Taylor Pleads with Ridge

The tension between Ridge and Taylor reached a boiling point in the guest house. Ridge insisted he had no intention of blindsiding Taylor, yet he couldn’t commit to a wedding date. Taylor, sensing something was amiss, asked the hard question: did he love Brooke more? Ridge admitted he thought being with Taylor was what he truly wanted.

Taylor reminded Ridge of all they had overcome together, including her recovery and their reunion after Naples. She stressed that Brooke’s near-death experience and Eric’s influence had clouded his judgment. “I won’t let you walk away from us again,” Taylor told him. She argued that Ridge knew Brooke would only betray and disappoint him again, and that Taylor was not a safety net for his toxic cycle with Brooke. Ridge, however, seemed torn, caught between his feelings and external pressures, while Taylor stood firm, asserting that he had accepted her proposal for a reason — as friends, parents, and lovers.

Thomas Scolds Brooke

Meanwhile, in the CEO’s office, Thomas confronted Brooke. He told her it was time to accept that Ridge and Taylor were moving forward with their wedding. Brooke argued that Ridge still loved her, but Thomas reminded her of the past suffering Taylor and his family endured due to Brooke’s actions.

Thomas made it clear that Brooke’s attempts to seduce Ridge back were futile. “You lost. My mom won. For good this time,” he declared. When Brooke tried to contact Ridge, Thomas warned her that Ridge wouldn’t respond, as he and Taylor were planning their wedding.

Will Faces a Moral Dilemma

Elsewhere, Will impressed his mom, Katie, at work but remained distracted. He struggled with keeping the secret of his intimate encounter with a masked mystery girl, who wasn’t Electra. Katie reminded him that while the memory was upsetting, he needed to consider honesty with Electra. Will wrestled with guilt and the fear that revealing the truth could ruin his relationship, but he recognized that love without honesty was meaningless. Katie encouraged him to let the past remain in the past while acknowledging his feelings.

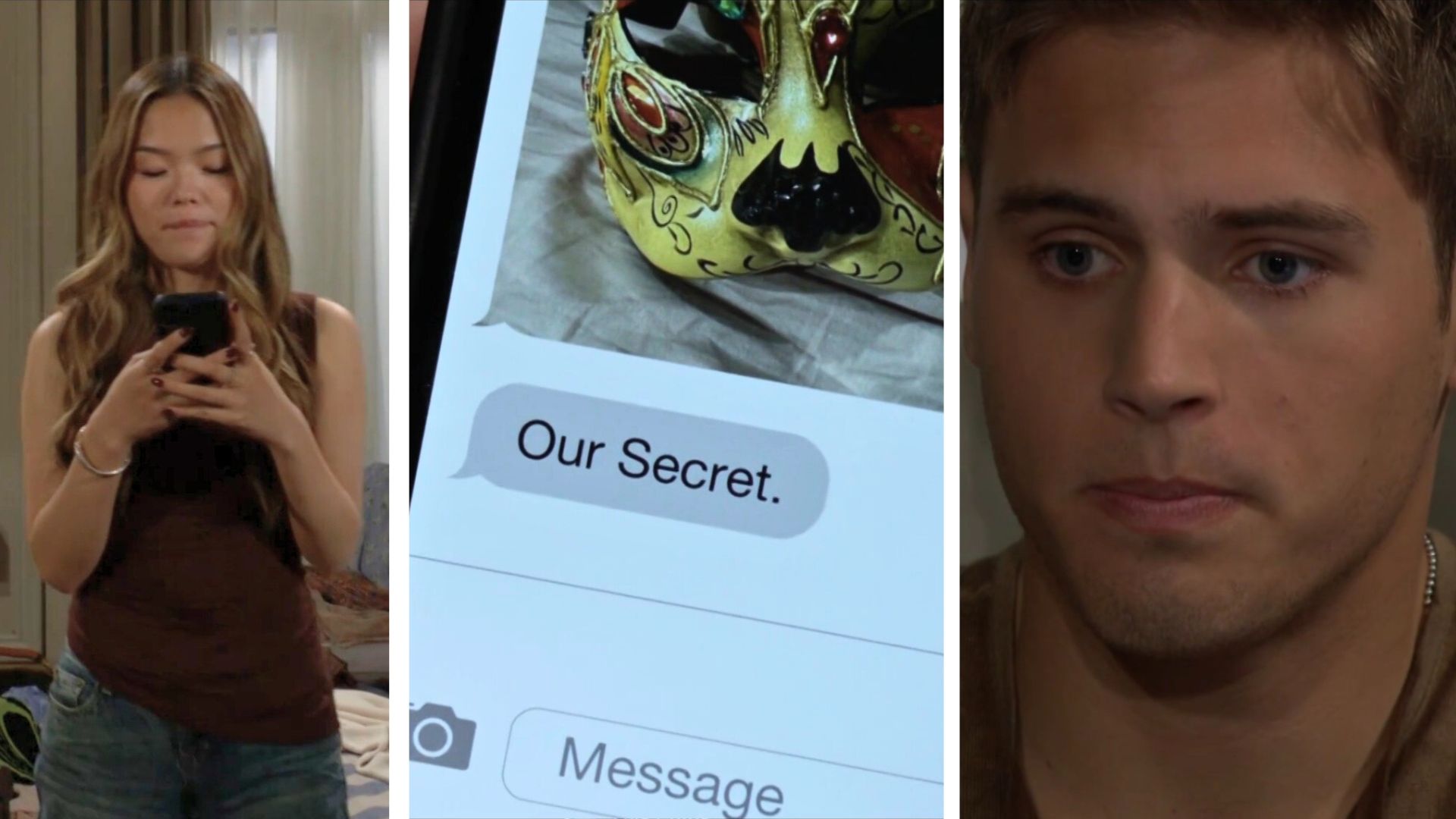

Luna’s Manipulation Escalates

Meanwhile, Luna continued scheming in Li’s apartment. Lost in daydreams about Will, she was caught by her aunt, Li, who warned her that her freedom and chance at a normal life could be jeopardized if she acted on her impulses. Li reminded Luna that she was in a “morality boot camp,” learning manners, responsibility, and a work ethic.

Despite this, Luna remained defiant. After Li left, Luna contemplated the benefits of becoming a Spencer and retrieved a pregnancy test. She reminisced about tricking Will, documented it with a photo of the mask, and sent it to him from a burner phone. Later, Will received the notification and was shocked to see the picture, with the caption: “Our secret.” Meanwhile, Luna smiled, holding the pregnancy test, hinting at the chaos she is about to unleash.

What’s Next

The episode set the stage for a week filled with romantic tensions, moral dilemmas, and manipulative schemes. Taylor is determined to hold onto Ridge, Thomas is safeguarding his mother’s happiness, Will is caught between guilt and honesty, and Luna is scheming behind the scenes, threatening to unravel lives with one simple text.

Viewers can expect heightened drama, difficult choices, and shocking revelations as the storylines unfold on The Bold and the Beautiful in the coming days.

Navigating the 2025 US Housing Market: 10 Critical Pitfalls First-Time Homebuyers Must Avoid

The dream of homeownership remains a cornerstone of the American ethos, a significant milestone that symbolizes stability, financial growth, and a place to truly call your own. As we step into 2025, the US housing market presents a unique landscape—a blend of persistent demand, evolving interest rate expectations, and an ever-present need for informed decision-making. Having guided countless first-time homebuyers through this intricate journey over the past decade, I’ve observed recurring patterns, common missteps that can transform an exciting prospect into a stressful ordeal or even a costly regret. This isn’t just about avoiding a bad deal; it’s about making a smart, sustainable investment in your future. Let’s unravel the ten most common mistakes I’ve seen first-time buyers make and how you, armed with the right knowledge, can steer clear of them.

Skipping the Mortgage Pre-Approval Process

In today’s competitive 2025 housing market, walking into an open house without a mortgage pre-approval letter is akin to showing up to a job interview without a resume – you’re simply not taken seriously. This isn’t just a formality; it’s your financial blueprint and a powerful negotiating tool.

What is Mortgage Pre-Approval?

Mortgage pre-approval is a formal assessment by a lender to determine how much they are willing to lend you for a home purchase. Unlike a mere pre-qualification, which is a quick, superficial estimate based on self-reported information, pre-approval involves a thorough verification of your financial health. Lenders will pull your credit report, scrutinize your income (via W-2s, pay stubs, tax returns), evaluate your assets (bank statements, investment accounts), and calculate your debt-to-income (DTI) ratio. Based on this comprehensive review, they issue a conditional commitment letter specifying the maximum loan amount you qualify for, typically valid for 60 to 90 days.

Why It’s Non-Negotiable in 2025:

Realistic Budgeting: The pre-approval process gives you a clear, honest picture of your purchasing power. It prevents the heartbreak of falling in love with a home that’s financially out of reach and helps you focus your search on properties you can genuinely afford, factoring in current mortgage rates.

Stronger Negotiating Position: In a market where inventory can still be tight in desirable areas, sellers and their agents prioritize offers from pre-approved buyers. It signals you’re serious, creditworthy, and capable of closing the deal, often giving your offer an edge over a non-pre-approved bidder, even if the price is similar.

Faster Closing Process: A significant portion of the financial heavy lifting is done upfront during pre-approval. This streamlines the underwriting phase once you’re under contract, potentially shaving days or even weeks off the closing timeline, which can be crucial for sellers looking for a swift transaction.

Early Identification of Credit Issues: This critical step allows you to uncover and address any potential credit report discrepancies or financial red flags before you’re in the midst of an active home search. Discovering a low credit score or an inaccurate debt entry during an offer scenario can derail your entire purchase.

How to Secure Your Pre-Approval:

Begin by researching reputable lenders—local banks, credit unions, and national mortgage companies—and compare their rates and loan programs (Conventional, FHA, VA, USDA). Gather essential documents: photo ID, Social Security Number, two years of W-2s and tax returns, recent pay stubs (30-60 days), and bank statements (60-90 days). Submit your application, consent to the credit check, and be prepared for the lender to verify employment and other financial details. Once approved, you’ll receive your letter, empowering you to confidently enter the market.

Underestimating the Total Cost of Homeownership

Many first-time buyers focus solely on the list price and the monthly mortgage payment, overlooking a myriad of “hidden” costs that can quickly accumulate and strain their finances. In 2025, being financially literate about these peripheral expenses is more critical than ever.

Beyond the Purchase Price – The True Costs:

Closing Costs: These are the fees paid at the close of a real estate transaction. They typically range from 2% to 5% of the loan amount and include:

Loan Origination Fees: What the lender charges for processing the loan.

Appraisal Fees: To determine the home’s value.

Title Insurance: Protects you and the lender from future claims against the property’s title.

Attorney Fees: If you live in a state where real estate attorneys are standard.

Recording Fees: To legally register your home purchase with the local government.

Prepaid Expenses: Such as property taxes and homeowner’s insurance premiums for the upcoming months.

Property Taxes: These are locally assessed taxes on real estate, varying significantly by state, county, and municipality. In 2025, with property values fluctuating, these taxes can be substantial. They are typically collected through your mortgage servicer and held in an escrow account, paid semi-annually or annually. Researching specific tax rates for your target areas is crucial.

Homeowners Insurance: Lenders mandate this coverage to protect their investment (and yours!) against damage from fire, theft, natural disasters, and liability. Premiums vary based on location, deductible, and coverage limits. In areas prone to specific risks like hurricanes, earthquakes, or floods, additional specialized insurance policies may be necessary and add significantly to your monthly outlay.

Homeowners Association (HOA) Fees: If you’re purchasing a condo, townhouse, or a home in a planned community, you’ll likely pay monthly or annual HOA fees. These cover the maintenance of common areas, amenities, and often exterior repairs. Always review HOA documents meticulously to understand what’s covered and any impending special assessments.

Utilities and Services: Budget for electricity, gas, water, sewer, trash, internet, and cable. These costs can vary significantly depending on the home’s size, age, and energy efficiency.

Maintenance and Repair Expenses: This is perhaps the most underestimated cost. Homes require constant upkeep. I always advise clients to budget at least 1% to 3% of the home’s purchase price annually for ongoing maintenance and unexpected repairs. This fund covers everything from a leaky faucet and appliance breakdowns to roof repairs or HVAC servicing.

Neglecting Thorough Neighborhood Due Diligence

Your home is more than just four walls and a roof; it’s intrinsically tied to its surroundings. Failing to research the neighborhood extensively is a common oversight that can lead to long-term dissatisfaction and impact your future resale value.

Key Factors to Evaluate for 2025:

Safety and Crime Rates: Utilize local police department websites, neighborhood statistics platforms, and national crime databases to understand the safety profile of an area.

Accessibility and Commute: Map out your typical commute to work, schools, and frequently visited locations. Consider traffic patterns during peak hours. In 2025, with hybrid work models prevalent, understanding public transportation options and major thoroughfares remains important.

School Districts: Even if you don’t have children, school district quality is a primary driver of property values in the US. Websites like GreatSchools.org provide valuable insights.

Local Amenities: Assess proximity to grocery stores, hospitals, parks, recreational facilities, restaurants, and entertainment options. How important are these conveniences to your lifestyle?

Community Demographics and Culture: Spend time in the neighborhood at different times of day and on weekends. Does it align with your lifestyle? Observe noise levels, traffic density, and general upkeep.

Future Development Plans: Research municipal development plans, zoning changes, and major infrastructure projects (e.g., new highways, public transit expansions, commercial developments). These can significantly impact property values, traffic, and the character of the neighborhood, both positively and negatively. Future developments in areas like sustainable energy or smart city initiatives might also influence desirability.

Remember, a great neighborhood enhances your quality of life and protects your investment. A “drive-by” isn’t enough; walk the streets, visit local businesses, and talk to residents if possible.

Overlooking the Importance of a Home Inspection

In a fast-paced market, some buyers are tempted to waive the home inspection contingency to make their offer more attractive. This is a gamble I strongly advise against. A home inspection is your best defense against inheriting expensive problems.

What Does a Home Inspection Cover in the US?

A professional home inspection is a non-invasive visual examination of the physical structure and mechanical systems of a house. A certified inspector will scrutinize:

Structural Components: Foundation, grading, roof, attic, walls, ceilings, floors, windows, and doors.

Exterior: Siding, trim, driveways, walkways, patios, decks, and drainage.

Roofing: Shingles, flashing, gutters, and downspouts.

Plumbing System: Water supply, drain, waste and vent systems, water heater, and fixtures.

Electrical System: Service entrance, main panel, wiring, outlets, and switches.

HVAC System: Heating, ventilation, and air conditioning units, including ductwork.

Appliances: Permanently installed kitchen and laundry appliances.

Safety Issues: Carbon monoxide detectors, smoke alarms, handrails, and egress windows.

Pest and Moisture: Signs of active pests (termites, rodents) and water intrusion.

Common Issues in US Homes:

I’ve seen it all: outdated electrical wiring (knob-and-tube, aluminum), leaky roofs, foundation cracks, active pest infestations, inefficient or failing HVAC systems, improper grading leading to water intrusion in basements, and plumbing issues from corroded pipes to faulty water heaters. Many older homes have lead paint or asbestos which, while not necessarily a defect, require careful management. New builds aren’t immune either; I’ve found issues ranging from improper insulation to overlooked structural details.

Finding a Reliable Home Inspector:

Certification Matters: Look for inspectors certified by reputable organizations like the American Society of Home Inspectors (ASHI) or the International Association of Certified Home Inspectors (InterNACHI).

Experience and Local Knowledge: An inspector with extensive experience, particularly with homes similar to the one you’re considering in your specific region, is invaluable. They understand local building codes and common regional issues.

References and Sample Reports: Ask your real estate agent for recommendations, but also do your own research. Request sample reports to ensure they are comprehensive and easy to understand. Read client testimonials.

Walk-Through: Always plan to attend the inspection. This allows you to ask questions directly, learn about the home’s systems, and see any issues firsthand. This invaluable interaction fosters a deeper understanding of your potential purchase.

Contingency: Ensure your purchase agreement includes an inspection contingency, allowing you to negotiate repairs, request a credit, or walk away if major issues are discovered.

Emptying All Savings for a Down Payment

While a larger down payment can reduce your monthly mortgage payment and potentially eliminate private mortgage insurance (PMI), completely depleting your savings for this purpose is a precarious financial strategy. As a homeowner, unexpected expenses are a certainty, not a possibility.

The Crucial Balance: Down Payment vs. Emergency Funds:

Emergency Reserve: I always advise clients to maintain a robust emergency fund, ideally covering three to six months of essential living expenses after your home purchase. This fund acts as a critical buffer against job loss, medical emergencies, or unforeseen home repairs (see point #2!).

Post-Closing Expenses: Remember, immediate expenses like moving costs, utility setup fees, new appliances, or even basic repairs often arise right after closing. Having liquid cash available prevents you from going into debt immediately after becoming a homeowner.

Financial Flexibility: Keeping a portion of your savings liquid allows for other life emergencies or investment opportunities that might arise. Don’t become “house poor” – where all your money is tied up in your home, leaving nothing for living.

Government Schemes and Down Payment Assistance Programs in the US:

The good news is that you don’t always need 20% down. There are numerous programs designed to help first-time buyers:

FHA Loans: Backed by the Federal Housing Administration, these offer low down payment options (as low as 3.5%) and more flexible credit requirements, though they require mortgage insurance premiums (MIP).

VA Loans: For eligible veterans, service members, and surviving spouses, VA loans often require no down payment and no private mortgage insurance.

USDA Loans: For low- to moderate-income borrowers in eligible rural areas, USDA loans also offer no down payment.

Conventional Loans: With as little as 3% down for qualified borrowers (e.g., Fannie Mae’s HomeReady or Freddie Mac’s Home Possible programs), though PMI is required if you put down less than 20%.

State and Local Down Payment Assistance (DPA) Programs: Many states, counties, and cities offer grants, deferred loans, or low-interest loans to help with down payments and closing costs. These are constantly evolving, so research what’s available in your specific area.

Alternative Down Payment Sources (with Caution):

Gifts from Family Members: Often allowed, but require a gift letter from the donor stating the money is not a loan.

Employer Assistance Programs: Some employers offer housing assistance as a benefit.

401(k) Loans or Withdrawals: While possible, this should be a last resort. Taking a loan against your 401(k) means paying yourself back with interest, while withdrawals often incur penalties and taxes, and you’re depleting your retirement savings.

Ignoring the Resale Value

For many first-time buyers, the focus is entirely on the “now” – finding a home that fits their current needs and budget. However, overlooking potential resale value is a short-sighted mistake. Your home is likely your largest asset, and its future appreciation is crucial for your long-term financial health.

Factors Affecting Resale Value in the US Market (2025 Perspective):

Location, Location, Location: Still the golden rule. Proximity to good schools, employment hubs, desirable amenities, and transportation infrastructure are paramount. As remote work trends stabilize in 2025, locations with a good balance of natural beauty and practical amenities will continue to thrive.

Infrastructure Development: Look for areas benefiting from new highways, public transit expansions, or other significant public investments. These signal growth and increased desirability.

Quality of Construction and Builder Reputation: A well-built home from a reputable builder generally holds its value better and requires fewer costly repairs down the line.

Curb Appeal and Condition: A well-maintained home with an attractive exterior will always fetch a better price. Buyers often form their first impression before even stepping inside.

Layout and Functionality: In 2025, flexible living spaces, dedicated home offices, and open-concept designs continue to be highly sought after. Consider if the home’s layout is practical for a broad range of buyers.

Energy Efficiency and Smart Home Technology: With rising utility costs and growing environmental consciousness, homes with energy-efficient windows, updated insulation, solar panels, and integrated smart home features (thermostats, lighting) are increasingly attractive to buyers and command higher values.

Local Market Trends: Understand the “comps” (comparable sales) in the area. Are home values appreciating steadily? What’s the average time on the market?

Think of your home as an investment. While you live in it, you’re also building equity. Making choices that protect and enhance its future value is a savvy financial move.

Falling in Love with a Home Beyond Your Budget

This is perhaps the most emotionally driven, yet financially perilous, mistake. The allure of a perfect kitchen, a spacious yard, or a prime location can easily override rational financial boundaries. I’ve witnessed too many clients stretch their budget to the absolute maximum, only to become “house poor” and resentful later.

Strategies for Staying Within Budget During House Hunting:

Set a Strict Budget Line: Before you even start browsing, establish your absolute maximum spending limit, and stick to it. This limit should be based on your pre-approval amount, but potentially lower, considering your comfort level with monthly payments and other financial goals.

Prioritize Needs vs. Wants: Create a clear list of what you absolutely need in a home (e.g., number of bedrooms, location for commute) versus what would be nice to have (e.g., gourmet kitchen, swimming pool). Be prepared to compromise on wants to stay within budget.

Utilize Online Tools Wisely: Use real estate websites and apps to filter homes by price, but resist the urge to peek at properties just above your budget. That “just a little more” can quickly lead to buyer’s remorse.

Consider the Long-Term Financial Impact: Every extra dollar spent on the purchase price translates into higher monthly mortgage payments, property taxes, and potentially higher closing costs and insurance. Calculate the full financial impact of stretching your budget.

Be Realistic: The “perfect” home often doesn’t exist, especially for a first-time buyer. Focus on finding a home that meets most of your needs, is within your budget, and has good bones. You can always personalize and upgrade over time.

Your home should be a source of joy, not constant financial stress. Buying below your maximum pre-approved amount offers a valuable buffer for unexpected expenses and allows for a more comfortable lifestyle.

Not Understanding the Legal and Contractual Aspects

The US real estate market, while generally transparent, involves complex legal documents and contractual obligations. Many first-time buyers rush through these, relying solely on their agent, and fail to grasp the gravity of what they’re signing. This can lead to significant complications and financial loss.

Common Legal & Contractual Issues to Understand:

The Purchase Agreement: This is the bedrock of your transaction. It’s a legally binding contract detailing the purchase price, contingencies (financing, inspection, appraisal), closing date, included fixtures, and remedies for default. Understand every clause.

Seller’s Disclosures: In most states, sellers are legally required to disclose known defects or issues with the property. Read these carefully; they offer valuable insights into the home’s history.

Title Search and Title Insurance: A title search investigates the property’s history to ensure there are no liens, unpaid taxes, easements, or ownership disputes that could hinder your rights. Title insurance protects you (and the lender) against future claims that might arise from previously undisclosed defects in the title. This is a non-negotiable expense.

Homeowners Association (HOA) Documents: If applicable, scrutinize the CC&Rs (Covenants, Conditions, and Restrictions), bylaws, and financial statements of the HOA. Understand the rules, fees, and any pending litigations or special assessments.

Contingencies: These are crucial clauses in your offer that protect you. They allow you to back out of a deal under specific circumstances without losing your earnest money deposit. Common contingencies include:

Financing Contingency: If you can’t secure a loan.

Inspection Contingency: If major issues are found during the home inspection.

Appraisal Contingency: If the home appraises for less than the purchase price.

Easements and Encroachments: Understand if anyone else has a legal right to use a portion of your property (easement) or if any part of the property extends onto a neighbor’s land (encroachment).

Zoning Laws: These municipal regulations dictate how land can be used (residential, commercial) and often specify building height, lot size, and setbacks. Understand what’s allowed in your area.

The Role of Professionals:

While your real estate agent is your primary guide, don’t hesitate to consult with a real estate attorney, especially if the transaction is complex or if you have specific legal concerns. They can provide an independent review of all documents and advise you on your rights and obligations.

Rushing the Decision Process

The feeling of urgency, whether driven by a hot market, fear of rising interest rates, or simply the desire to settle, can lead to impulsive decisions. I’ve often seen buyers succumb to pressure, making offers without sufficient consideration or waiving critical protections, only to face profound regrets.

When to Exercise Patience and Even Walk Away:

Undisclosed or Unaddressed Property Concerns: If a seller is unwilling to address significant inspection findings, or if new, material issues come to light after your offer is accepted, don’t feel obligated to proceed.

Seller’s Unfair Practices: If the seller or their agent engages in dishonest behavior, fails to provide disclosures, or acts coercively, it’s a major red flag.

Changed Personal Financial Circumstances: Life happens. If your job status changes, or a major unexpected expense arises before closing, re-evaluate if homeownership is still financially viable for you.

Coercive Tactics: Never let an agent or seller pressure you into waiving contingencies you’re uncomfortable with, or force a decision before you’ve had time to think and consult. A good agent will advise, not dictate.

Appraisal Gap: In competitive markets, homes sometimes appraise for less than the agreed-upon purchase price. If you don’t have the cash to cover the appraisal gap, or the seller won’t renegotiate, be prepared to walk away if your contract allows it.

Buying a home is a marathon, not a sprint. While being decisive is important in a competitive market, being informed and patient is paramount. A truly “good deal” should feel right and financially sound, not rushed and riddled with anxiety. Trust your gut, and don’t be afraid to take a step back if something doesn’t feel right.

Neglecting to Plan for the Future

A home isn’t just a purchase; it’s a long-term asset that evolves with your life. Many first-time buyers focus solely on their immediate needs, failing to consider how their home will accommodate future changes, both personal and financial.

Considering Long-Term Family and Lifestyle Needs (2025 Perspective):

Family Growth or Shrinkage: Will your family expand with children, or will aging parents potentially move in? Conversely, will children eventually leave the nest, making a large home feel empty? Consider the flexibility of the floor plan for various life stages.

Accessibility and Commute Evolution: While you might work remotely now, will your job or career path require a return to office commuting in the future? How will local infrastructure evolve?

Access to Services: Evaluate proximity to future schools, specialized healthcare facilities, or recreational spaces that might become important as your family changes.

Home Office Needs: The pandemic solidified the importance of dedicated home office space. As work models continue to evolve, consider if the home offers a quiet, functional space for remote work.

Lifestyle Changes: Do you envision taking up a new hobby that requires specific space (e.g., a workshop, art studio) or desiring more outdoor living?

Financial Flexibility: Your home can be a source of future financial flexibility. Consider how building equity might enable future moves, renovations, or even contribute to retirement planning. Keep an eye on potential refinancing opportunities as interest rates fluctuate, which could lower your payments or allow for cash-out options for future needs.

Aging in Place: As you get older, will the home’s layout, stairs, and maintenance requirements be manageable?

By anticipating potential changes, you can make a more resilient purchase that serves you well for many years, avoiding the expense and disruption of an unplanned move.

Embarking on the journey of homeownership in 2025 is an exciting adventure, filled with potential and promise. However, it’s a path best navigated with caution, meticulous research, and the wisdom gleaned from experience. Avoiding these ten common pitfalls won’t just save you stress and money; it will empower you to make a confident, well-informed investment that truly enriches your life.

Are you ready to make your homeownership dream a reality with clarity and confidence? Reach out today for personalized guidance and expert insights tailored to your unique journey in the dynamic 2025 housing market. Let’s ensure your first home purchase is a stepping stone to lasting financial success and happiness.