The previous episode of The Bold and the Beautiful saw Ridge, Bill, Katie, Taylor, and Finn arguing about what should be done with Luna out of house arrest and prison. Meanwhile, Electra and Ivy had a stirring conversation about Will and what to do moving forward in this Luna pregnancy mess.

Shraddha Kapoor Debunks Skincare Myths – Watch Her Take on the Hype!

The drama, the doubts, the punishments, the confrontations, the clashes, and more are about to get heated in the coming few weeks. Here’s what fans can expect from the October 10, 2025, episode of The Bold and the Beautiful when they can tune in to CBS to watch the hit daytime drama.

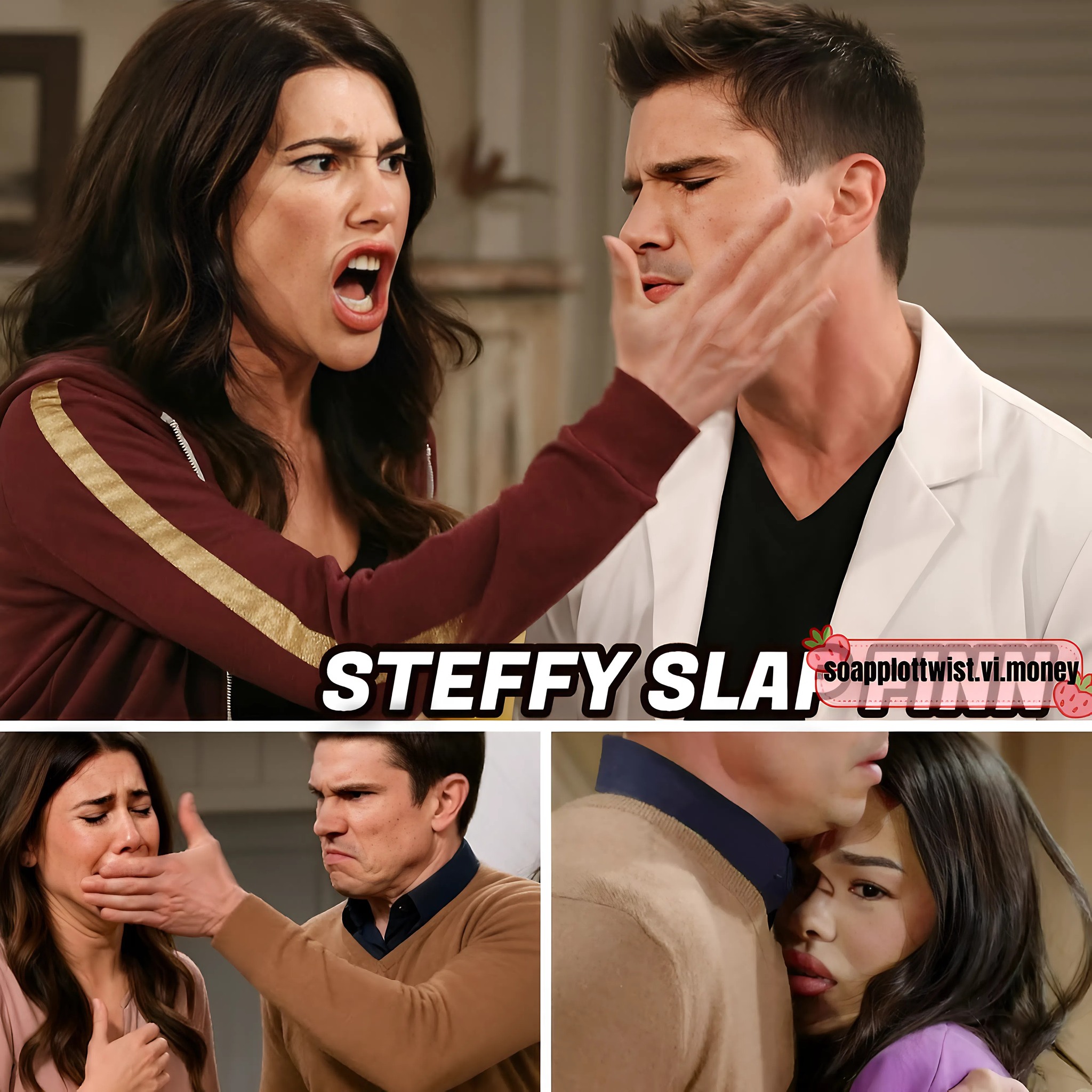

The Bold & The Beautiful Spoilers: October 10, 2025

The final episode of the week features Will and Electra sharing quite a sweet moment. After days of conflict, guilt, confusion, and friction, the two have found their way back to each other. Will has made it clear that he loves Electra and still wants to be with her despite whatever happened.

When Will and Electra share a sweet moment, is this the start of their reconciliation? Will they agree to get through this mess together? Or will the paternity test foil things between them again? Up next, Bridget arrives at Katie and Bill’s, which alarms Luna. Is she really hiding something?

The whole pregnancy mess has caused conflict between members of the Spencer, Finnegan, Nozawa, and Forrester families as they try to figure out what Luna’s future is going to be, in prison or locked at the Spencer estate. Katie has asked her niece, Bridget, to come and take the paternity test.

After all, Luna is known for her evil schemes, and she can easily tamper with any other paternity tests. Is this why Luna is worried? She cannot manipulate the test now? What will the result be? And then lastly, Taylor and Brooke agree that before Steffy is told, Luna is safely behind bars.

The two have never been on the same side of things, especially with the decades-long love triangle between them and Ridge. But it seems that despite Ridge’s recent decision to break his engagement with Taylor and marry Brooke, the two are on the same page regarding what to do with Luna.

They agree that Steffy shouldn’t be informed that Luna is still alive until she is put back into prison. What will the eventual decision be? How will Steffy react when she comes back home and finds out everything that happened?

Navigating the 2025 Multifamily Real Estate Landscape: Top Cities for High-Yield Investment

As a seasoned veteran with a decade embedded in the trenches of multifamily real estate, I’ve seen cycles come and go. The past few years have certainly been a rollercoaster, marked by unprecedented supply-demand dynamics and economic shifts that tested even the most robust portfolios. However, as we stand on the precipice of 2025, the horizon for multifamily real estate investment looks not just brighter, but strategically aligned for substantial growth. Experts universally anticipate a significant realignment of market forces, paving the way for sustained rent growth and attractive returns, making now an opportune moment to strategically expand your real estate portfolio diversification.

Multifamily properties have always been a cornerstone for wealth building real estate, offering a compelling blend of stability, inflation hedging, and consistent passive income real estate. The resilience of the rental housing sector, even through periods of economic uncertainty, underscores its intrinsic value. As interest rates find their equilibrium and demographic shifts continue to fuel demand for rental units, discerning investors are looking for the next frontier of opportunity. This isn’t just about buying property; it’s about making astute commercial property investment decisions that drive long-term value and optimize cash flow real estate.

Our deep dive into the real estate market analysis 2025 reveals critical insights into which markets are poised for outperformance. We’ve meticulously evaluated a confluence of factors – from robust job creation and population migration to occupancy rates, cap rates, and price-to-rent ratios. This isn’t just a list; it’s a strategic blueprint, forged from extensive market research and boots-on-the-ground experience, designed to guide your next impactful apartment building investment.

The Driving Forces Behind 2025’s Multifamily Rebound

To truly understand where to invest, we must first grasp the macro narrative shaping 2025. Several powerful tailwinds are converging:

Demographic Shifts: The millennial generation, now in their prime earning years, continues to drive household formation, many opting for the flexibility and affordability of renting. Simultaneously, an aging population seeks maintenance-free living options. This sustained demand underpins the sector’s stability.

Housing Affordability Crisis: Escalating home prices and higher mortgage rates in many major metros mean homeownership remains out of reach for a significant portion of the population, thereby bolstering the rental market.

Job Growth & Economic Reshaping: Cities with diversified economies, strong tech sectors, healthcare hubs, and advanced manufacturing are attracting talent and consequently, residents. This creates a continuous need for quality housing.

Supply Rebalancing: While some markets experienced an oversupply of new units post-pandemic, the pace of new construction is moderating. This rebalancing act, combined with steady demand, is critical for stabilizing occupancy and fostering healthy rental income property growth.

Inflation Hedging: Multifamily properties historically act as a powerful hedge against inflation. Rents can be adjusted to keep pace with rising costs, protecting your purchasing power and enhancing the appeal of this asset class.

Understanding these foundational elements is crucial before pinpointing the best cities for real estate investment. Our analysis goes beyond raw numbers, interpreting them through the lens of market fundamentals and future growth potential.

Dissecting the Metrics: An Expert’s Toolkit

Before we unveil our top 10, let’s briefly touch upon the key performance indicators (KPIs) we prioritize when evaluating an income property opportunity:

Occupancy Rate: A strong occupancy rate (ideally 90%+) indicates robust tenant demand and effective property management. It’s a direct measure of a market’s health.

Cap Rate (Capitalization Rate): This metric (Net Operating Income / Property Value) offers a snapshot of a property’s potential rate of return. While higher cap rates can signal greater risk, in established markets, they reflect a balanced risk-reward profile.

Price-to-Rent Ratio: This comparison helps assess whether it’s more financially advantageous to rent or buy in a given market. A lower ratio often suggests a healthier rental market from an investment perspective, indicating that rental income provides a relatively strong return compared to the property’s purchase price.

Rent Growth Projections: Critical for future profitability, strong projected rent growth signals a market with high demand and limited supply.

Population and Job Growth: These are the fundamental drivers of demand. Without people and jobs, a market cannot sustain long-term rental growth.

Economic Diversity: Markets with varied industries are more resilient to economic downturns, providing a stable tenant base.

With these principles in mind, let’s explore the top multifamily markets for 2025, offering a strategic guide for your next high-yield real estate acquisition.

The 10 Best Cities for Multifamily Investing in 2025

Our curated list represents markets that excel across these critical metrics, offering compelling opportunities for value-add multifamily strategies and long-term appreciation.

Las Vegas, Nevada

Las Vegas continues its remarkable transformation beyond tourism, emerging as a diversified economic powerhouse. Its appeal to businesses and residents seeking a lower cost of living and no state income tax remains a potent draw. We’ve been actively investing here for years, witnessing firsthand the consistent demand. The market’s infrastructure is expanding, and robust job creation in technology, logistics, and healthcare underpins a thriving rental sector.

Projected Median Property Price (2025): $425,000 – $435,000

Anticipated Occupancy Rate (2025): 91-92%

Estimated Cap Rate (2025): 5.6-6.2%

Price-to-Rent Ratio (2025): 19.5-20

Projected Average Rent (2025): $1,850 – $1,900

Expert Insight: Beyond the glitz, Vegas offers significant opportunity zones investing potential, particularly in revitalized urban cores, making it prime for strategic development or acquisition of rental property investment.

Atlanta, Georgia

The capital of the New South, Atlanta’s economic engine is firing on all cylinders. A magnet for corporate relocations and a hub for film, tech, and logistics, its population growth is staggering. The city’s dynamic appeal, coupled with a relatively attractive cost of living compared to coastal metros, ensures a continuous influx of new renters. Atlanta’s diverse job market provides a stable foundation for strong multifamily demand.

Projected Median Property Price (2025): $410,000 – $425,000

Anticipated Occupancy Rate (2025): 89-90%

Estimated Cap Rate (2025): 5.7-6.0%

Price-to-Rent Ratio (2025): 16.5-17

Projected Average Rent (2025): $1,650 – $1,700

Expert Insight: Atlanta’s extensive infrastructure projects, including MARTA expansion, further enhance connectivity and appeal, boosting property values in well-located submarkets. It’s a prime target for 1031 exchange multifamily opportunities.

Charlotte, North Carolina

Charlotte is a star performer in the booming Carolinas, driven by its status as a major banking and financial services hub. This economic strength fuels a vibrant job market, attracting young professionals and families. The city’s robust population growth directly translates to sustained demand for rental housing. We see Charlotte as a consistent leader for multifamily investment, offering a strong balance of growth and stability.

Projected Median Property Price (2025): $385,000 – $410,000

Anticipated Occupancy Rate (2025): 92-93%

Estimated Cap Rate (2025): 5.6-5.8%

Price-to-Rent Ratio (2025): 17.5-18.5

Projected Average Rent (2025): $1,850 – $1,900

Expert Insight: Consider submarkets surrounding new corporate campuses or expanding medical facilities for enhanced rental income property and appreciation potential. The city’s quality of life is a significant draw.

Tampa, Florida

Florida’s favorable tax climate (no state income tax) combined with Tampa’s rapidly diversifying economy makes it a perpetual favorite for investors and residents. Beyond tourism, Tampa boasts growing sectors in finance, healthcare, and technology. Its strategic port and beautiful Gulf Coast location continue to attract a diverse population, underpinning a positive long-term outlook for multifamily real estate investing.

Projected Median Property Price (2025): $375,000 – $385,000

Anticipated Occupancy Rate (2025): 90-91%

Estimated Cap Rate (2025): 5.6-5.9%

Price-to-Rent Ratio (2025): 14.5-15

Projected Average Rent (2025): $1,850 – $1,900

Expert Insight: Tampa is experiencing a significant urban revitalization, particularly in downtown and surrounding districts. Look for value-add multifamily plays in areas benefiting from new commercial developments and public transport enhancements.

Denver, Colorado

Denver’s allure as an outdoor enthusiast’s paradise combined with its high-growth tech and aerospace industries ensures a constant stream of new residents. The Mile-High City’s economy remains robust, exhibiting strong absorption rates for multifamily units. While property prices are higher, the strong demand and high quality of life contribute to sustained rental growth and appreciation, positioning it as a key commercial real estate investment market.

Projected Median Property Price (2025): $595,000 – $610,000

Anticipated Occupancy Rate (2025): 89.5-90.5%

Estimated Cap Rate (2025): 5.3-5.5%

Price-to-Rent Ratio (2025): 23.5-24.5

Projected Average Rent (2025): $1,850 – $1,950

Expert Insight: Despite higher price points, Denver’s consistent economic expansion and limited developable land continue to drive strong long-term appreciation. Focus on submarkets with excellent connectivity to major employment centers.

Nashville, Tennessee

“Music City” has cemented its status as one of the nation’s most dynamic multifamily markets. Its unique cultural appeal, coupled with a surging economy in healthcare, technology, and advanced manufacturing, draws a diverse demographic. We’ve invested heavily in Nashville, recognizing its consistent high occupancy rates and reliable revenue streams. The city’s ongoing development and friendly business environment make it a top contender for private equity real estate allocations.

Projected Median Property Price (2025): $465,000 – $480,000

Anticipated Occupancy Rate (2025): 89-90%

Estimated Cap Rate (2025): 5.6-5.9%

Price-to-Rent Ratio (2025): 19.5-20.5

Projected Average Rent (2025): $1,950 – $2,000

Expert Insight: Nashville’s decentralized growth pattern means opportunities exist in various submarkets, not just the urban core. Explore areas benefiting from new corporate campuses or healthcare expansions for strong cash flow real estate prospects.

San Diego, California

San Diego offers a unique proposition: a market characterized by limited supply and exceptionally strong demand. Strict zoning laws and geographical constraints restrict new development, while its appealing climate, diverse economy (military, biotech, tourism, tech), and high quality of life ensure continuous population growth. This supply-demand imbalance creates a high-barrier-to-entry market with excellent long-term appreciation potential for real estate portfolio diversification.

Projected Median Property Price (2025): $890,000 – $920,000

Anticipated Occupancy Rate (2025): 95-96%

Estimated Cap Rate (2025): 4.7-4.9%

Price-to-Rent Ratio (2025): 24.5-25.5

Projected Average Rent (2025): $2,600 – $3,100

Expert Insight: While cap rates are tighter, San Diego’s inherent desirability and robust job market make it a strong candidate for investors seeking long-term appreciation rather than immediate high cash flow. Consider strategic property management solutions to maximize returns here.

Salt Lake City, Utah

Salt Lake City is no longer just an emerging market; it’s a rapidly maturing one with a dynamic economy. Its “Silicon Slopes” tech corridor attracts talent and companies, while its natural beauty offers an unparalleled quality of life. We recognized its potential years ago, and it continues to deliver. The city provides a compelling blend of strong growth, relative affordability compared to coastal tech hubs, and a pro-business environment, making it a reliable real estate investment trust (REIT) alternative.

Projected Median Property Price (2025): $535,000 – $550,000

Anticipated Occupancy Rate (2025): 94-95%

Estimated Cap Rate (2025): 5.6-5.8%

Price-to-Rent Ratio (2025): 25.5-26.5

Projected Average Rent (2025): $1,750 – $1,800

Expert Insight: Salt Lake City’s robust population growth, driven by both domestic migration and a strong birth rate, ensures a steady stream of renters. Look for newer construction or well-maintained assets in family-friendly neighborhoods.

Columbus, Ohio

Columbus stands out as a Midwest gem, offering an exceptional blend of solid growth and impressive affordability. Home to Ohio State University, a thriving tech scene, and a strong logistics sector, the city boasts a diversified and resilient economy. Its unique market conditions—characterized by a healthy job market and accessible entry points for investors—make it a prime location for strategic multifamily real estate investing. It represents a significant opportunity for investors seeking strong returns without the premium pricing of coastal markets.

Projected Median Property Price (2025): $285,000 – $295,000

Anticipated Occupancy Rate (2025): 92-93%

Estimated Cap Rate (2025): 6.9-7.2%

Price-to-Rent Ratio (2025): 15.5-16

Projected Average Rent (2025): $1,580 – $1,630

Expert Insight: Columbus offers some of the most attractive cap rates on this list, signaling a robust return on investment potential. Its emerging status and continued economic diversification make it ideal for long-term hold strategies and value-add multifamily projects.

Dallas, Texas

The colossal Dallas-Fort Worth metroplex remains one of the nation’s most active and dynamic apartment markets. Benefiting from significant corporate relocations, diverse job growth across numerous sectors (tech, finance, logistics, energy), and no state income tax, Dallas continues to attract thousands of new residents annually. Its sheer scale and economic momentum ensure a constant demand for rental units across various price points, solidifying its position as a top-tier market for commercial property investment.

Projected Median Property Price (2025): $400,000 – $415,000

Anticipated Occupancy Rate (2025): 89-90%

Estimated Cap Rate (2025): 5.1-5.6%

Price-to-Rent Ratio (2025): 18.5-19

Projected Average Rent (2025): $1,850 – $1,900

Expert Insight: Dallas’s vast and diverse submarkets offer opportunities for every investment strategy, from luxury high-rises to more affordable workforce housing. Understanding the nuanced demographics and growth patterns within the metroplex is key to successful real estate market analysis 2025 here.

Mastering Your Multifamily Investment Strategy in 2025

Identifying the right market is only the first step. True success in multifamily real estate investing in 2025 will hinge on meticulous due diligence, robust financial structuring, and intelligent property management solutions. The landscape for income properties is dynamic, requiring investors to stay informed on local zoning changes, infrastructure developments, and evolving tenant preferences.

Whether you’re exploring opportunity zones investing or optimizing existing rental income property portfolios, the goal remains the same: generate sustainable, predictable returns while mitigating risk. The cities highlighted above offer a prime starting point for investors seeking to capitalize on the powerful tailwinds propelling the multifamily sector into 2025. This asset class continues to demonstrate its power for wealth building real estate, offering a pathway to significant financial growth and passive income real estate.

Ready to transform your investment strategy and capitalize on these unparalleled opportunities in 2025? Don’t let the complexities of the market deter you. Partner with proven experts who possess a decade of dedicated experience and a track record of identifying and executing successful high-yield real estate acquisitions.

Unlock your potential for significant real estate portfolio diversification and robust returns. Connect with us today to discuss your vision and forge a path to exceptional multifamily real estate investment success.