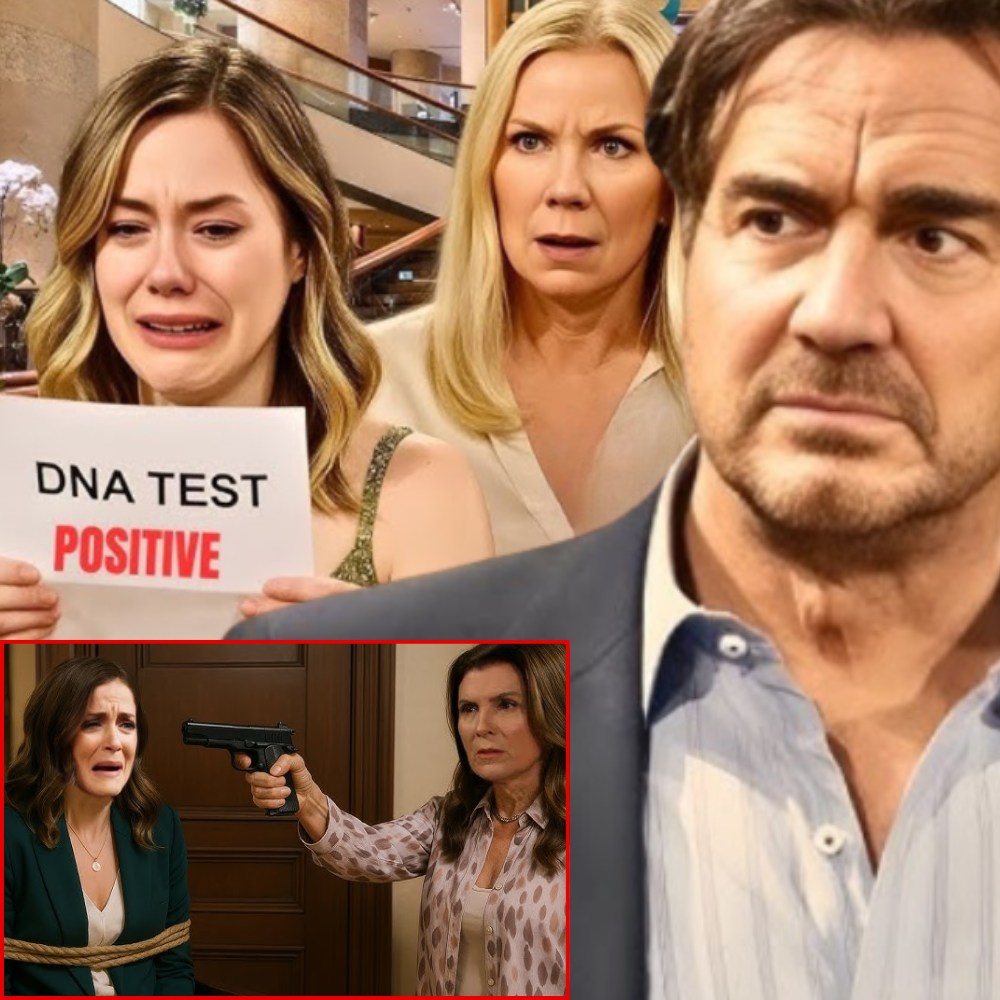

In a week filled with heartbreak, terror, and shocking confessions, The Bold and the Beautiful delivers one of its most intense storylines yet. Fans are bracing themselves for a showdown that’s been building for months — Dr. Taylor Hayes finds herself face-to-face with the one woman capable of destroying her life completely: Sheila Carter. What begins as a tense confrontation soon spirals into a terrifying ordeal that leaves Taylor literally begging for her life.

According to new spoilers, the drama explodes when Sheila discovers the truth about Taylor and Deacon’s secret affair. The revelation sends her into a jealous frenzy, fueled by betrayal and humiliation. Sheila, already unstable, feels like her entire world has collapsed — the man she loved, the life she dreamed of, gone in an instant. In her twisted mind, there’s only one person to blame: Taylor.

The episode begins quietly, with Taylor alone in her office at the hospital. She’s working late, trying to focus, but something feels off. The lights flicker, the air grows heavy, and she senses she isn’t alone. Moments later, a shadow moves behind her — and there stands Sheila, eyes cold, voice trembling with rage. “Did you really think you could take him from me?” she hisses. Taylor freezes. Her heart pounds as Sheila steps closer, every word dripping with venom.

Taylor tries to reason with her. “Sheila, please — it’s not what you think.” But reason has no place in Sheila’s world. The more Taylor speaks, the angrier she becomes. She throws a framed photo across the room, shattering glass everywhere. “You took everything from me!” she screams. “First my son, now my man. You think you’re better than me because you wear a white coat and talk about healing people? You destroy lives, Taylor!”

Desperate and terrified, Taylor admits she and Deacon never meant to hurt anyone. She pleads for understanding, but Sheila doesn’t want apologies — she wants revenge. The tension rises as Sheila blocks the door, trapping Taylor inside. “You’re not walking away from this,” she growls. Taylor begins to tremble, her composure slipping. “Please, don’t do this,” she whispers, tears forming in her eyes. “You don’t have to hurt me. I’ll leave him — I’ll stay away from Deacon, I swear. Just… please don’t kill me.”

Spoilers reveal that this confrontation takes a chilling turn when Sheila pulls a gun from her purse. Taylor gasps in horror. She tries to reach for her phone, but Sheila fires a warning shot into the wall. “No police, no lies, no more therapy sessions about forgiveness,” Sheila says with a bitter laugh. “Now you listen to me.” The scene is pure, edge-of-your-seat intensity — one of those moments that reminds viewers why Sheila Carter remains one of daytime television’s most iconic villains.

As Taylor breaks down, sobbing, she finally confesses something she’s kept hidden: guilt over her own past mistakes — shooting Bill Spencer, choosing Ridge over herself, and constantly trying to fix people who can’t be fixed. She tells Sheila, through tears, that she understands pain better than anyone. “I’ve been broken too,” she cries. “I’ve made choices I regret every single day. But killing me won’t take your pain away.”

For a moment, Sheila hesitates. The fury in her eyes wavers, and something almost human flickers through — sorrow, maybe even grief. Taylor seizes the opportunity to reach her. “You can still walk away,” she says softly. “Be the mother, the woman you wanted to be. Don’t let this define you.” It’s a classic Taylor move — empathy even when staring down danger — but with Sheila, nothing is predictable.

Navigating the Storm: Your Expert Guide to Foreclosure Prevention in 2025

As someone who has spent over a decade guiding homeowners through the treacherous waters of financial distress, I understand the profound anxiety that comes with falling behind on mortgage payments. The economic landscape of 2025, while showing signs of resilience in some sectors, still presents unique challenges—from persistent inflation to an unpredictable job market and interest rate fluctuations. Losing your home isn’t just a financial blow; it’s an emotional earthquake. But let me be absolutely clear: foreclosure is not an inevitable outcome. With proactive steps, informed decisions, and the right resources, you can protect your most valuable asset. This comprehensive guide, built on years of hands-on experience, is designed to empower you with the knowledge and strategies to navigate these difficult times and keep your home.

Confront the Challenge Early: Don’t Ignore the Red Flags

The single most critical piece of advice I can offer, year after year, remains constant: do not ignore the problem. The moment you anticipate or experience difficulty making your mortgage payment, that’s your cue to act. In my experience, procrastination is the silent killer of homeownership during financial hardship. Every missed payment compounds the issue, adding late fees, increasing the principal balance, and, most importantly, shrinking your window of opportunity for effective intervention. Lenders are legally bound to follow specific timelines for foreclosure proceedings, and the further behind you fall, the harder it becomes to reinstate your loan and explore viable alternatives.

Think of your mortgage as a living financial commitment. When it starts to falter, early detection is akin to catching an illness in its nascent stages—much easier to treat and cure. Delaying action out of fear, shame, or simply hoping the problem will magically disappear, only serves to strengthen the lender’s position and weaken yours. By 2025, with advanced digital tracking and automated communication, your lender will know you’re behind almost immediately. Don’t let the first notification you receive be a formal notice of default. Be ahead of the curve, preparing your defense before the attack fully materializes. Proactive engagement can be the difference between a temporary setback and permanent loss.

Engage Your Lender: They Are Not the Enemy

It’s a common misconception that your mortgage lender wants to take your house. In reality, a foreclosure is a costly and time-consuming process for them, often resulting in a net loss. Lenders prefer to keep borrowers in their homes, and they are typically equipped with various “loss mitigation” options designed to help you through difficult financial times. My decade of experience consistently shows that lenders are more receptive to working with homeowners who reach out before the situation escalates.

In 2025, contacting your lender has never been easier, though the sheer volume of options can be overwhelming. Don’t just rely on automated phone lines. Seek out their specific “loss mitigation,” “home retention,” or “hardship assistance” departments. Prepare yourself with details of your financial hardship: what happened (job loss, medical emergency, divorce), how long it’s expected to last, and what steps you’re taking to address it. Be honest, articulate, and persistent.

Lenders offer a spectrum of solutions:

Forbearance: A temporary suspension or reduction of payments, usually for a few months, with the understanding that the missed payments will be repaid later.

Repayment Plan: Spreading the missed payments over several months, added to your regular monthly payment.

Loan Modification: A permanent change to the terms of your loan (e.g., lower interest rate, extended loan term, principal reduction in rare cases) to make payments more affordable. This is often a highly sought-after mortgage hardship solution.

Short Sale: Selling your home for less than you owe, with the lender agreeing to accept the sale proceeds as full satisfaction of the debt.

Deed-in-Lieu of Foreclosure: Voluntarily transferring ownership of your property to the lender to avoid the foreclosure process.

Your goal in this initial contact is to open a dialogue and understand which foreclosure prevention programs might be applicable to your situation. Document every conversation: date, time, representative’s name, and what was discussed. This paper trail is invaluable.

Master Your Mail and Digital Communications: Critical Information Awaits

In today’s hybrid communication environment of physical mail and digital portals, it’s more important than ever to diligently open and respond to all correspondence from your lender. This isn’t just about good practice; it’s about legal imperative. The initial notices you receive will often contain vital information about your foreclosure alternatives and rights, outlining the very home retention strategies your lender offers. These are not junk mail; they are often your first line of defense.

As the situation progresses, later mail or digital notifications may include critical legal notices, such as a Notice of Default or a Notice of Sale, depending on your state’s laws. Your failure to open or read these documents will absolutely not be an excuse in foreclosure court. Judges operate on the assumption that you received proper notification.

In 2025, many lenders leverage online borrower portals for communication, document submission, and application tracking. Regularly check your online account for messages, updates, and requirements. Enable email and text notifications if available. Missing a deadline for submitting documentation can derail an otherwise viable loan modification application, pushing you closer to foreclosure. Be meticulous in managing both your physical mailbox and your digital inbox. Every piece of communication is a clue or a directive in your battle against foreclosure.

Understand Your Mortgage Rights and State Laws

Knowledge is power, especially when facing foreclosure. Don’t rely on hearsay or assumptions. Dig out your original loan documents—the promissory note, mortgage or deed of trust, and any riders. Read them. Understand the terms, particularly the clauses related to default, acceleration, and foreclosure. These documents lay out exactly what your lender is legally permitted to do if you can’t make your payments.

Beyond your personal loan documents, it is absolutely crucial to understand the foreclosure laws and timelines specific to your state. Foreclosure processes vary significantly across the United States. Some states operate under a “judicial foreclosure” system, which requires the lender to go through court, often providing homeowners with more time and opportunities to respond. Other states use “non-judicial foreclosure,” a faster process that allows the lender to foreclose without court intervention, provided certain conditions are met.

The best way to educate yourself on your state’s specific laws is to contact your State Government Housing Office or search their official website for “foreclosure laws [Your State].” Additionally, organizations like the National Consumer Law Center (NCLC) provide excellent resources. Knowing whether you’re in a judicial or non-judicial state, understanding the specific notice requirements, and recognizing potential legal defenses can significantly impact your strategy and options for avoiding mortgage default. This foundational understanding empowers you to advocate for yourself effectively or to work more productively with a housing counselor or attorney.

Explore Foreclosure Prevention Options (Loss Mitigation) In Depth

Once you’ve contacted your lender and understood your rights, the next step is to deeply understand the various loss mitigation options available. This isn’t a one-size-fits-all solution; your eligibility will depend on your specific loan type, the nature of your hardship, and your payment history.

Let’s delve a bit deeper into the most common options, which are often your best bet for financial hardship solutions:

Loan Modification: As mentioned, this is a permanent change. Lenders often look for proof of a “qualifying hardship,” a new sustainable income, and a willingness to cooperate. Documentation for this can be extensive, requiring recent pay stubs, tax returns, bank statements, and a detailed hardship letter. Success hinges on demonstrating a “changed financial circumstance” that makes your original payment unsustainable but that a modified payment would make affordable.

Forbearance Agreements: While temporary, a well-structured forbearance can provide crucial breathing room. It’s vital to understand the terms of repayment once the forbearance period ends. Will it be a lump sum? A repayment plan? Or a deferral to the end of the loan? By 2025, many lenders have become more flexible in the repayment of forbearance amounts, often allowing them to be tacked onto the end of the loan.

Principal Reduction/Forgiveness: While rare, particularly for conventional loans, some government-backed programs or certain types of mortgages (e.g., those from the HAMP era, though largely expired) historically offered this. It’s worth asking if any such government housing aid is available or if your loan servicer has specific internal programs.

Short Sale: If keeping your home isn’t feasible, a short sale allows you to sell the property for less than the outstanding mortgage balance, with the lender agreeing to absorb the loss. This can be complex, often requiring a real estate agent experienced in short sales, and it does impact your credit, though less severely than a foreclosure.

Deed-in-Lieu of Foreclosure: If you can’t sell and can’t afford to stay, voluntarily handing over the deed can spare you the public record of a foreclosure and potentially mitigate credit damage.

Online resources from HUD, federal agencies, and reputable non-profits are invaluable for understanding these options. Don’t be afraid to ask your lender for a comprehensive list of all mortgage relief options they offer.

Leverage HUD-Approved Housing Counselors: Your Free Advocate

In my professional opinion, one of the most underutilized and powerful resources for homeowners facing foreclosure is the U.S. Department of Housing and Urban Development (HUD)-approved housing counseling network. These services are either free or offered at a very low cost, funded by HUD, and available nationwide. This is not a scam; it’s a lifeline.

A HUD-approved housing counselor is an impartial, knowledgeable expert who can:

Explain Your Options: They understand the intricacies of foreclosure law, federal programs, and lender-specific foreclosure prevention programs.

Organize Your Finances: They can help you create a realistic budget, identify areas for cost-cutting, and prepare the extensive documentation required for loan modification eligibility.

Act as Your Liaison: Crucially, they can represent you in negotiations with your lender. This is particularly valuable if you feel overwhelmed, intimidated, or aren’t getting clear answers from your servicer. Their professional standing can sometimes open doors or expedite processes that individual homeowners struggle with.

Identify Scams: They are highly attuned to the predatory practices of foreclosure scams and can help you avoid falling victim.

To find an approved HUD counselor, visit the official HUD website (www.hud.gov) or call their hotline: 800-569-4287 (TTY: 800-877-8339). Make this call. It could be the most important one you make. Their expertise is a powerful tool in your equity protection strategy.

Rigorous Prioritization: Scrutinize Every Dollar

When facing a potential foreclosure, your financial priorities must shift dramatically. After essential healthcare, keeping a roof over your head should become your absolute number one financial imperative. This requires a ruthless review of your spending habits and a willingness to make temporary sacrifices.

Sit down and meticulously review every expense. Create a detailed budget, distinguishing between essential needs and discretionary wants. Ask yourself:

What can be cut entirely? Subscriptions you don’t fully utilize, premium cable packages, dining out, entertainment memberships, daily specialty coffees. These optional expenses are the first to go.

What can be reduced? Groceries (meal planning, less expensive brands), transportation (carpooling, public transit), clothing (buying only essentials).

Can you temporarily delay payments on “unsecured” debts? Credit cards, personal loans, and store credit accounts generally carry less severe consequences for temporary non-payment than your mortgage. While this impacts your credit score, it’s often a necessary sacrifice to secure your primary residence. Communicate with these creditors if you must delay payments to avoid further penalties.

This isn’t about long-term austerity; it’s about a short-term, intensive effort to create sufficient cash flow to cover your mortgage. Demonstrate to yourself, and potentially to your lender if you’re applying for assistance, that you are committed to doing everything in your power to make your payment. This proactive budgeting is a key component of effective financial counseling for homeowners.

Strategic Use of Assets and Supplemental Income

Sometimes, simply cutting expenses isn’t enough. In these situations, it’s time to explore how your existing assets or potential for increased income can provide the necessary bridge. This isn’t about depleting your life savings recklessly, but about making calculated decisions to protect your home.

Consider:

Underutilized Assets: Do you have a second vehicle you rarely use that could be sold? Jewelry, collectibles, or other non-essential valuables? A life insurance policy with cash value that you could borrow against or surrender (after careful consideration of its purpose)? These are not easy decisions, but a temporary liquidation of non-essential items can generate the cash needed to reinstate your loan or cover a few crucial payments.

Additional Income Streams: Can anyone in your household take on extra shifts, a part-time job, or freelance work? In 2025, the gig economy offers numerous opportunities—delivery services, online tutoring, freelance writing, virtual assistance, or local services. Even a few hundred extra dollars a month can make a significant difference.

Family/Friend Assistance: While often a difficult conversation, temporary assistance from close family or friends, if available, can be a short-term solution. Clearly define repayment terms if you pursue this.

The key here is not just generating cash, but also demonstrating to your lender that you are making every conceivable sacrifice to keep your home. This level of commitment can weigh heavily in your favor when they are evaluating your home retention options.

Beware of Foreclosure Prevention Companies: Avoid Paying for Free Help

This warning cannot be overstated: you do not need to pay fees for legitimate foreclosure prevention help. Period. In my experience, the vast majority of “for-profit” companies that promise to negotiate with your lender for a hefty fee are preying on vulnerable homeowners. This money—often equivalent to two or three months of mortgage payments—could be going directly towards your actual mortgage.

Legitimate businesses exist, yes, but the information and services they charge for are often precisely what your lender’s loss mitigation department or a HUD-approved housing counselor will provide free of charge. These companies often employ high-pressure sales tactics, make unrealistic guarantees, and then disappear once they’ve collected their fee, leaving you worse off than before.

Red flags to watch out for:

Guarantees of stopping foreclosure immediately. No legitimate entity can guarantee this.

Demanding upfront fees. Free services are available.

Asking you to sign over your deed or title. This is a massive red flag for foreclosure recovery scams (discussed next).

Advising you to stop paying your lender. This is reckless advice that will only accelerate the foreclosure process.

Telling you not to contact your lender directly. They want to be the sole point of contact, often to obscure their questionable practices.

Focus on trusted, free resources. That money is far better spent on protecting home equity by making actual mortgage payments.

Evade Foreclosure Recovery Scams: Protect Your Title

This is perhaps the most insidious and damaging type of scam: the “foreclosure recovery” or “foreclosure rescue” scam. These predatory schemes don’t just take your money; they aim to steal your home. They target homeowners who are deep into the foreclosure process, offering what seems like a miraculous solution.

The most common tactic involves a firm claiming they can stop your foreclosure immediately if you simply sign a document appointing them to act on your behalf or to transfer your property into a trust. What you may actually be signing is a document that signs over the title to your property, effectively making you a renter in your own home, with no equity and no ownership. You think you’re getting help; you’re actually signing away your future.

Here’s my sternest warning: Never, ever sign a legal document without fully reading and understanding all the terms, and without getting independent professional advice. This advice should come from a licensed attorney specializing in real estate or foreclosure defense, a trusted real estate professional, or a HUD-approved housing counselor. These professionals can explain the nuances of the document and confirm its legitimacy. The cost of a consultation with an attorney for an hour or two is a negligible investment compared to losing your entire property and accumulated equity. Be vigilant. Be skeptical. Protect your deed as if your financial life depends on it—because it does.

Moving Forward: Your Path to Stability

The journey through financial hardship and potential foreclosure is undoubtedly stressful, but it’s a journey that many have successfully navigated. The key is to act swiftly, gather accurate information, leverage available resources, and remain persistent. The tools and strategies I’ve outlined, refined over a decade of helping homeowners, are designed to give you the best possible chance to retain your home and rebuild your financial stability.

Remember, every situation is unique, and the path forward may require a combination of these approaches. Don’t be afraid to ask for help, and don’t let shame prevent you from seeking the support you deserve. Your home is more than just a house; it’s a foundation for your life and your family’s future.

Don’t face this challenge alone. If you’re struggling with mortgage payments or facing the threat of foreclosure, reach out today. Take the critical first step towards securing your home and your peace of mind. Contact a HUD-approved housing counselor immediately or speak with your lender to explore your options. Your future in your home starts with action now.