to walk away, usually protected by a financing contingency.

Title Issues: If the title search uncovers unresolvable liens, ownership disputes, or other major property liens or clouds on the title that cannot be cleared, it’s wise to step away.

Mistake #10: Neglecting to Plan for Your Future Needs

Your first home isn’t just for today; it’s an investment in your future. Overlooking your long-term needs when making this significant purchase is a common mistake that can force you into an unwanted move sooner than anticipated. My expertise emphasizes thinking beyond the immediate.

Considering Long-Term Family Needs

Family Growth or Shrinkage: Are you planning to start a family, or does your current family structure include aging parents who might eventually live with you? Consider the number of bedrooms, bathrooms, and overall living space needed not just now, but in 5-10 years.

Access to Essential Facilities: If you have or plan to have children, evaluate access to quality schools, parks, and childcare facilities. For elderly parents, consider proximity to healthcare, accessible features within the home, and local support services.

Work-From-Home Needs: The shift to remote work setup is a lasting trend. Does the home offer a suitable space for a dedicated home office, or at least a flexible area that can serve this purpose? Reliable internet infrastructure is also key.

Accessibility and Life Stages: As you age, will the home still be functional? Consider stairs, bathroom layouts, and ease of maintenance. While you might not need single-level living now, it’s a factor for later life.

Future Property Investment Potential: Think about how the home fits into your broader long-term financial planning. Will it build sufficient home equity to serve as a stepping stone to a larger home, or as a source of funds for retirement or other investments?

By diligently avoiding these 10 common mistakes, first-time homebuyers in 2025 can transform what often feels like a daunting challenge into a confident, successful journey toward a fulfilling and financially sound homeownership experience.

Ready to turn your homeownership dreams into a confident reality in 2025? Don’t navigate this complex market alone. Reach out today for personalized expert guidance and ensure your first home purchase is a strategic and joyful success.