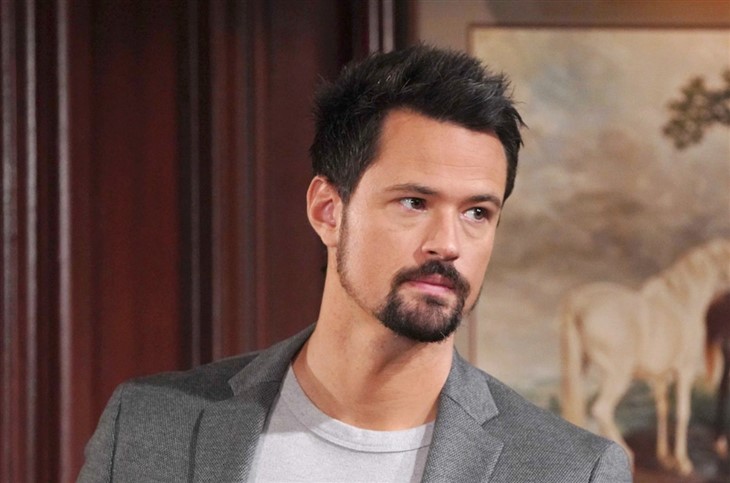

Thomas Forrester Returns to Los Angeles

The Bold and the Beautiful spoilers confirm Thomas Forrester is back in Los Angeles. His return comes with plenty of questions and even more drama. Thomas explained that Douglas Forrester is busy with school and friends, so the boy stayed behind. That leaves Thomas returning home alone, but with a clear mission — to oversee Ridge Forrester and Taylor Hayes’ upcoming wedding.

From the start, Thomas made his intentions clear. He wants to ensure Brooke Logan stays away from Ridge. His determination has already raised eyebrows and stirred up concerns about whether his darker impulses are beginning to resurface.

Taylor’s Subtle Influence

Taylor Hayes couldn’t be happier to see her son back in town. Yet fans noticed how often she vents to him about Brooke. That influence may be fueling Thomas’ obsession.

Already, Thomas confronted Brooke and warned her to stop interfering in Ridge and Taylor’s relationship. He even told Taylor that he demanded Ridge “act like a man.” On the surface, this sounds like a protective son backing up his mother. But given Thomas’ history, viewers can’t help but wonder if Taylor’s words are planting seeds that may push him into dangerous territory again.

Li Finnegan’s recent conversation with Taylor also stood out. Taylor mentioned that if Thomas slips back into old habits, she is ready to step in. That kind of foreshadowing almost guarantees trouble ahead.

Career and Love Life in Shambles

Thomas’ return also highlights how little stability he has left. His design career doesn’t seem to be thriving in Paris. Without a major project or a clear creative outlet, he appears restless.

His personal life isn’t much better. His engagement to Paris Buckingham is over, leaving him single and adrift. Grace Buckingham’s criminal choices only complicated matters further. Although Paris may have chosen to distance herself, some fans speculate there could be more to her sudden absence.

Could Paris have been caught up in her mother’s mess? If thugs are still chasing Grace for money, Paris might have become a target. This unresolved thread could eventually collide with Thomas’ storyline, making his personal turmoil even more intense.

Obsession Takes Center Stage

With no career focus and no romantic partner, Thomas seems fixated on Ridge and Taylor’s marriage. That level of obsession raises red flags. Instead of focusing on rebuilding his life, he’s throwing himself into protecting his parents’ relationship from Brooke.

Spoilers hint this obsessive energy could drive Thomas to extremes. His past schemes — from manipulating Hope to concealing secrets — show he can spiral quickly when he feels cornered. Fans are already debating how far he’ll go this time and whether Brooke will once again find herself in Thomas’ crosshairs.

Villainous Tendencies on the Horizon?

The big question is whether Thomas will resist temptation or return to his darker ways. Right now, the setup feels eerily familiar. A troubled Thomas with no healthy distractions, a mother fueling his resentment toward Brooke, and a fractured personal life — it’s the perfect recipe for disaster.

If Thomas gives in to his old patterns, he could derail Ridge and Taylor’s happiness before the wedding even begins. Worse, he might find himself destroying the fragile trust he worked so hard to rebuild with his family.

Final Thoughts

Thomas Forrester’s return is anything but simple. With his design career faltering, his relationship with Paris over, and his fixation on Ridge and Taylor’s wedding growing stronger, the warning signs are everywhere. Will Thomas manage to stay on the right path, or will history repeat itself in heartbreaking fashion?

Fans should buckle up. The coming weeks promise drama, emotional confrontations, and possibly the rebirth of Thomas’ villainous side. Keep watching The Bold and the Beautiful on CBS or Paramount+ to see how far Thomas will go this time.

Avoiding the Top 10 Pitfalls: An Expert’s Guide for First-Time Homebuyers in 2025

As an expert who has navigated the tumultuous waters of the real estate market for over a decade, I’ve witnessed countless aspiring homeowners embark on one of life’s most significant journeys. Buying your first home in 2025 is an exciting prospect, promising financial stability, a place to call your own, and a cornerstone for your future. Yet, it’s also a complex endeavor fraught with potential missteps. The current market, characterized by evolving interest rates, shifting inventory, and a dynamic economic landscape, demands more vigilance and strategic planning than ever before. My goal with this guide is to arm you with the knowledge to sidestep the most common and costly mistakes first-time buyers make, ensuring your path to homeownership is as smooth and successful as possible.

Mistake #1: Skipping Mortgage Pre-Approval

In the competitive 2025 housing market, walking into an open house without a mortgage pre-approval is akin to entering a marathon without training. It not only puts you at a severe disadvantage but can also lead to heartbreaking disappointments. Many first-time buyers mistakenly believe pre-qualification is enough, or they simply want to “see what’s out there” before talking to a lender. This is a critical error.

What is Mortgage Pre-Approval?

Mortgage pre-approval is a comprehensive assessment by a lender of your financial health. It involves a deep dive into your credit history, income, assets, and debts to determine exactly how much they are willing to lend you for a home purchase. Unlike a mere pre-qualification, which is often a quick, informal estimate, pre-approval involves a hard credit pull and verification of your financial documents. The lender provides you with an official letter stating the maximum loan amount you qualify for, often with a specified interest rate locked in for a period.

Why It’s Non-Negotiable in 2025:

Realistic Budgeting: The pre-approval process forces you to confront your true financial capacity. It sets a clear ceiling on what you can afford, preventing you from falling in love with properties outside your price range and saving you valuable time and emotional energy. With fluctuating interest rates, understanding your exact buying power is paramount.

Stronger Negotiating Power: In a market that can still be competitive, sellers and their agents prioritize offers from pre-approved buyers. A pre-approval letter signals to sellers that you are a serious, qualified buyer, making your offer more attractive and increasing your chances of acceptance, even against slightly higher bids from unapproved buyers. It shows you’ve done your homework.

Faster Closing Process: Having your financial ducks in a row upfront significantly streamlines the closing process. Many of the required financial verifications are already complete, reducing potential delays and stress. This efficiency is highly valued in fast-paced markets.

Uncovering Potential Issues: The pre-approval process acts as an early warning system. It can uncover credit report inaccuracies, debt-to-income ratio concerns, or other financial red flags that you can address before you’re under contract, preventing last-minute catastrophes.

Navigating the US Pre-Approval Process:

Research Lenders: Explore different mortgage lenders—banks, credit unions, and independent mortgage brokers. Compare interest rates, loan products (Conventional, FHA, VA, USDA), and customer service reviews. Consider asking for referrals from trusted real estate agents.

Gather Documents: Be prepared with:

Photo ID (Driver’s License/Passport)

Proof of Address (Utility Bill)

Proof of Income (W-2s for the last two years, recent pay stubs, two years of federal tax returns if self-employed or with varied income)

Bank statements (last 2-3 months for all checking/savings accounts)

Investment account statements

Information on existing debts (student loans, car loans, credit cards)

Submit Your Application: You can apply online or in person. Be thorough and honest.

Credit Check & Underwriting: The lender will conduct a hard credit inquiry and begin verifying your submitted information.

Receive Your Letter: Once approved, you’ll receive your pre-approval letter, detailing your maximum loan amount and terms. Remember, this letter is conditional and valid for a specific period (usually 60-90 days).

Mistake #2: Underestimating the True Cost of Homeownership

Many first-time buyers fixate solely on the purchase price and monthly mortgage payment, failing to budget for the myriad of other expenses that come with owning a home. In 2025, these “hidden costs” can quickly derail a carefully planned budget if not anticipated.

Beyond the Purchase Price: Key Costs to Budget For:

Closing Costs: These are fees paid at the closing of a real estate transaction. They typically range from 2% to 5% of the loan amount and include:

Loan Origination Fees: Paid to the lender for processing your loan.

Appraisal Fee: Cost for a professional appraisal of the home’s value.

Title Insurance: Protects you and the lender against future claims on the property’s title.

Attorney Fees: If required in your state for real estate transactions.

Recording Fees: Paid to the local government to record the new deed and mortgage.

Escrow Fees: Fees for the escrow agent who handles the funds and documents.

Prepaid Expenses: Such as property taxes and homeowner’s insurance premiums, often paid upfront for several months.

Property Taxes: These are recurring annual taxes assessed by local government bodies (city, county, school district) based on the property’s assessed value. Rates vary drastically by state and even within counties. Research your target area’s average effective tax rate—it can significantly impact your monthly housing payment (PITI: Principal, Interest, Taxes, Insurance).

Homeowner’s Insurance: Crucial for protecting your investment against damage from fire, theft, natural disasters, and liability. Premiums vary based on location, home value, and deductible. In certain areas prone to specific risks (e.g., hurricanes, earthquakes, floods), additional specialized insurance may be required, adding substantial cost.

Homeowners Association (HOA) Fees: If you’re buying a condo, townhouse, or a home in a planned community, you’ll likely pay monthly HOA fees. These cover maintenance of common areas, amenities, and sometimes utilities. Research what these fees cover, as they can range from basic landscaping to extensive recreational facilities. Unforeseen special assessments are also a risk.

Utility Connections & Deposits: Budget for connecting electricity, water, gas, internet, and sometimes sewer services. Many utility companies require a deposit for new accounts.

Initial Setup Costs: Moving expenses, new furniture, window treatments, and immediate repairs or upgrades (e.g., painting) can add up quickly.

Anticipating Maintenance and Repair Expenses:

Even a brand-new home will require ongoing maintenance. For older homes, anticipate more substantial upkeep. A good rule of thumb is to budget 1% to 2% of the home’s purchase price annually for maintenance and repairs.

Routine Maintenance: Lawn care, gutter cleaning, HVAC filter changes, pest control.

Periodic Expenses: Exterior painting (every 5-10 years, $3,000 – $10,000+), roof replacement (every 20-30 years, $5,000 – $30,000+), appliance repair/replacement ($100 – $1,000+ per incident).

Emergency Fund: Beyond the 1-2% rule, maintain a separate emergency fund for unexpected breakdowns like a burst pipe, a failing water heater, or an AC unit dying in the summer heat.

Mistake #3: Neglecting Comprehensive Neighborhood Research

Buying a home isn’t just about the structure itself; it’s about buying into a community, a lifestyle, and a location. Overlooking thorough neighborhood research is a common pitfall that can lead to buyer’s remorse, particularly in a dynamic 2025 market where neighborhood desirability can shift rapidly.

Factors to Scrutinize Beyond the Property Line:

Safety and Crime Rates: Utilize local police department websites, neighborhood-specific crime mapping tools, and community forums. Drive through the neighborhood at different times of day and night.

Accessibility & Commute: How long will your daily commute be? Evaluate proximity to major highways, public transportation options (bus stops, train stations), and essential services like grocery stores, healthcare facilities, and pharmacies.

School Districts: Even if you don’t have children, school district quality significantly impacts property values and future resale potential. Research school ratings and demographics.

Local Amenities: Assess the availability and quality of parks, recreational facilities, shopping centers, restaurants, cultural venues, and healthcare providers. Does the neighborhood align with your lifestyle?

Community Demographics and Culture: Spend time in the area. What’s the general vibe? Is it family-friendly, bustling, quiet, diverse? Attend local events if possible to get a feel for the community.

Noise and Traffic: Visit during rush hour, school dismissal, and late at night. Is the property near a busy road, train tracks, or airport flight path?

Future Development Plans: Research local zoning laws, municipal development plans, and proposed infrastructure projects (new roads, commercial developments, public transit expansions). These can dramatically affect property values, noise levels, and traffic patterns—positively or negatively. A planned park could boost value; a new industrial complex could detract.

Mistake #4: Overlooking the Importance of a Professional Home Inspection

An attractive façade or a recently renovated interior can easily mask serious underlying issues. Skipping or downplaying a professional home inspection is a gamble you cannot afford, especially with the investment you’re making. A skilled inspector acts as your diligent detective, uncovering what meets the eye and what lies beneath.

What a US Home Inspection Covers:

A comprehensive home inspection evaluates the major systems and structural integrity of the property. This typically includes:

Structural Components: Foundation, grading, roof structure, framing.

Exterior: Siding, windows, doors, flashing, trim, driveways, sidewalks.

Roof: Covering, drainage systems, flashing, skylights.

Plumbing: Water heater, supply lines, drains, waste and vent systems, fixtures.

Electrical: Service entrance, panel, wiring, outlets, switches, light fixtures.

Heating, Ventilation, and Air Conditioning (HVAC): Heating and cooling equipment, ductwork, distribution.

Interior: Walls, ceilings, floors, doors, windows, fireplace, stairs.

Insulation and Ventilation: Attic, crawlspace, major appliances (if built-in).

Moisture & Drainage: Evidence of water penetration, proper drainage around the foundation.

Specialty inspections for issues like radon, mold, lead paint, asbestos, or pest infestations (especially termites) may be recommended based on the property’s age, location, and condition, and often require separate experts.

Common Issues Found in US Homes:

Foundation Problems: Cracks, settling, water intrusion in basements or crawl spaces.

Aging Electrical Systems: Outdated wiring (e.g., knob-and-tube, aluminum), insufficient amperage for modern needs, improperly wired panels.

Plumbing Issues: Leaks, low water pressure, old or corroded pipes, failing water heaters.

Roofing Problems: Missing shingles, leaks, poor drainage, nearing end of lifespan.

HVAC Malfunctions: Inefficient or failing heating and cooling units, inadequate ventilation.

Water Intrusion: Evidence of leaks in walls, ceilings, or basements, often leading to mold or structural damage.

Pest Infestations: Termites, carpenter ants, rodents, or other pests that can cause significant damage.

Finding a Reliable Home Inspector:

Seek Referrals: Ask your real estate agent (but ensure they provide several options, not just one favored contact), friends, or colleagues for recommendations.

Check Credentials: Look for inspectors certified by reputable organizations like the American Society of Home Inspectors (ASHI) or the International Association of Certified Home Inspectors (InterNACHI). Verify their license (if required in your state) and insurance.

Experience & Specializations: Choose an inspector with significant experience, particularly with homes similar to the one you’re considering (e.g., historic homes, specific construction types).

Review Sample Reports: Ask to see a sample report to understand its thoroughness and clarity.

Follow Along: Be present during the inspection. Ask questions. This is an invaluable learning opportunity about your potential new home. The inspection report provides leverage for negotiating repairs or credits, or even walking away if major undisclosed issues surface.

Mistake #5: Emptying Savings for a Down Payment

While a larger down payment generally means lower monthly mortgage payments and potentially a better interest rate, liquidating all your savings to achieve this is a dangerous financial strategy. In 2025, economic uncertainties underscore the necessity of a robust financial cushion post-purchase.

The Peril of Being “House Poor”:

Many first-time buyers deplete their entire life savings—sometimes even borrowing from retirement accounts—to meet the 20% down payment ideal. While commendable, this leaves them vulnerable to unexpected expenses that inevitably arise shortly after closing. You need liquidity for:

Emergency Fund: Crucially, a fund covering 3-6 months of living expenses (including your new mortgage payment) for job loss, medical emergencies, or unforeseen life events.

Closing Costs: As discussed, these are significant and separate from your down payment.

Immediate Repairs & Maintenance: Even with an inspection, small issues often pop up, or you might want to immediately paint, change locks, or replace old appliances.

Moving Expenses: Professional movers, packing supplies, utility setup fees.

Furniture & Décor: Outfitting your new space.

Balancing Down Payment with Financial Prudence:

Explore Low Down Payment Options: Don’t feel pressured into 20%. Many reputable loan programs require less:

FHA Loans: As little as 3.5% down, popular for first-time buyers.

VA Loans: 0% down for eligible veterans and service members.

USDA Loans: 0% down for eligible rural properties.

Conventional Loans: Some options allow as little as 3% down (though private mortgage insurance (PMI) will be required for less than 20% down).

Down Payment Assistance Programs (DPA): Research state, county, and city programs that offer grants or low-interest loans to first-time homebuyers. These can significantly reduce your upfront cash requirement.

Gifts from Family: Lenders allow gifts from family members for down payments, often requiring a “gift letter” confirming it’s not a loan.

401(k) Loans/Withdrawals (Use with Extreme Caution): While possible, borrowing from your retirement fund carries significant risks (missed investment growth, taxes, penalties if you leave your job). Consult a financial advisor before considering this.

Mistake #6: Ignoring Future Resale Value

First-time buyers often focus solely on their immediate needs and preferences, neglecting to consider how appealing their chosen home will be to a future buyer. This short-sightedness can impact your long-term financial growth, as your home is often your largest asset.

Factors Influencing Resale Value in the US Market:

Location, Location, Location: This timeless adage holds true. Proximity to good schools, employment hubs, desirable amenities, and convenient transportation is paramount. A home in a highly-rated school district, even if modest, often appreciates faster.

Market Trends & Economic Growth: Research historical appreciation rates in the area. Look for signs of local economic vitality, job growth, and infrastructure investments.

Builder Reputation & Construction Quality: A well-known, reputable builder often signals better construction quality and can command a premium at resale. Substandard construction can lead to costly repairs and deter future buyers.

Home Condition & Updates: Well-maintained homes with modern updates (kitchens, bathrooms, energy-efficient windows, smart home technology) will always be more attractive. Conversely, a home requiring significant renovations will appeal to a smaller pool of buyers (investors or those willing to put in sweat equity).

Layout & Functionality: Open floor plans, multiple bathrooms, flexible spaces (for home offices), and good storage are highly desirable. Unique or overly personalized layouts might limit appeal.

Curb Appeal: The first impression is critical. A well-maintained exterior, landscaping, and attractive entry enhance perceived value.

Energy Efficiency: With rising utility costs, homes with energy-efficient windows, HVAC systems, and insulation are increasingly valued. Solar panels can also be a significant draw.

Consider your potential exit strategy. How easy will it be to sell this home in 5-10 years? Will its value have appreciated enough to provide a solid return on your investment, enabling you to move up or pursue other financial goals?

Mistake #7: Falling in Love with a Home Beyond Your Budget

This is perhaps the most emotionally charged mistake. It’s easy to get swept away by a home that checks every box, even if it stretches your finances precariously thin. However, making an impulsive decision based on emotion rather than practicality can lead to years of financial strain and regret.

The Dangers of Being “House Poor”:

Financial Stress: Constantly worrying about making mortgage payments can impact mental health and relationships.

Limited Discretionary Income: Little money left for savings, investments, vacations, entertainment, or even unexpected car repairs.

Deferred Maintenance: Neglecting necessary home repairs because funds aren’t available, leading to larger, more expensive problems down the line.

Stifled Life Goals: Inability to save for retirement, children’s education, or career changes.

Strategies for Staying Within Your Budget During House Hunting:

Establish a Strict Budget Line (and Stick to It): Your pre-approval letter sets the maximum, but your personal comfortable budget might be lower. Factor in all potential costs (PITI, utilities, maintenance, HOA, lifestyle) to determine your true affordability.

Differentiate Needs vs. Wants: Create a “must-have” and “nice-to-have” list. Be prepared to compromise on some “wants” to stay within your financial comfort zone.

Leverage Online Tools: Use detailed mortgage calculators that include taxes, insurance, and potential HOA fees to understand the total monthly payment for any property you consider.

Bring a Dispassionate Advisor: If possible, bring a trusted friend or family member (who understands your financial situation) to showings. They can offer a reality check when emotions run high.

Walk Away if Necessary: It’s tough, but if a home genuinely pushes you beyond your financial comfort zone, be prepared to walk away. There will always be another property. Your financial well-being is more important than any single house.

Mistake #8: Not Understanding the Legal Aspects

The US real estate market is governed by a complex web of local, state, and federal laws. Ignorance of these legal intricacies can lead to significant delays, unexpected costs, or even legal disputes down the road. This is particularly crucial in 2025, with increasing regulations and consumer protections.

Key Legal Aspects for US Homebuyers:

Title Search & Clear Title: A title company or attorney conducts a title search to ensure the seller has the legal right to sell the property and that there are no undisclosed liens, encumbrances (e.g., mortgages, tax liens, mechanic’s liens), easements, or claims against the property. A “clear title” is essential.

Purchase Agreement (Contract): This legally binding document outlines all terms of the sale. Understand every clause, including:

Contingencies: Conditions that must be met for the sale to proceed (e.g., financing contingency, inspection contingency, appraisal contingency).

Earnest Money: A deposit made to show your serious intent, typically held in escrow.

Closing Date: The agreed-upon date for the final transfer of ownership.

Included/Excluded Items: What appliances, fixtures, or personal property are part of the sale.

Seller Disclosures: Most states require sellers to disclose known material defects of the property. Review these carefully, and if anything seems amiss, investigate further.

Zoning Laws: Understand the zoning regulations for the property and neighborhood (e.g., residential, commercial, multi-family). This impacts future development, property use, and potential for additions.

Property Lines & Surveys: Ensure you understand the exact boundaries of your property. A survey can prevent future disputes with neighbors.

Homeowners Association (HOA) Documents: If applicable, thoroughly review the HOA’s Covenants, Conditions, and Restrictions (CC&Rs), bylaws, and financial statements. These dictate what you can and cannot do with your property, assess fees, and can significantly impact your lifestyle.

Role of Legal Professionals: In some states, a real estate attorney is mandatory; in others, a title company handles much of the legal paperwork. Regardless, consider hiring an attorney for independent advice to review contracts, especially in complex transactions.

Mistake #9: Rushing the Decision

Buying a home is a monumental decision, not one to be made under pressure or haste. While the 2025 market can sometimes move quickly, rushing your due diligence can lead to costly oversights and profound regrets. Impulsive purchases rarely align with long-term satisfaction.

When to Slow Down or Walk Away From a Deal:

Undisclosed or Major Property Concerns: If the home inspection reveals significant issues the seller failed to disclose, or if the repairs are too extensive or costly for your budget, it’s a major red flag.

Unfair Bargaining Practices: If the seller or their agent engages in coercive tactics, refuses reasonable negotiations, or demands terms that are clearly disadvantageous to you, reconsider.

Altered Personal Financial Circumstances: A job loss, unexpected major expense, or a change in interest rates that impacts your loan terms can necessitate stepping back. Don’t force a purchase if your financial situation changes.

Lack of Due Diligence Opportunities: If you’re pressured to waive contingencies (like inspection or appraisal) without a full understanding of the risks, that’s a sign to pause. While a competitive market may tempt you to waive some, understand the potential ramifications.

Gut Feeling: Trust your instincts. If something feels off, if you have persistent doubts, or if you simply don’t feel “right” about the property, it’s okay to walk away. Buyer’s remorse is a heavy burden.

No Time for Reflection: Ensure you have ample time to visit the property multiple times, discuss it with family, and sleep on the decision. Don’t let artificial deadlines push you into a decision you haven’t fully processed.

Remember, a good real estate agent will guide you through this process, but they work for you. You have the ultimate say.

Mistake #10: Neglecting to Plan for the Future

A home is more than just a place to live; it’s a long-term asset and a central component of your financial and life plan. Failing to consider your future needs and goals when purchasing can result in a home that quickly becomes unsuitable or even a financial liability.

Considering Long-Term Needs and Life Phases:

Family Growth (or Shrinkage): Do you plan to have children? Will elderly parents eventually move in? Consider the number of bedrooms, bathrooms, and overall living space required. A starter home might be perfect now but cramped in five years.

Location Relevance: Will the neighborhood still meet your needs as your family evolves? Evaluate access to good schools, parks, childcare, and healthcare facilities.

Career Changes & Commute: Will a potential career change impact your commute? Could the home accommodate a dedicated home office if remote work becomes a permanent fixture of your professional life?

Aging in Place: As you get older, accessibility features like single-level living, wider doorways, and walk-in showers might become important. Consider if the home could be adapted or if it would be suitable for resale to fund a more accessible property.

Financial Flexibility: How does this home purchase fit into your broader financial picture? Does it allow for future investments, retirement savings, or other life goals? Over-extending yourself now could limit future opportunities.

Long-Term Maintenance & Renovation Plans: Factor in the long-term costs of major systems replacement (roof, HVAC) and potential future renovations (kitchen, bathroom remodels) into your financial projections.

By adopting a long-term perspective, you can select a home that not only meets your immediate needs but also supports your evolving lifestyle and financial aspirations for decades to come.

Your Journey to Homeownership Starts Now

Navigating the complexities of the 2025 housing market requires diligence, expert guidance, and a proactive approach. Avoiding these ten common pitfalls won’t just save you money; it will save you stress, reduce risk, and fundamentally enhance your experience as a first-time homebuyer. Your home is more than an investment; it’s the backdrop to your life, and securing the right one requires careful planning and informed decisions.

Don’t let these potential missteps overshadow the excitement of buying your first home. Equip yourself with knowledge, align with trusted professionals, and make smart, strategic choices.

Ready to turn your homeownership dreams into a confident reality? Contact a local real estate expert or mortgage professional today to start building your personalized strategy and take the first informed step towards your future home.