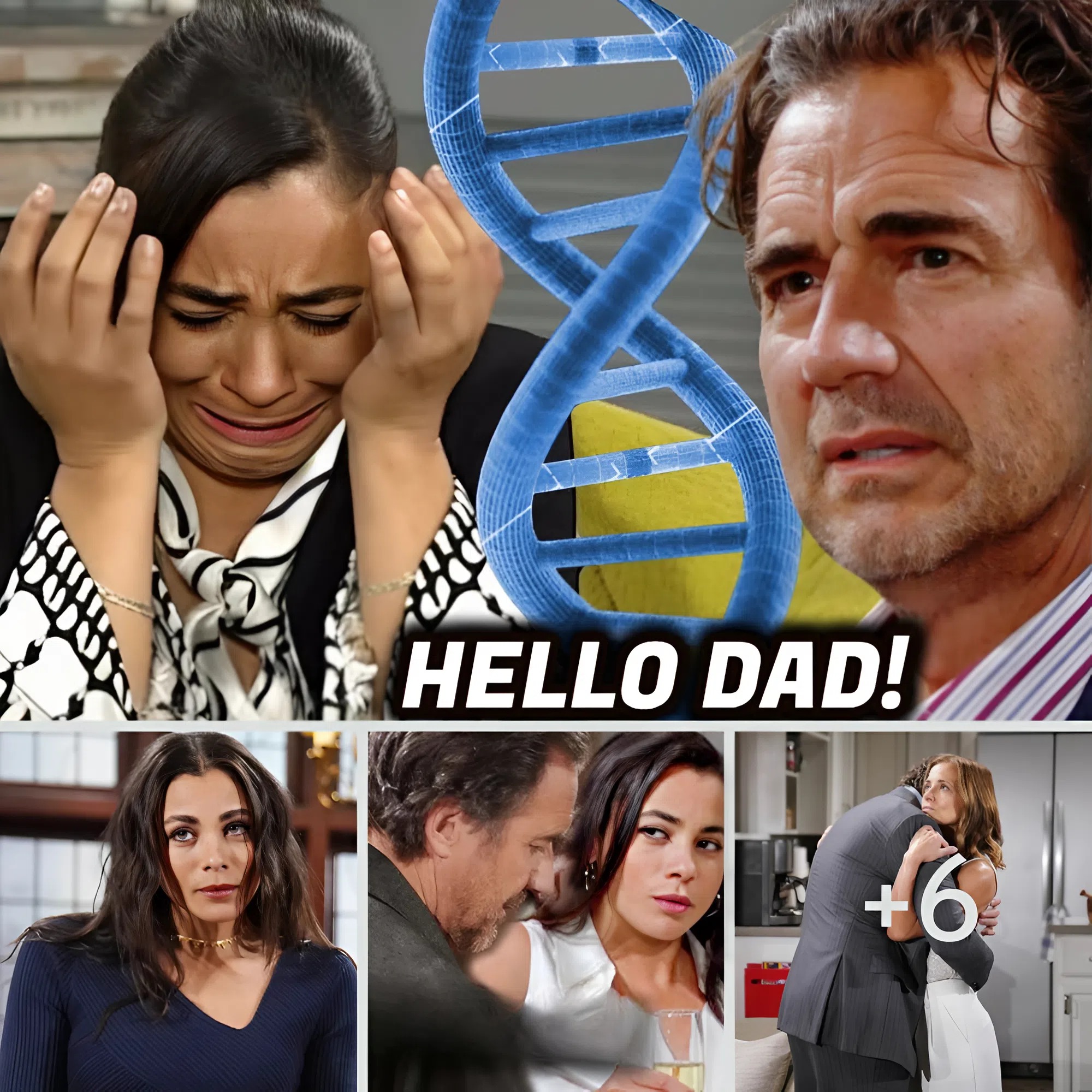

Daphne’s True Identity Exposed

A dreadful secret rocks the Forrester family when Daphne, the nurse who seemed to arrive with pure intentions, is revealed to be Eric Forrester’s biological daughter. This revelation is not just a twist — it’s an earthquake that cracks the very foundation of the family.

For decades, Eric worked to build a legacy as a titan of fashion, a devoted father, and a moral leader. But Daphne’s arrival threatens to expose a hidden past filled with betrayal, weakness, and silence. Was she the product of a fleeting affair Eric buried in his memory? Or worse, a daughter he knowingly abandoned?

Eric Faces a Legacy in Ruins

For Eric, already battling age and illness, the truth leaves him torn between guilt and denial. Should he embrace Daphne as his daughter and risk public humiliation, or deny her and try to protect his carefully crafted image? Either choice will change his family — and the company — forever.

Quinn Fuller sees the news as her worst nightmare. She fought for years to be Eric’s one true partner, only to discover a living reminder of his past mistakes now standing in her home. Quinn’s fury will not just be aimed at Eric but also at Daphne, whom she will likely accuse of scheming her way into the Forrester dynasty.

The Forrester Children React

Ridge, Thorne, Kristen, and Felicia are equally shaken. Ridge, long considered Eric’s heir, suddenly faces the threat of a new sibling with a potential claim to the family empire. His confidence and authority are shaken to the core.

Thorne, often overlooked, may sympathize with Daphne as a fellow outsider. Kristen and Felicia, meanwhile, must reconcile their image of a noble father with the reality of a man who abandoned a child.

A Corporate Earthquake

The revelation does more than fracture relationships. It also sends Forrester Creations into crisis. Shareholders panic, rivals like Spectra circle, and legal questions swirl. Does Daphne deserve a share of Eric’s holdings? Could her presence rewrite the line of succession at the fashion house?

Suddenly, what began as a family scandal becomes a full-blown war of inheritance and power.

Ridge’s Wedding Shattered

The most immediate fallout hits Ridge. On the day he is set to marry Brooke, Eric confesses the truth. The weight of the revelation proves unbearable. Ridge halts the ceremony in front of family and friends, leaving Brooke humiliated at the altar.

This isn’t just a cold-footed groom — it’s a man whose entire identity has been destroyed in a matter of minutes. If Ridge isn’t truly Eric’s son, then everything he has believed about his place in the Forrester family collapses. His legacy, his role at Forrester Creations, and even his relationship with Brooke feel like a lie.

A Dynasty in Pieces

The aftermath is devastating. Brooke is left furious and heartbroken, unable to understand Ridge’s sudden rejection. Quinn schemes to push Daphne out. The Forrester siblings begin to turn on one another. And Eric, consumed by guilt, realizes his deathbed confession may have destroyed the very family he wanted to save.

Whether Daphne came in search of love or as a woman seeking revenge, her presence has shattered the Forrester myth once and for all. The perfect dynasty is no more — leaving behind a legacy defined not by silk and power, but by betrayal and broken truths.

Navigating the 2025 Housing Market: 10 Critical Pitfalls First-Time Homebuyers Must Avoid

After a decade immersed in the dynamic currents of the US real estate market, I’ve witnessed firsthand the exhilarating highs and daunting challenges faced by countless first-time homebuyers. The dream of homeownership remains a cornerstone of the American ideal, yet the path to achieving it is more complex than ever, especially as we look at the landscape of 2025. With evolving economic indicators, shifting mortgage interest rates forecast, and continued demand, making smart, informed decisions is paramount.

Many hopeful buyers, fueled by excitement and perhaps a touch of inexperience, inadvertently stumble into common traps that can derail their dreams or lead to significant financial strain down the road. This isn’t just about avoiding a bad deal; it’s about securing a stable financial future and finding a home that genuinely serves your long-term aspirations.

Drawing from years of practical experience and an acute awareness of the nuances of the 2025 housing market, I’ve compiled the ten most critical mistakes I consistently see first-time homebuyers make. By understanding and proactively sidestepping these missteps, you can transform your homebuying journey from a stress-filled ordeal into a triumphant acquisition. Let’s delve into what not to do when seeking your first American home.

Mistake #1: Skipping the Mortgage Pre-Approval Process – A 2025 Imperative

In today’s competitive market, walking into an open house or making an offer without a solid mortgage pre-approval is akin to entering a marathon unprepared. It’s not just a formality; it’s your financial passport, especially in 2025 where sellers often favor buyers who demonstrate readiness and credibility.

What is Mortgage Pre-Approval in the US Context?

Mortgage pre-approval is a comprehensive review by a US lender (bank, credit union, or mortgage broker) of your financial health. They scrutinize your credit score for home loan eligibility (typically FICO scores), income stability, employment history, existing assets, and a thorough assessment of your debt-to-income (DTI) ratio. This deep dive allows them to determine the maximum loan amount you qualify for, subject to certain conditions. Unlike a mere pre-qualification, which is a rough estimate, pre-approval involves a hard credit pull and a more rigorous verification process, making it significantly more valuable.

Why is Pre-Approval More Crucial Than Ever in 2025?

Realistic Budgeting: In a market with fluctuating prices, knowing your precise borrowing capacity is essential. It helps you target properties within your true affordability, preventing the heartbreak of falling in love with a home you can’t realistically finance. This clarity can also illuminate opportunities for down payment assistance programs US or specific first-time homebuyer loans 2025 like FHA or VA loans, if you qualify.

Stronger Negotiating Leverage: Imagine a seller receiving multiple offers. The one backed by a robust pre-approval letter instantly gains an advantage. It signals that you are a serious, qualified buyer, reducing perceived risk for the seller and potentially leading them to prioritize your offer, even if it’s not the absolute highest.

Expedited Closing Process: Pre-approval streamlines the financing portion of your home purchase. Much of the heavy lifting regarding your financial verification is already done, allowing for a smoother, faster path to closing, which can be a significant advantage when time is of the essence.

Proactive Credit Issue Resolution: The pre-approval process often uncovers any hidden credit report inaccuracies or financial red flags early on, giving you time to address them before they jeopardize your loan application. This foresight can save weeks or even months of delays.

How to Secure Your Pre-Approval in the US:

Research Lenders: Explore various US lenders, comparing their rates, fees, and customer service. Look into different loan types: Conventional, FHA (often popular for low down payment mortgage options), VA (for eligible veterans), and USDA (for rural properties).

Gather Documentation: Prepare your financial paperwork:

Photo ID (Driver’s License, Passport)

Social Security Number

Recent pay stubs (last 30-60 days)

W-2 forms (last two years)

Tax returns (last two years)

Bank statements (last 2-3 months)

Statements for any investments, retirement accounts (e.g., 401k, IRA)

Details of existing debts (student loans, car loans, credit cards)

Apply: You can apply online, over the phone, or in person. Be prepared for a detailed financial discussion.

Credit Check: The lender will perform a “hard inquiry” on your credit report.

Verification: Expect verification of employment and possibly other assets.

Receive Pre-Approval Letter: This letter will state the maximum loan amount, estimated interest rate, and often the loan type. Remember, this isn’t a guaranteed loan, but a conditional commitment.

Mistake #2: Underestimating the True Cost of Homeownership in 2025

Many first-time buyers fixate solely on the list price and the monthly mortgage payment, overlooking a complex web of additional expenses that make up the real cost of owning a home in the US. In 2025, with inflation still a factor and service costs rising, these “hidden” expenses can significantly impact your budget.

Beyond the Purchase Price: The Full Financial Picture

Closing Costs Explained: These are the fees paid at the close of the real estate transaction. They can range from 2% to 5% of the loan amount and include:

Lender Fees: Origination fees, underwriting fees, application fees.

Title Insurance: Protects both you and the lender against title defects.

Appraisal Fee: To confirm the home’s value for the lender.

Inspection Fees: For structural, pest, radon, etc.

Escrow Fees: For the neutral third party handling the transaction.

Recording Fees: To register the new deed with the county.

Attorney Fees: In states where attorneys are required for closing.

Prepaid Items: Property taxes and homeowner’s insurance premiums often paid upfront into an escrow account. A useful closing costs calculator can help you estimate these.

Property Taxes: These vary drastically by state, county, and even municipality. In some areas, they can add hundreds, if not thousands, to your monthly payment. Always research property tax rates by state and local jurisdictions before making an offer. These rates can also be reassessed annually.

Homeowner’s Insurance (P&C): Essential protection against damage, theft, and liability. Premiums can vary based on location (e.g., coastal areas with hurricane risk), home value, and your claims history. In 2025, expect potential increases due to climate-related events.

Mortgage Insurance:

Private Mortgage Insurance (PMI): Required for conventional loans if your down payment is less than 20%.

Mortgage Insurance Premium (MIP): For FHA loans, often for the life of the loan or a significant period, regardless of down payment.

Homeowners Association (HOA) Fees: If you buy a condo, townhouse, or home in a planned community, these mandatory monthly fees cover maintenance of common areas, amenities (pools, gyms), and sometimes external repairs. Make sure to thoroughly understand HOA fees explained and their rules.

Utility Connections and Deposits: Expect costs for setting up electricity, gas, water, internet, and sometimes new deposits.

Brokerage Fees: While typically paid by the seller, understanding how real estate agents are compensated is still important context for buyer’s agent commission structures.

Moving Costs: Don’t forget the expense of professional movers, rental trucks, or packing supplies.

Anticipating Maintenance and Repair Expenses:

Homeownership is an ongoing investment. Plan for:

Annual Maintenance Budget: A common rule of thumb is to budget 1% to 2% of the home’s value annually for maintenance and repairs. So, a $400,000 home might require $4,000-$8,000 per year.

Routine Upkeep: Landscaping, cleaning, gutter clearing, HVAC filter changes.

Larger Repairs: Replacing a roof (every 15-30 years), HVAC system (10-15 years), water heater (10-12 years), or appliances. Even minor issues like a leaky faucet or electrical outlet repair can add up.

Mistake #3: Neglecting In-Depth Neighborhood Research

A beautiful house in the wrong neighborhood can quickly become a regrettable purchase. The location profoundly impacts your daily life, your home’s appreciation, and its eventual resale value.

Factors Beyond the Property Line in 2025:

Safety and Crime Rates: Utilize online resources (local police department websites, NeighborhoodScout, Niche.com) to research crime statistics. This is paramount for peace of mind and family safety.

Commute Times: Realistically assess your commute to work, schools, and frequent destinations. Traffic patterns can be unpredictable; test the commute during peak hours.

School Districts: For many US buyers, particularly those with or planning families, the quality of local schools is a top priority. Strong school districts correlate directly with higher property values and demand. Research school ratings and boundary lines carefully.

Amenities and Lifestyle: Evaluate proximity to grocery stores, healthcare facilities, parks, recreational areas, dining, and shopping. Does the area offer the lifestyle you desire (e.g., quiet suburban, bustling urban, outdoor-centric)?

Community Demographics and Culture: Does the neighborhood’s vibe align with your preferences? Some prefer diverse, active communities, while others seek tranquil, tight-knit enclaves.

Noise and Traffic: Visit the neighborhood at different times of day and night. Is it under a flight path? Near a busy highway? Close to a hospital with sirens?

Future Development Plans and Their Impact on Property Value:

Municipal Development Plans: Research local zoning laws, upcoming infrastructure projects (new roads, public transport like subway/light rail extensions), and revitalization initiatives. These can significantly enhance or detract from property values.

Commercial and Residential Growth: Are new businesses moving in? Are there plans for new housing developments? Both can signal growth but also increased traffic or changes to neighborhood character.

Environmental Considerations: Are there any flood plains, wildfire risks, or environmental hazards in the area? Check FEMA flood maps.

Mistake #4: Overlooking the Importance of a Comprehensive Home Inspection

In the US, a professional home inspection is non-negotiable. It’s your primary defense against inheriting costly structural, mechanical, or safety issues that aren’t apparent during a casual walkthrough. While sellers are legally required to disclose known issues in many states, an inspection uncovers unknown or hidden problems.

What Does a Home Inspection Cover in the US?

A thorough inspection by a certified professional (often adhering to standards set by organizations like ASHI or InterNACHI) will typically examine:

Structural Integrity: Foundation, framing, roof structure, walls, floors, ceilings.

Exterior: Siding, windows, doors, gutters, drainage, chimney, decks/patios.

Roofing: Materials, condition, flashing, ventilation.

Interior: Walls, ceilings, floors, windows, doors.

Plumbing System: Water supply, drains, hot water heater, fixtures, visible pipes.

Electrical System: Service panel, wiring, outlets, switches, light fixtures.

HVAC System: Heating, ventilation, and air conditioning units, ductwork.

Appliances: Built-in appliances (if applicable, though some inspectors may not test all).

Attic and Basement/Crawl Space: Insulation, ventilation, moisture, signs of pests.

Safety Issues: Presence of carbon monoxide detectors, smoke detectors, railings.

Common Structural & Systemic Issues in US Homes:

Beyond the obvious, inspectors look for:

Foundation Problems: Cracks, uneven floors, signs of settling.

Roof Leaks/Damage: Deteriorated shingles, damaged flashing, improper drainage.

Water Intrusion: Basements, crawl spaces, attics prone to moisture, mold.

Outdated Electrical Systems: Knob-and-tube wiring, insufficient amperage, faulty outlets.

Plumbing Issues: Leaks, low water pressure, old piping materials (e.g., galvanized steel).

HVAC Failures: Inefficient units, deferred maintenance, improper sizing.

Radon Gas: A colorless, odorless radioactive gas that can accumulate in homes, especially in certain geographic areas. Testing for it is highly recommended.

Asbestos and Lead Paint: Common in older homes, requiring mitigation.

Pest Infestations: Termites, rodents, carpenter ants.

How to Find a Reliable Home Inspector (and Why it Matters):

Seek Referrals: Ask your real estate agent, friends, or family for recommendations.

Verify Credentials: Look for inspectors certified by ASHI (American Society of Home Inspectors) or InterNACHI (International Association of Certified Home Inspectors). These organizations require extensive training and adherence to strict ethical and performance standards.

Review Sample Reports: Ask to see an inspector’s sample report to understand their thoroughness and clarity.

Check Reviews and Experience: Look up online reviews and inquire about their specific experience with homes of a similar age and type to the one you’re considering.

Accompany the Inspector: Always attend the inspection. It’s an invaluable learning opportunity to understand the home’s condition firsthand and ask questions directly. Don’t let cost deter you; a good home inspection cost is a small price to pay for significant peace of mind.

Mistake #5: Emptying Savings for the Down Payment – A Risky Strategy

While a larger down payment generally means lower monthly mortgage payments and potentially a better interest rate, completely depleting your savings account is a dangerous gamble for a first-time homeowner. In 2025, with economic uncertainties, maintaining liquidity is vital.

Balancing Down Payment with an Essential Emergency Fund:

The 3-6 Month Rule (or More): I advise clients to maintain an emergency fund equivalent to at least 3-6 months of all living expenses (mortgage, utilities, food, transportation, insurance, etc.). For homeowners, I often recommend leaning towards 6-9 months, or even 12, to account for unexpected home repairs.

Unexpected Homeownership Expenses: Remember Mistake #2. A new home can present unforeseen repair costs (e.g., a burst pipe, a failing appliance, a sudden roof leak). Without readily available cash, you could face significant stress, debt, or even risk your home.

Life’s Unpredictability: Job loss, medical emergencies, or other personal crises can strike at any time. An emergency fund acts as a crucial safety net.

Government Schemes and Alternative Down Payment Sources in the US:

FHA Loans: Often allow down payments as low as 3.5%.

VA Loans: For eligible veterans and service members, these loans typically require no down payment at all. This is a significant VA loan benefit.

USDA Loans: For qualifying rural properties, these also offer zero down payment options.

State and Local Down Payment Assistance (DPA) Programs: Many states, counties, and cities offer grants, second mortgages, or forgivable loans to help first-time homebuyers with down payments and closing costs. Research these thoroughly; they can be invaluable.

Gifts from Family Members: Many loan programs allow down payment funds to come from a gift, provided specific documentation (a gift letter) is supplied by the donor confirming the funds are not a loan.

Employer Assistance Programs: Some companies offer housing assistance or relocation packages.

401(k) Loans: While tempting, borrowing from your retirement account should be a last resort and approached with extreme caution. You’ll miss out on potential investment growth, and if you leave your job, the loan may become immediately due or subject to taxes and penalties. This is generally not recommended as a primary down payment strategy.

Mistake #6: Ignoring Future Resale Value & Long-Term Investment Potential

Many first-time buyers become so focused on finding any home that they overlook its long-term viability as an asset. Your first home is often your largest investment, and understanding its future investment property analysis and appreciation potential is key, especially in 2025 where real estate market trends are continuously evolving.

Factors Affecting Resale Value in the US Market:

Location, Location, Location: Still the golden rule. Proximity to desirable school districts, major employment hubs, public transportation, and popular amenities (parks, cultural centers, retail) significantly drives value.

Infrastructure Development: New highways, light rail, hospitals, or major commercial developments in the vicinity can boost property values. Conversely, plans for undesirable developments (e.g., landfills, noisy industrial zones) can depress them.

Quality of Construction and Builder Reputation: Well-built homes from reputable builders tend to hold their value better and require less maintenance. Buyers often pay a premium for perceived quality and peace of mind.

Curb Appeal and Condition: A well-maintained home with attractive landscaping and a clean exterior always sells faster and for a higher price.

Layout and Functionality: Open floor plans, flexible spaces (home office potential), and desirable features (updated kitchens/bathrooms, energy efficiency) are highly sought after.

Market Trends (2025 Outlook): While impossible to predict perfectly, understanding general housing market forecasts for your specific area regarding supply, demand, and economic growth is crucial. Homes in areas with expected job growth and limited new construction are likely to appreciate more.

Future-Proofing: Consider features that will remain desirable: energy efficiency, smart home technology infrastructure, and adaptable spaces.

Mistake #7: Falling in Love with a Home Beyond Your Realistic Budget

This is an emotional trap that snares many first-timers. The allure of a perfect kitchen, a spacious yard, or a prime location can cloud judgment, leading to impulsive bids on homes that stretch or break your budget. The 2025 market, while potentially softening in some areas, can still ignite bidding wars, pushing prices beyond comfort zones.

Tips for Staying Within Budget During the House Hunt:

Establish a Strict Budget BEFORE You Start Looking: Based on your pre-approval amount and your own comfortable monthly payment, determine your absolute maximum. Do not even look at homes above this limit.

Differentiate “Needs” from “Wants”: Create two lists. “Needs” are non-negotiable (e.g., number of bedrooms, location for school, safe neighborhood). “Wants” are desirable but flexible (e.g., granite countertops, a specific architectural style, a finished basement). Prioritize needs first.

Utilize Online Tools for Comparison: Use real estate portals to compare similar properties (“comps”) in your desired areas. This helps you understand actual market value versus asking price and prevents overpaying.

Consider the Long-Term Financial Picture: Ask yourself: Can I afford this home if interest rates tick up? What if I have unexpected expenses? Will I still be able to save for retirement or my children’s education? This holistic view is part of a sound long-term real estate strategy.

Work with a Knowledgeable Buyer’s Agent: A good agent acts as your advocate, helping you stay grounded, find properties that meet your criteria and budget, and negotiate effectively. They understand the market dynamics and can spot when a price is genuinely out of sync with value.

Mistake #8: Not Fully Understanding the Legal Aspects of US Real Estate

The legal framework of US real estate transactions is intricate and varies by state. Ignorance is not bliss here; it can lead to devastating financial and legal repercussions. Every document you sign, from the purchase agreement to closing disclosures, carries legal weight.

Common Legal & Transactional Issues in US Real Estate:

Title Defects: Issues that challenge ownership, such as undisclosed liens, easements, boundary disputes, or errors in previous deeds. A thorough title search importance cannot be overstated.

Property Surveys: Confirming property lines and identifying any encroachments is vital.

Zoning Laws and Covenants: Understanding local zoning (e.g., residential, commercial) and any restrictive covenants (e.g., HOA rules on fencing, paint colors) is critical. Non-compliance can lead to fines or forced alterations.

Purchase Agreement Complexities: This legally binding contract outlines all terms. Understand contingencies (financing, inspection, appraisal), deadlines, and default clauses.

Disclosure Laws: Sellers are required to disclose known material defects (e.g., lead paint, structural issues, past water damage). Understand what disclosures are mandatory in your state.

Homeowners Association (HOA) Documents: If applicable, you must review HOA bylaws, CC&Rs (Covenants, Conditions, and Restrictions), and financial statements. These govern everything from noise levels to pet restrictions to future assessments.

Role of Legal Professionals: In some states (e.g., New York, Massachusetts), a real estate attorney is typically involved to review contracts and represent your interests at closing. In others, a title company handles the closing. Know who represents your interests.

Mistake #9: Rushing the Decision and Succumbing to Pressure

Buying a home is one of the biggest financial commitments you’ll ever make. Rushing into it, whether due to market frenzy, seller pressure, or personal impatience, often leads to unfavorable outcomes, regret, and costly mistakes. Even in a fast-paced 2025 market, calculated patience is a virtue.

When to Pump the Brakes and Potentially Walk Away from a Deal:

Undisclosed or Serious Property Concerns: If the inspection reveals significant, costly, or dangerous issues that the seller refuses to address or compromise on, it’s often best to walk away. Don’t let sunk costs (inspection fees, appraisal fees) cloud your judgment.

Seller’s Unfair Bargaining Practices: If the seller is unwilling to negotiate fairly, is demanding unreasonable terms, or shows signs of dishonesty, it’s a red flag.

Altered Personal Financial Circumstances: If your job situation changes, you incur unexpected debt, or mortgage interest rates suddenly spike, reassess your affordability. Don’t commit if your financial foundation feels shaky.

Coercive Strategies from Agents or Sellers: If you feel pressured to make a decision quickly, waive contingencies, or bid beyond your comfort zone, take a step back. A good agent will advise you, but never force your hand.

Lack of Due Diligence Period: Never waive your inspection, appraisal, or financing contingencies just to win a bid, especially in a competitive market. These protections are there for a reason.

Gut Feeling: Sometimes, a deal just doesn’t feel right. If your intuition is telling you something is off, listen to it. There will always be another home.

Mistake #10: Neglecting to Plan for the Future

Your first home isn’t just a place to live today; it’s a foundation for your future. Short-sighted decisions can limit your flexibility, financial growth, and long-term happiness. Think of your home as a component of your overall long-term real estate strategy.

Considering Long-Term Family Needs & Lifestyle Changes:

Family Growth or Shrinkage: Will you have children? Do you anticipate elderly parents moving in? Does the home offer enough bedrooms, bathrooms, and living space to adapt to these changes without forcing an expensive move in a few years?

Schools and Child-Friendly Amenities: Even if you don’t have children yet, proximity to good schools and parks is a significant factor for future family life and resale value.

Home Office Needs: The shift to remote and hybrid work is here to stay in 2025. Does the home offer a dedicated space for a home office, or can one be easily created?

Accessibility and Aging-in-Place: Could this home accommodate you or family members with mobility challenges in the future? Are there stairs? Can modifications be made easily?

Financial Flexibility: How will this mortgage impact your ability to save for other goals like retirement, college, or future investments? Will you have room to leverage home equity investment down the line?

Building Your Future with Your Home:

Your first home is more than just shelter; it’s often the first step in building substantial wealth through equity. By considering its potential to grow with you, you’re making a strategic investment, not just a purchase. Think about how you might utilize refinance mortgage options in the future to improve your financial position or access equity for other needs.

Your Smart Start to Homeownership in 2025

Navigating the US housing market in 2025 as a first-time homebuyer is undoubtedly complex, but it’s also incredibly rewarding. By proactively avoiding these ten common mistakes, you’re not just safeguarding your investment; you’re setting yourself up for a truly fulfilling and financially stable homeownership journey. Remember, knowledge is your most powerful tool. Don’t rush, don’t assume, and always seek expert advice.

Are you ready to turn your homeownership dreams into a tangible reality with confidence? Don’t let uncertainty hold you back. Connect with a trusted real estate advisor today to build a personalized strategy that accounts for the nuances of the 2025 market and sets you on the path to finding your perfect home.