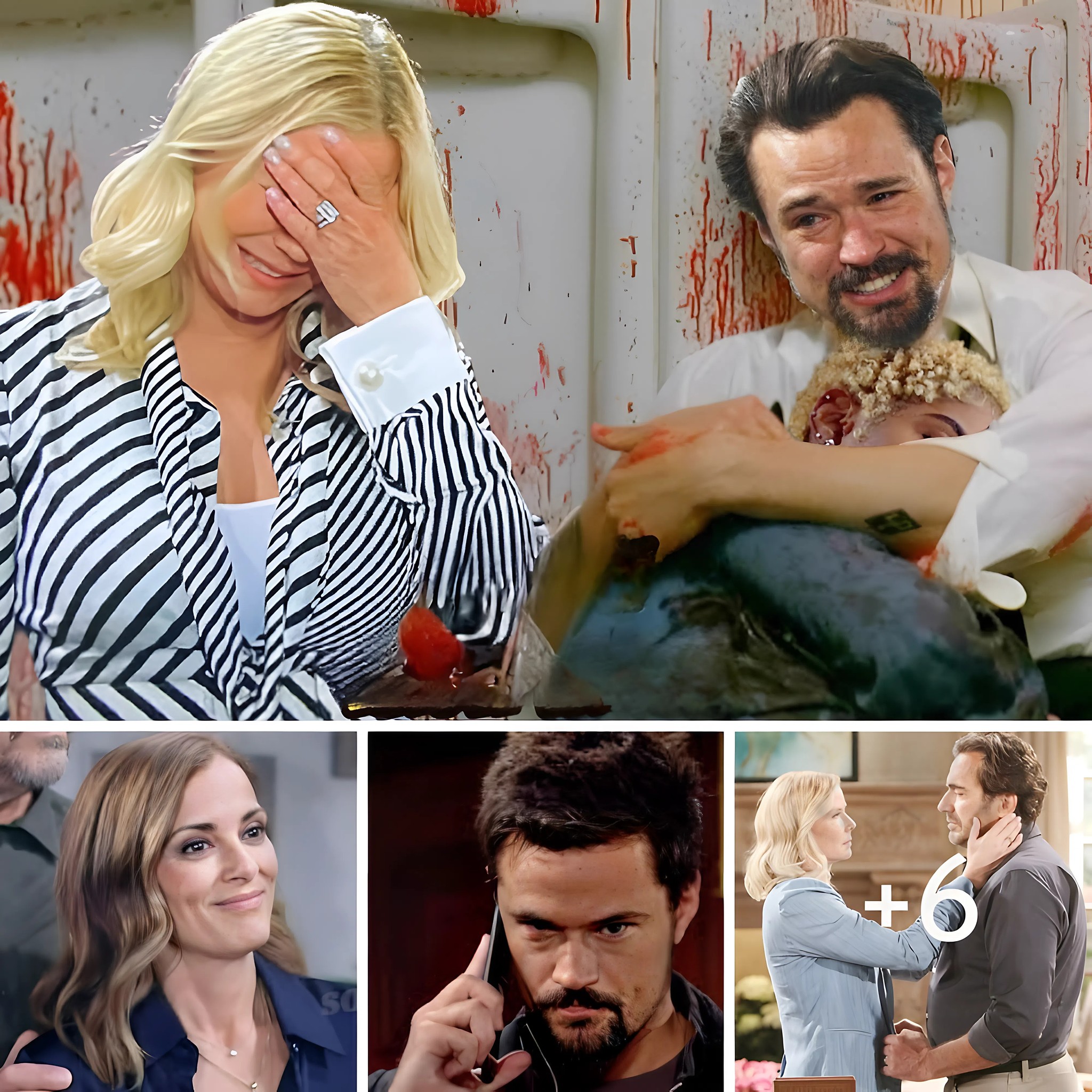

Thomas Forester on the Edge

The September 3 episode of The Bold and the Beautiful raised alarm bells for longtime fans. Thomas Forester once again shows signs of slipping into old habits, leaving Taylor Hayes, Ridge Forrester, and viewers worried.

During a tense heart-to-heart with Lee Finnegan, Taylor admitted her fear that Thomas may spiral back into destructive patterns. Ridge also expressed his unease, pointing out Thomas’s growing isolation in both work and family life. That sense of drifting could easily drive him toward darker impulses.

The collapse of Ridge and Taylor’s attempted reunion appears to be the breaking point. Thomas himself confessed that he might not withstand another heartbreak. With his emotions raw, three possible villain arcs are emerging that could shake the Forrester family to its core.

Targeting Brooke Logan

One possibility is Thomas turning his resentment toward Brooke. If he blames her for destroying his parents’ happiness, he could start with subtle sabotage — spreading rumors at Forrester Creations or altering designs to damage her reputation. If writers push him further, Thomas might escalate to a full-blown frame-up, or even a chilling abduction storyline to confront Brooke about her role in the family’s fractures.

This arc would tap into Thomas’s history of obsession and manipulation, with ripple effects on both the Logan and Forrester clans.

Obsession With Hope Returns

Another potential path is a renewed fixation on Hope Logan. In his fragile state, Thomas might see Hope as his emotional anchor. That longing could manifest in manipulative ways: inserting himself into her fashion line, planting doubts about Liam, or even staging “rescues” to win her trust.

If unchecked, his obsession could spiral into invasive tactics such as tracking her movements or cutting her off from loved ones. This story would mirror past behavior while adding psychological layers, raising the stakes for Hope, Liam, and the wider Logan–Spencer families.

Clash With Luna

A third option pits Thomas against Luna No, who once endangered Steffy Forrester. Fueled by protective rage, Thomas could launch a vendetta. Picture him hiring investigators, uncovering Luna’s darkest secrets, and exposing her to the world. The result would be a cat-and-mouse psychological battle, with Luna scrambling to defend herself against his calculated attacks.

This fresh rivalry would highlight Thomas’s intelligence and ruthlessness, while giving viewers a new feud brimming with suspense.

Beyond the Gates Crossover Rumors

While Thomas’s storyline simmers, fans are buzzing about potential cast shakeups linked to CBS’s rising soap Beyond the Gates. Rumors suggest that B&B might “lend” one of its stars to the new series, sparking crossover possibilities.

Lawrence Saint-Victor (Carter Walton) was once rumored to make the jump. Though he shut those whispers down, Carter’s rocky romance with Hope could still fuel an exit storyline. His departure would leave Forrester Creations scrambling, while Beyond the Gates could gain a charismatic new player.

Another name in circulation is Delon de Metz (Zende Forrester). Often underused, Zende could thrive on Beyond the Gates as a bold fashion consultant, embroiled in high-society rivalries and romance. Fans speculate that such a move would give the actor a platform to shine while strengthening inter-soap ties.

CBS has already experimented with crossover plots, most recently with The Young and the Restless. Expanding that to include The Bold and the Beautiful could create explosive shared storylines that keep both shows fresh.

Eric Forrester Meddles in Ridge’s Love Life

Meanwhile, Eric Forrester is making waves of his own. Though happy with Donna Logan, Eric has turned his attention to Ridge’s love life — and he isn’t shy about voicing his opinion.

Eric remains convinced that Ridge belongs with Brooke, not Taylor. His subtle interventions include recalling Ridge and Brooke’s passionate history, contrasting it with Taylor’s steady but less fiery presence.

As Ridge prepares to marry Taylor, Eric ramps up his efforts, planting seeds of doubt through quiet conversations and family gatherings. Ridge finds himself torn, sketching wedding designs that suddenly feel hollow and replaying his father’s words in his mind.

Eric’s meddling may change the course of the wedding entirely. Will Ridge follow his father’s advice and return to Brooke, or will he commit to Taylor despite lingering doubts?

What’s Next

With Thomas’s instability, crossover rumors swirling, and Eric pulling strings behind the scenes, The Bold and the Beautiful is delivering high-stakes drama on multiple fronts. Fans should brace for explosive revelations and emotional twists that could redefine relationships across the Forrester and Logan families — and maybe even beyond Los Angeles.

Mastering Your First Home Purchase: 10 Pitfalls to Avoid in the 2025 Market

As a real estate expert with over a decade navigating the dynamic housing landscape, I’ve witnessed firsthand the exhilaration and anxieties that come with buying your first home. The year 2025 presents a unique blend of opportunities and challenges for aspiring homeowners. Interest rates, while fluctuating, remain a significant factor, and inventory levels continue to vary wildly by region, making savvy decision-making more crucial than ever. Many first-time buyers, eager to jump into homeownership, often stumble over common missteps that can derail their dreams or lead to costly regrets. This article isn’t just a list; it’s a battle-tested guide, offering insights from the trenches to ensure your journey to homeownership is as smooth and successful as possible. Let’s unravel the ten critical mistakes to steer clear of in today’s evolving market.

Mistake #1: Skipping the Mortgage Pre-Approval Process

In the competitive 2025 housing market, a mortgage pre-approval isn’t merely a suggestion—it’s your golden ticket. Without it, you’re essentially window shopping with no wallet, and sellers won’t take your offers seriously. This isn’t just a quick online form; it’s a rigorous financial health check performed by a lender. They’ll scrutinize your credit history, assess your FICO score, verify your income (W2s, tax returns, pay stubs), review your assets, and calculate your debt-to-income (DTI) ratio. The resulting pre-approval letter specifies the maximum loan amount you qualify for, often with a projected interest rate.

Benefits You Can’t Afford to Ignore:

Realistic Budgeting: Before you even step foot into an open house, you’ll have a crystal-clear understanding of your true purchasing power. This prevents the heartbreaking scenario of falling in love with a home well outside your financial reach.

Enhanced Negotiating Power: When you submit an offer with a pre-approval letter, you signal to the seller that you’re a serious, qualified buyer. This dramatically strengthens your position, especially in multiple-offer situations, potentially giving you the edge over others who are less prepared.

Streamlined Closing: A substantial portion of the financing legwork is already complete, which can significantly expedite the closing process—a major plus for both buyers and sellers looking for efficiency.

Early Issue Identification: The pre-approval process can unearth potential credit issues or documentation gaps you weren’t aware of, giving you ample time to address them before they become an emergency.

Navigating Pre-Approval in 2025:

Start by researching and comparing different lenders, including local banks, credit unions, and online mortgage providers. Don’t just settle for the first quote; aim for at least three to ensure you’re getting the most competitive 2025 mortgage rates. Be ready to provide comprehensive documentation: photo ID, proof of residence, at least two years of W2s and tax returns, recent pay stubs, and bank statements for the last 60 days. Lenders will pull your credit report to evaluate your creditworthiness. Once verified, you’ll receive your pre-approval letter, valid for a specific period (typically 60-90 days). Remember, this isn’t a commitment to lend, but a strong indication of what you can borrow.

Mistake #2: Underestimating the True Cost of Homeownership

The sticker price of a home is just the beginning. Many first-time buyers, fixated on the mortgage payment, overlook a multitude of “hidden” costs that can quickly drain their finances. In 2025, these ancillary expenses are often rising, making a thorough understanding of the total cost of homeownership absolutely essential.

Beyond the Purchase Price – The Hidden Financial Landscape:

Closing Costs: These are typically 2-5% of the loan amount and include a dizzying array of fees: loan origination, appraisal, title insurance (owner’s and lender’s), escrow fees, recording fees, attorney fees (mandatory in some states), and points if you choose to buy down your interest rate. Closing costs explained should be a deep dive for every buyer.

Property Taxes: These vary dramatically by state, county, and even municipality. They are typically reassessed periodically, so what a seller pays now might not be what you pay in 2025. Use a reliable property tax calculator USA for your target areas.

Homeowner’s Insurance: A non-negotiable expense, especially with increasing risks in certain regions (e.g., wildfires, hurricanes, floods). Homeowner’s insurance rates 2025 are seeing upward pressure. You’ll need a policy that covers damage, liability, and often specific perils depending on your location. Flood insurance is typically separate and highly recommended in designated zones.

Homeowners Association (HOA) Fees: If you’re buying into a condo, townhouse, or planned community, expect monthly or annual HOA fees. These cover shared amenities and maintenance but can also come with strict rules and potential special assessments. Understand the HOA covenants and restrictions before you commit.

Utilities & Connections: Expect to pay for new utility accounts (electricity, gas, water, internet) and potentially connection fees.

Maintenance & Repairs: This is the most frequently underestimated cost. As a rule of thumb, budget 1-4% of your home’s value annually for maintenance. This covers everything from routine upkeep (landscaping, HVAC servicing) to unexpected emergencies (leaky roof, plumbing issues, appliance breakdown). Don’t forget that as smart home technology becomes more integrated, repairs can sometimes be more specialized.

Anticipating Maintenance and Repair Expenses:

From repainting every 5-7 years to budgeting for potential HVAC system replacements (every 10-15 years), plumbing fixes, or electrical upgrades, these costs accumulate. Consider a home warranty in the first year to cover appliance and system breakdowns, but understand their limitations. Being an expert means anticipating not just the visible but also the invisible—the wear and tear that comes with homeownership.

Mistake #3: Neglecting to Research the Neighborhood Thoroughly

Location, location, location remains the mantra in real estate. But “location” is far more nuanced than just a ZIP code. A superficial glance at a neighborhood is a grave first-time home buyer mistake. Your home is an investment, and its value, as well as your quality of life, will be inextricably linked to its surroundings.

Crucial Factors for Neighborhood Evaluation in 2025:

Safety and Crime Rates: Beyond anecdotal evidence, consult local police department websites, resources like NeighborhoodScout or Niche.com, and local news archives. These provide objective data on neighborhood safety ratings.

Accessibility & Commute: How easy is it to get to work, schools, and essential services? Evaluate public transportation options, traffic patterns during peak hours, and future infrastructure projects that might impact commute times.

Schools: Even if you don’t have children, best school districts for home value is a primary driver of appreciation. Excellent schools attract families, which sustains demand and property values.

Amenities & Lifestyle: What parks, shopping centers, restaurants, hospitals, and entertainment venues are nearby? Do they align with your lifestyle? Are there green spaces or community centers?

Community Demographics & Culture: Spend time in the area. What’s the vibe? Is it family-friendly, bustling with young professionals, or a quiet retirement community?

Noise & Traffic: Visit at different times of day and on weekends. Is there a highway nearby, an airport flight path, or a bustling commercial strip that might generate unwanted noise?

Future Development Plans and Their Impact on Property Value:

Look beyond what currently exists. What are the municipal development plans for the next 5-10 years? Are there proposed metro lines, highway expansions, or large commercial projects? Research future real estate development in the area. Zoning laws can also dictate future changes; a quiet residential street could become a commercial corridor if zoning shifts. These developments can significantly impact property values, either positively through increased amenities and accessibility, or negatively through increased traffic, noise, or property taxes. An expert buyer thinks long-term about property value appreciation factors.

Mistake #4: Overlooking the Importance of a Comprehensive Home Inspection

Never, ever waive a home inspection. I repeat: never. This is arguably the most critical contingency in a purchase agreement. A superficial view or trusting the seller’s word is a recipe for disaster. A professional home inspection in 2025 provides an unbiased evaluation of the property’s condition, uncovering defects that could cost you thousands down the line.

What Does a US Home Inspection Cover?

A thorough inspection examines virtually every accessible component of the house:

Structural Elements: Foundation, framing, roof structure, walls, and ceilings.

Exterior: Roof (shingles, flashing, gutters), siding, windows, doors, drainage, grading.

Interior: Walls, floors, ceilings, doors, windows, fireplaces.

Major Systems: HVAC (heating, ventilation, air conditioning), plumbing (water heater, pipes, fixtures), electrical (panel, wiring, outlets).

Appliances: Built-in appliances like ovens, dishwashers, and garbage disposals.

Safety Issues: Carbon monoxide detectors, smoke alarms, egress windows, general safety hazards.

Common Issues in US Homes:

Watch out for red flags such as foundation cracks, water intrusion (especially in basements or crawl spaces), outdated electrical systems (knob-and-tube, aluminum wiring), inefficient or old HVAC systems, plumbing leaks, pest infestations (termites, rodents), mold growth, and issues with the roof. Deferred maintenance often surfaces here. You might also encounter structural designs that are out of code with today’s standards or permits missing for past renovations—all things that fall under common home inspection issues.

Finding a Reliable Home Inspector:

Seek out certified inspectors from reputable organizations like the American Society of Home Inspectors (ASHI) or the International Association of Certified Home Inspectors (InterNACHI). Ask your real estate agent for recommendations, but also do your own research, read reviews, and ask for sample reports. Look for inspectors who offer additional services like radon testing, sewer line scopes, and mold inspections, particularly for older homes or homes in specific geographical areas. Crucially, attend the inspection yourself. It’s an invaluable educational experience, allowing you to ask questions and observe firsthand.

Mistake #5: Emptying All Savings for the Down Payment

While a larger down payment (e.g., 20% to avoid Private Mortgage Insurance, or PMI) is often ideal, completely depleting your savings account is a dangerous gamble. Homeownership, especially in the first few years, comes with unexpected expenses. Sacrificing your entire safety net for a slightly lower monthly payment can leave you vulnerable.

Balancing Down Payment with an Emergency Fund:

I strongly advise having at least 3-6 months of essential living expenses saved in an easily accessible emergency fund after your down payment and closing costs are paid. This buffer is critical for unexpected job loss, medical emergencies, or—as is common for new homeowners—unforeseen home repairs. Your goal isn’t just to buy a house, but to sustain homeownership comfortably.

Government Schemes and Assistance in 2025:

Many states and local municipalities offer down payment assistance programs 2025 for first-time buyers. These can come in the form of grants (free money), deferred loans (repaid when you sell or refinance), or low-interest second mortgages. Federal programs like FHA loans allow down payments as low as 3.5%, VA loans offer no down payment for eligible veterans, and USDA loans target rural areas with zero down payment options. Researching these first-time buyer grants 2025 can significantly ease the financial burden.

Alternative Down Payment Sources:

Gift Funds: Family members can gift money for a down payment, but strict documentation (a gift letter confirming it’s not a loan) is required by lenders.

Employer Assistance Programs: Some companies offer benefits or loans to help employees with home purchases.

401(k) Loans/Withdrawals: While possible, proceed with extreme caution. Borrowing from your retirement account has significant risks, including taxes and penalties if not repaid, and it depletes your long-term savings. This should be a last resort after consulting a financial advisor.

Mistake #6: Ignoring Future Resale Value

Many first-time home buyer mistakes stem from short-sightedness. You’re buying a home to live in, but it’s also a significant investment. Ignoring its potential resale value can lead to financial stagnation or even loss down the road. Think of your home as a long-term asset, not just a current shelter.

Factors Affecting Resale Value in the US Market (2025 Outlook):

Location Fundamentals: Proximity to job centers, quality schools, public transit, and desirable amenities like parks and reputable hospitals remain paramount.

Infrastructure Development: New highways, public transportation expansions, revitalized downtown areas, or “smart city” initiatives can dramatically boost property values. Conversely, declining infrastructure can depress them. Keep an eye on local news for 2025 housing market trends related to development.

Property Condition & Curb Appeal: A well-maintained home with attractive landscaping and a modern aesthetic will always command a higher price. Buyers in 2025 are increasingly looking for move-in-ready properties.

Builder Reputation & Construction Quality: Homes built by reputable builders with solid construction often hold their value better.

Smart Home Technology Integration: While not a primary driver, certain smart home features (thermostats, lighting, security) can be a differentiating factor for resale. Consider upgrades that offer good smart home automation ROI.

Economic Stability & Job Growth: Strong local economies and robust job markets attract residents, increasing demand and thus property values. This is a key real estate appreciation forecast factor.

Legal Certainty: Ensure clear titles and no outstanding legal disputes related to the property.

An expert anticipates future market desires. While you’re buying for yourself, consider what a future buyer might want.

Mistake #7: Falling in Love with a Home Beyond Your Budget

Emotional attachment is a powerful force in real estate, but it can also be a dangerous one. I’ve seen countless first-time buyers fall head over heels for a property only to realize it stretches their finances to the breaking point. This is a classic home buying budget tip failure. An impulsive decision based purely on aesthetics or a “dream home” fantasy can lead to immense financial stress and potential regret.

Tips for Staying Within Budget During House Hunting:

Set a Strict Boundary: Before you begin browsing, establish your absolute maximum budget based on your pre-approval letter and a realistic assessment of your comfort level with monthly payments. Do not look at homes even slightly above this.

Differentiate Needs vs. Wants: Create two lists: “Must-Haves” (e.g., specific number of bedrooms, commute time, school district) and “Nice-to-Haves” (e.g., granite countertops, a specific type of flooring, a large backyard). Be prepared to compromise on the latter.

Utilize Online Tools Wisely: While helpful for initial searches, use mortgage affordability calculators to understand the long-term impact of different price points. Don’t let beautifully staged online photos sway you from your financial plan.

Lean on Your Agent: A good real estate agent acts as your guide and reality check. They should help you stay grounded, showing you properties that meet your criteria and budget, rather than tempting you with aspirational homes.

Avoid the “Bidding War” Trap: In competitive markets, it’s easy to get caught up in the emotional frenzy of a bidding war. Set a personal limit and be prepared to walk away if the price escalates beyond what you’re comfortable with. There will always be another home.

Remember, the true “dream home” is one you can comfortably afford, allowing you to enjoy your life without constant financial anxiety.

Mistake #8: Not Fully Understanding the Legal Aspects

The US real estate market is governed by a complex web of federal, state, and local laws. Neglecting the legal due diligence can lead to costly disputes, ownership challenges, or unforeseen restrictions. In 2025, with increasing regulatory scrutiny and digital record-keeping, it’s more critical than ever to ensure all legal ducks are in a row.

Common Legal Issues in US Real Estate:

Unclear Land Titles: Ensuring a clear title is paramount. A title search uncovers any liens, easements, boundary disputes, or other claims against the property that could complicate ownership. Title insurance protects you (and your lender) against these issues.

Easements: These grant someone else the right to use a portion of your property (e.g., utility companies for power lines, a neighbor for shared driveway access). Understand all property easements USA that apply.

Covenants, Conditions & Restrictions (CC&Rs): Particularly prevalent in HOA communities, these are rules governing what you can and cannot do with your property (e.g., paint colors, fence heights, parking). Ignoring HOA covenants restrictions can lead to fines or legal action.

Zoning Laws: These municipal regulations dictate how land can be used (residential, commercial, industrial). Ensure the property’s use aligns with current zoning regulations residential.

Lack of Proper Permits: Any major renovation or addition should have required permits. Unpermitted work can lead to fines, difficulties in selling, or even mandatory demolition.

Disclosure Laws: Most states have seller disclosure laws 2025 requiring sellers to reveal known defects or issues with the property. Review these disclosures carefully.

Boundary Disputes: Ensure property lines are clearly defined and there are no encroachments from neighboring properties.

The Role of a Real Estate Attorney:

While not mandatory in all states (some use title companies for closings), retaining a real estate attorney can be an invaluable investment. They can review contracts, title reports, and disclosure documents, advising you on potential risks and protecting your interests throughout the transaction. Don’t just consider the real estate lawyer cost; consider the cost of not having one if issues arise.

Mistake #9: Rushing the Decision

The pressure to buy, whether from a hot market, a looming lease expiration, or simply first-time homebuyer strategies from friends, can lead to hurried, regrettable decisions. While speed can be advantageous in a competitive market, rushing through due diligence is a perilous path. Remember that even in 2025, a home purchase is one of the largest financial commitments you’ll ever make.

The Perils of Impulsive Purchasing:

When you rush, you’re more likely to overlook critical details in the home inspection, neglect thorough neighborhood research, or ignore red flags from the seller. You might also overpay, waive important contingencies out of desperation, or compromise on your core “must-haves.” This leads to buyer’s remorse, financial strain, and potential long-term dissatisfaction. Effective home buying due diligence takes time.

When to Walk Away from a Deal (and be prepared to):

Significant Undisclosed Property Issues: If the home inspection reveals major structural defects, severe pest infestations, extensive mold, or other costly problems the seller wasn’t upfront about, it’s a clear signal.

Seller Unwillingness to Negotiate: If the seller refuses to address reasonable inspection repairs or engage in fair bargaining, it can be a sign of future difficulties.

Unfavorable Financial Changes: Your personal financial circumstances might change unexpectedly (job loss, major expense) after an offer but before closing. Re-evaluate your affordability.

Appraisal Gap: If the appraisal comes in significantly below the agreed-upon purchase price, and you can’t or won’t cover the appraisal gap strategy with cash, walking away might be the smartest move.

Coercive Tactics: If your real estate agent or the seller’s agent pressures you excessively or uses aggressive tactics, it’s a major red flag. Always trust your gut.

Exercising patience and discipline, even when FOMO (Fear Of Missing Out) is strong, is a hallmark of an expert buyer. Don’t be afraid to utilize real estate contingencies explained to protect yourself.

Mistake #10: Neglecting to Plan for the Future

Your first home isn’t just for today; it’s a foundation for your future. Many first-time home buyer mistakes involve short-term thinking, ignoring how life changes will impact their housing needs. As an expert, I always encourage buyers to project five, ten, or even fifteen years down the line.

Considering Long-term Family Needs and Lifestyle Changes:

Family Growth: Do you plan to have children? Will elderly parents eventually move in? Consider the number of bedrooms, bathroom accessibility, and overall space required. Proximity to good schools, hospitals, and parks becomes crucial.

Career & Remote Work: Will your job require relocation? Can you work remotely, necessitating a dedicated home office or flexible space? The rise of remote work in 2025 has made a remote work home office setup a significant factor for many buyers.

Aging in Place: Are there features that would allow you to comfortably live in the home as you age (e.g., first-floor master, wider doorways, potential for ramps)? This relates to aging in place home modifications.

Lifestyle Changes: Will hobbies require extra storage, a workshop, or a larger yard? Are you considering pets?

Future-Proofing Your Home and Finances:

Think about the longevity of the home. Are there opportunities for additions or renovations if your family expands? What future-proofing your home strategies can you implement (e.g., energy efficiency upgrades, smart home technology infrastructure)? Consider your long-term home buying strategy and how this first purchase fits into your broader financial plan, including potential resale or using it as an investment property down the line. This forward-thinking approach minimizes the chances of outgrowing your home too quickly or facing unexpected financial burdens due to lack of planning.

Your Next Step Towards Confident Homeownership

Navigating the complexities of buying your first home in the 2025 market doesn’t have to be overwhelming. By avoiding these ten common pitfalls, you equip yourself with the knowledge and foresight of an experienced homeowner. This journey is a marathon, not a sprint, and preparation is your most powerful asset.

Ready to transform your homeownership dream into a confident reality? Don’t leave your biggest investment to chance. Connect with a trusted real estate professional in your area today to discuss your specific needs, explore local market conditions, and build a personalized strategy that sets you up for success. Let’s make your first home purchase a smart, secure, and truly satisfying experience.