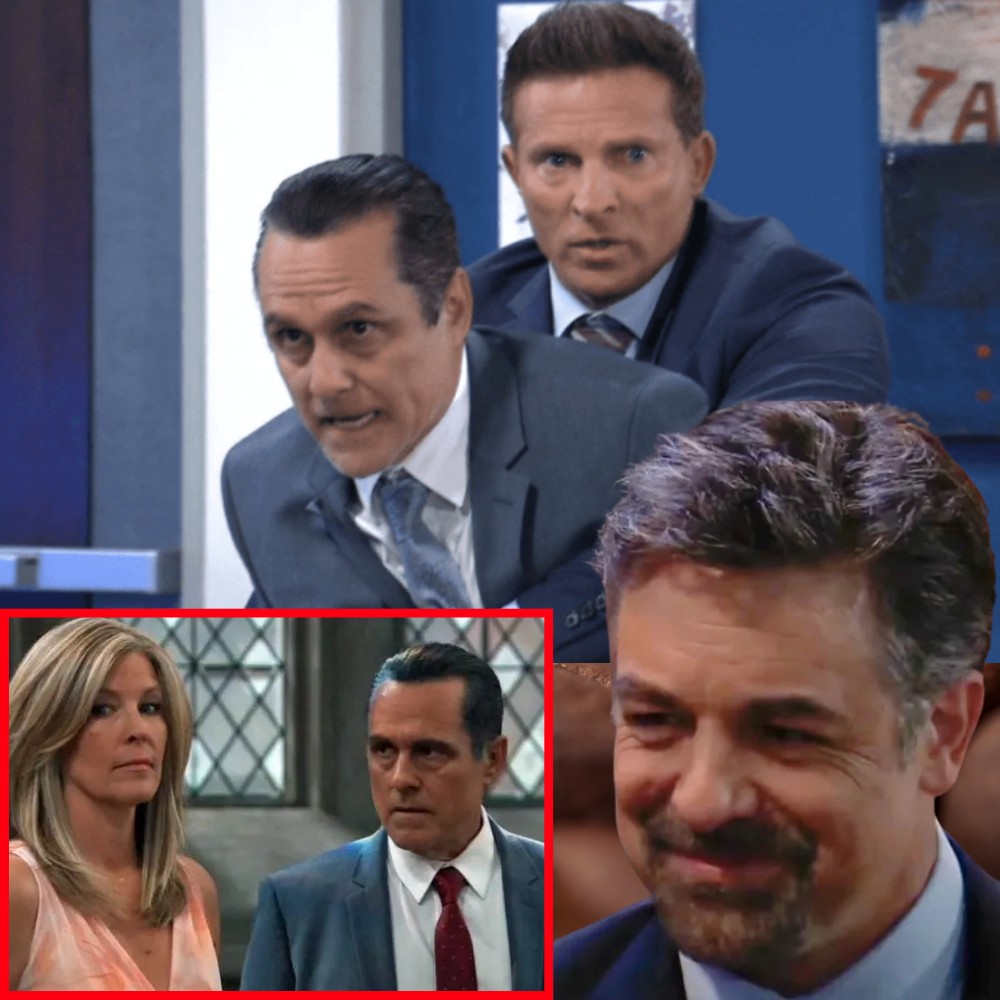

Sonny Receives Brennan’s DNA Results Confirming He’s Veronica Bard’s Son: How Long Will This Blood Feud Rage On?

In a dramatic twist that has left everyone stunned, Sonny recently received a mysterious black envelope containing DNA results that confirm Brennan is indeed Veronica Bard’s son. This revelation has reignited an already intense blood feud, raising questions about family loyalties, unresolved conflicts, and the future of this bitter rivalry. As tensions escalate, many are left wondering how long this feud will continue and what consequences this newfound truth will bring.

The Shocking Confirmation: Brennan Is Veronica Bard’s Son

The arrival of the black envelope was unexpected, and its contents even more so. DNA testing is often the definitive way to settle disputes about parentage, and in this case, it has unequivocally proven that Brennan is the biological son of Veronica Bard. This confirmation has far-reaching implications for all parties involved.

For Sonny, receiving this envelope was a pivotal moment. It not only validated suspicions but also forced him to confront the reality of his family’s complicated past. Veronica Bard, a figure shrouded in mystery and controversy, now has undeniable ties to Brennan, which could shift power dynamics and alliances within the family.

This revelation also raises questions about the history of Veronica’s relationship with Brennan’s father and how this secret was kept hidden for so long. The DNA results serve as a catalyst, bringing buried secrets to the surface and threatening to unravel long-standing grievances.

Impact on the Ongoing Blood Feud

The confirmation that Brennan is Veronica Bard’s son has intensified the existing blood feud, a conflict marked by deep-seated resentment and unresolved issues. Blood feuds often stem from perceived betrayals, family honor, and a desire for retribution, and this new information adds fuel to the fire.

Sonny and other family members are now faced with the challenge of navigating this complex situation. Will they use this knowledge to heal old wounds, or will it deepen the divisions? The answer remains uncertain, but the stakes are undeniably high.

The feud’s continuation depends largely on how each party chooses to respond to this revelation. Some may see it as an opportunity for reconciliation, while others might view it as a reason to escalate the conflict. The emotional and psychological toll on everyone involved cannot be underestimated.

Furthermore, this situation highlights the broader implications of family secrets and the power of truth to disrupt established narratives. It serves as a reminder that unresolved issues, when left unaddressed, can fester and erupt in unexpected ways.

Navigating the Storm: Ten Expert Strategies to Safeguard Your Home from Foreclosure in 2025

The dream of homeownership, a cornerstone of the American spirit, can sometimes be overshadowed by unforeseen financial challenges. As we navigate the economic landscape of 2025, marked by evolving interest rates, inflation, and dynamic job markets, many homeowners might find themselves grappling with the daunting prospect of falling behind on mortgage payments. The fear of losing your home to foreclosure is deeply unsettling, but it’s crucial to understand that financial strain doesn’t automatically equate to losing your property.

With over a decade of experience guiding homeowners through these turbulent waters, I can assure you there are proactive, effective steps you can take to prevent foreclosure. This isn’t just about delaying the inevitable; it’s about leveraging available resources, understanding your rights, and engaging strategically with your lender to secure a sustainable path forward. Let’s delve into ten critical strategies that can help you protect your most valuable asset.

Confronting the Challenge Head-On: The Power of Early Intervention

The most significant mistake a homeowner facing financial difficulty can make is ignoring the problem. It’s a natural human instinct to hope a crisis will resolve itself, but with mortgage payments, this rarely happens. Each missed payment compounds the issue, adding late fees, potentially increasing interest rates, and digging you deeper into a hole that becomes exponentially harder to climb out of. The further behind you become, the more difficult it is to reinstate your loan, and the higher the likelihood of losing your home.

In 2025, with advanced data analytics and automated tracking, lenders are often aware of potential issues even before you are. Proactive engagement, therefore, is paramount. As soon as you anticipate a struggle, or as soon as that first payment becomes difficult, that’s your cue to act. Early intervention allows for a broader range of loss mitigation options, giving you more flexibility and control over the outcome. Waiting until a formal Notice of Default arrives significantly limits your choices and increases stress. Think of it as addressing a small leak before it becomes a burst pipe.

Your Lender: A Partner, Not an Adversary

Many homeowners hesitate to contact their mortgage servicer, viewing them as an antagonist ready to seize their property. This perception is often far from the truth. Lenders, fundamentally, do not want to foreclose on your home. Foreclosure is a costly, time-consuming, and resource-intensive process for them. They would much prefer to work with you to find a solution that keeps you in your home and ensures your loan is eventually repaid.

The key is to initiate contact as soon as you recognize a problem. Don’t wait for them to call you. Reach out to their “Loss Mitigation” or “Foreclosure Prevention” department. Explain your situation clearly and honestly. Be prepared to provide details about your financial hardship – whether it’s a job loss, medical emergency, divorce, or significant income reduction. Many lenders in 2025 have dedicated teams and robust programs designed to assist borrowers through difficult financial times. They are trained to discuss various mortgage relief options and can provide valuable guidance. Remember, establishing open communication early demonstrates your good faith and commitment to resolving the issue.

Mail Matters: Decoding Lender Communications

In our digital age, it’s tempting to disregard physical mail, especially if it looks like official notices you’d rather not deal with. However, when you’re facing mortgage payment difficulties, every piece of mail from your lender is critical. The initial notices you receive will often contain valuable information about foreclosure prevention options and resources designed to help you weather financial problems. These early letters are not just warnings; they are invitations to engage and explore solutions.

Ignoring this mail can have severe consequences. Later correspondence will escalate in formality and may include crucial legal notices, such as a Notice of Intent to Foreclose or even a Summons and Complaint if your state requires judicial foreclosure. Missing these can mean missing deadlines to respond, which could lead to a default judgment against you, fast-tracking the loss of your home. In a foreclosure court, claiming you “didn’t open the mail” will not be accepted as an excuse. Develop a habit of opening and carefully reviewing all lender communications immediately, seeking clarification on anything you don’t understand.

Know Your Rights: Navigating the Legal Landscape of Homeownership

Understanding your rights and the specifics of your mortgage agreement is a powerful shield against potential foreclosure. Begin by locating your original loan documents – the promissory note and mortgage or deed of trust. Read them carefully to understand the terms and conditions, including what your lender is legally permitted to do if you can’t make your payments. Pay close attention to clauses related to default, acceleration, and the lender’s remedies.

Beyond your personal documents, familiarize yourself with your state’s specific foreclosure laws and timeframes. Foreclosure processes vary significantly from state to state. Some states operate under a “judicial foreclosure” process, requiring the lender to file a lawsuit in court, which typically offers homeowners more time and opportunities to respond. Others follow “non-judicial foreclosure,” where the lender can proceed with a public sale without court oversight, often on a much tighter timeline. Contacting your State Government Housing Office, your state’s Attorney General’s office, or a local bar association can provide invaluable information on these differences. Knowing whether you reside in a judicial or non-judicial foreclosure state can profoundly impact your strategy. This knowledge empowers you to ask informed questions and challenge any procedural missteps by your lender.

Unlocking Loss Mitigation: A Spectrum of Solutions

There’s a common misconception that if you fall behind, your only option is to catch up on all missed payments immediately or face foreclosure. In reality, lenders offer a diverse array of loss mitigation strategies designed to help homeowners avoid this fate. These solutions are not handouts; they are mutually beneficial agreements that help the lender recover their investment and allow you to retain your home.

Forbearance: This allows you to temporarily reduce or suspend your mortgage payments for a set period, typically due to a temporary hardship. At the end of the forbearance period, you’ll need to repay the paused amounts, often through a lump sum, a repayment plan, or by adding them to the end of your loan.

Repayment Plan: If your hardship is temporary and resolved, a repayment plan allows you to make your regular payment plus an additional amount each month to catch up on overdue payments over a short period.

Loan Modification: This is a permanent change to one or more terms of your mortgage loan, such as the interest rate, term length, or even the principal balance, to make your payments more affordable. This is a common and highly effective option for long-term affordability issues.

Short Sale: If keeping your home isn’t feasible, a short sale allows you to sell your property for less than the amount you owe on the mortgage, with the lender’s approval. This can help you avoid the more damaging credit impact of a foreclosure.

Deed in Lieu of Foreclosure: This involves voluntarily giving the property deed back to the lender in exchange for a release from your mortgage obligation. It’s often considered when a short sale isn’t possible, and you want to avoid a full foreclosure on your record.

Understanding these options is crucial. Research available programs, including any specific mortgage assistance programs 2025 might offer, as government-backed initiatives can sometimes emerge in response to economic conditions.

The Lifeline of a HUD-Approved Housing Counselor

One of the most valuable, yet often underutilized, resources for homeowners facing foreclosure is a HUD-approved housing counseling agency. The U.S. Department of Housing and Urban Development (HUD) funds these agencies to provide free or very low-cost housing counseling nationwide. These counselors are highly trained, unbiased professionals who act as your advocate.

A HUD-approved housing counselor can:

Help you understand your rights and the various foreclosure prevention options available.

Assist you in organizing your finances, developing a realistic budget, and identifying areas for cost-cutting.

Help you gather the necessary documentation for loan modification applications or other home retention solutions.

Crucially, they can represent you in negotiations with your lender, leveraging their expertise and understanding of the system to achieve the best possible outcome.

These services are designed to empower you with knowledge and support, without costing you a dime. To find an approved HUD counselor, visit the HUD website (www.hud.gov) or call 800-569-4287 (TTY 800-877-8339). Leveraging their expertise is a critical step in navigating complex financial situations. Many homeowners find that having a professional intermediary significantly reduces stress and improves the chances of a favorable resolution.

Financial Fortitude: Strategic Budgeting and Prioritization

When facing financial distress, a rigorous re-evaluation of your spending habits is non-negotiable. After healthcare, keeping your house should be your absolute top financial priority. Every other expense should be scrutinized and, if necessary, cut or significantly reduced to ensure your mortgage payment is made.

Review your entire financial picture. Where can you cut spending? Look for discretionary expenses such as cable TV, streaming subscriptions, gym memberships, dining out, entertainment, and non-essential shopping. These might seem like small sacrifices individually, but collectively, they can free up substantial funds. Consider the “latte factor” – those small daily purchases that add up.

Many financial experts advocate for temporarily delaying payments on credit cards and other “unsecured” debt (debt not backed by collateral like your home) until your mortgage is current. While this might negatively impact your credit score in the short term, prioritizing your home prevents a far more catastrophic blow. Your home equity is often your largest asset; protecting it must take precedence over consumer debt. This isn’t about ignoring debt, but strategically sequencing your payments to protect your primary residence. For a comprehensive overhaul, consider consulting a non-profit credit counseling agency to help structure a budget and potentially negotiate with other creditors.

Leveraging Your Resources: Assets, Income, and Hardship Proof

Demonstrating your commitment to keeping your home is critical to your lender. This isn’t just about cutting expenses; it’s about exploring every avenue to increase available cash and prove genuine hardship. Do you have any assets that could be converted to cash? Perhaps a second, underutilized vehicle, jewelry, high-value collectibles, or even a life insurance policy with a cash value that you could borrow against or surrender? While these are often difficult decisions, selling non-essential assets could provide the immediate funds needed to reinstate your loan or cover a forbearance repayment.

Beyond assets, explore avenues to increase income. Can anyone in your household take on extra shifts, a part-time job, or a side hustle? The gig economy in 2025 offers numerous opportunities for supplementary income, from ride-sharing to freelance work. Even if these efforts don’t completely solve your financial shortfall, they show your lender that you are actively willing to make sacrifices and exhaust all options to keep your home. When applying for loan modification or other programs, lenders often require detailed documentation of your financial situation, including income, expenses, and a written hardship letter. This letter should clearly articulate the cause of your financial struggle and the steps you’re taking to rectify it. Being transparent and proactive strengthens your case.

Beware the Predatory Practices: Avoiding For-Profit Scams

In times of widespread financial difficulty, unscrupulous actors emerge, preying on vulnerable homeowners. Be extremely wary of companies that demand upfront fees for foreclosure prevention help. You absolutely do not need to pay for legitimate foreclosure prevention assistance. That money is far better spent on your mortgage payment itself.

Many “for-profit” companies will contact you, often with slick marketing and aggressive sales tactics, promising to negotiate with your lender on your behalf or to offer immediate relief. While some may be legitimate businesses, they will charge you a hefty fee – often equivalent to two or three months’ mortgage payments – for information and services that your lender or a HUD-approved housing counselor will provide free of charge. These companies rarely have any special access or influence with lenders that you or a HUD counselor don’t already possess. Their primary goal is profit, not your long-term financial well-being. Always prioritize free resources first. If a company demands payment before providing services, or guarantees a specific outcome, consider it a major red flag. Legitimate foreclosure help free of charge is readily available.

Protecting Your Property: Safeguarding Against Foreclosure Recovery Fraud

The most sinister scams involve schemes where homeowners are tricked into signing over the title to their property under false pretenses. These foreclosure recovery scams are particularly insidious because they leverage your desperation against you. A common scenario involves a firm claiming they can “stop your foreclosure immediately” if you simply sign a document appointing them to act on your behalf. What you may actually be signing is a deed, transferring ownership of your property to the scammer, effectively turning you into a renter in your own home, with no equity or ownership rights. They then often charge you exorbitant “rent” and eventually evict you.

Never, under any circumstances, sign a legal document related to your property without fully reading, understanding, and seeking independent professional advice. Consult an attorney specializing in real estate, a trusted real estate professional, or a HUD-approved housing counselor before signing anything. If a deal sounds too good to be true, it almost certainly is. Be especially wary of:

Promises to stop foreclosure immediately for a fee.

Requests to sign papers you haven’t read or don’t understand.

Offers to have someone pay your mortgage and let you live in your home as a renter.

Demands that you send your mortgage payment to anyone other than your lender or its authorized agent.

Your home is your most significant asset. Protect it with vigilance and the power of informed decision-making.

Taking the First Step: Your Path to Financial Stability

Navigating the complexities of mortgage hardship and foreclosure prevention can feel overwhelming, but you are not alone. The strategies outlined above are not just theoretical; they are proven pathways to home retention solutions for countless Americans. The key lies in proactive engagement, thorough understanding of your options, and a willingness to seek legitimate, expert help.

Don’t let fear or embarrassment prevent you from taking action. Your future, and the security of your home, depend on it. If you’re currently struggling with mortgage payments or foresee difficulties on the horizon, take the first critical step today. Reach out to your lender, connect with a HUD-approved housing counselor, and empower yourself with knowledge. Your home is worth fighting for, and the resources to help you are readily available.

Ready to secure your home’s future? Don’t wait. Contact a HUD-approved housing counselor or your mortgage servicer’s loss mitigation department today to explore your options and develop a personalized plan.