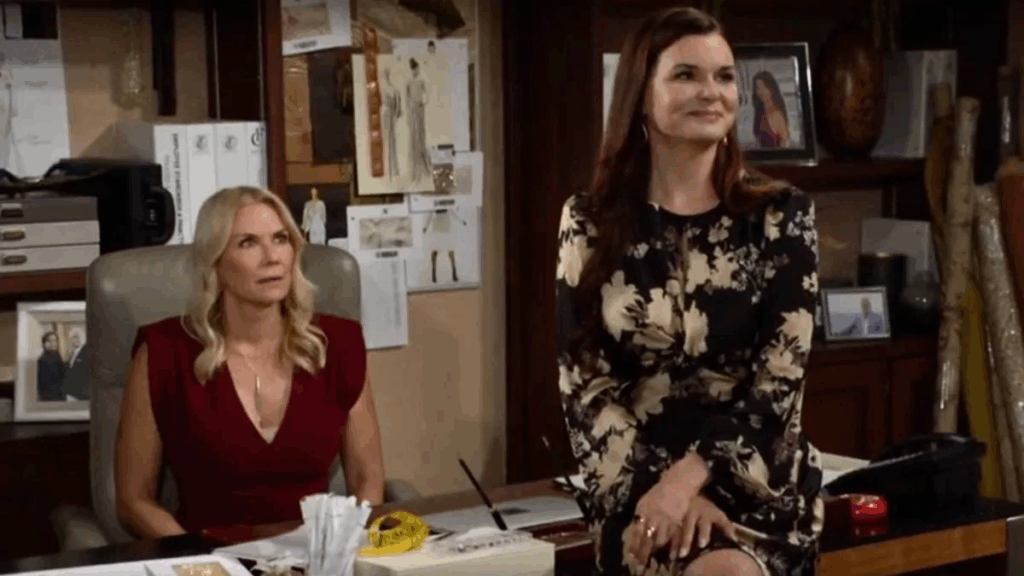

Tensions in The Bold and the Beautiful are at an all-time high as Ridge, Brooke, and Taylor’s love triangle spins into fresh chaos. Brooke Logan has been keeping quiet about what re

Your 2025 Homeownership Playbook: 10 Critical Mistakes First-Time Buyers Must Avoid

Buying your first home in the United States is an exhilarating milestone, a true cornerstone of the American Dream. Yet, in the dynamic 2025 housing market, it’s also an arena fraught with potential pitfalls for the uninitiated. With a decade of navigating these waters for countless first-time buyers, I’ve seen enthusiasm turn to frustration, and dreams delayed by avoidable missteps. My goal today is to arm you with the insider knowledge to make your home purchase not just successful, but genuinely empowering. We’ll dissect the ten most common blunders I’ve witnessed, offering a clear roadmap to navigate the complexities of homeownership with confidence.

Mistake #1: Skipping the Mortgage Pre-Approval Power Play

In a competitive market, a pre-approval letter isn’t just a suggestion; it’s your golden ticket. Many first-timers jump straight into house hunting, only to fall in love with a property they can’t afford, or worse, lose out on an offer because they weren’t taken seriously.

What is Mortgage Pre-Approval in the US?

Mortgage pre-approval is a formal assessment by a lender of your financial capacity to borrow. It involves a thorough review of your credit history (FICO scores are paramount here), income stability (W2s, tax returns, pay stubs), existing debts (student loans, car payments, credit cards), and assets (bank statements, investment portfolios). Unlike a simple pre-qualification, a pre-approval includes a hard credit pull and verification of your submitted documentation, giving you a conditional commitment for a specific loan amount.

Why Pre-Approval is Non-Negotiable for 2025 Buyers:

Realistic Budgeting: This process clarifies your true borrowing power, grounding your property search in financial reality. You’ll know your maximum loan amount, allowing you to factor in down payment and closing costs for a precise budget.

Competitive Edge: Sellers and their agents in 2025 are looking for certainty. A pre-approval letter signals you’re a serious, qualified buyer, significantly strengthening your offer against others who might only be pre-qualified or haven’t even started the financing process.

Streamlined Closing: Having most of your financial documentation pre-vetted dramatically accelerates the loan underwriting process once your offer is accepted, often leading to a quicker and smoother closing.

Early Issue Detection: The pre-approval phase is an opportune time to uncover and address any lurking credit report discrepancies or debt-to-income (DTI) ratio issues that could derail your mortgage application later. Catching these early gives you time to rectify them.

Navigating US Mortgage Pre-Approval:

Start by researching reputable lenders—local banks, credit unions, and national mortgage brokers. Each may offer slightly different rates and programs. You’ll typically need:

Photo ID: Driver’s License or Passport.

Proof of Income: W2s from the past two years, recent pay stubs (30-60 days), and if self-employed, two years of federal tax returns and profit & loss statements.

Asset Verification: Bank statements (last 2-3 months) for checking, savings, and investment accounts to show funds for down payment and reserves.

Debt Information: Details on existing loans (student, auto), credit cards, and any other financial obligations.

Once submitted, the lender performs a credit check, verifies your documents, and issues a pre-approval letter stating the maximum loan amount and terms, usually valid for 60-90 days.

Mistake #2: Underestimating the True Cost of Homeownership

Many first-time buyers fixate solely on the purchase price and monthly mortgage payment, blindsiding themselves to the myriad of “hidden” costs that define homeownership in the US. In 2025, these ancillary expenses can easily add tens of thousands to your initial outlay and hundreds to your monthly budget.

Key Costs Beyond the Sticker Price:

Closing Costs: These are significant, typically ranging from 2% to 5% of the loan amount, and cover:

Lender Fees: Origination fees, underwriting fees, discount points (optional, to lower interest rate).

Title Insurance: Protects both you and the lender from future claims against the property’s title.

Escrow Fees: Paid to a neutral third party (title company or attorney) to handle the transaction.

Appraisal Fee: Confirms the home’s value for the lender.

Survey Fee: Confirms property boundaries (often required).

Recording Fees: Paid to the local government to record the new deed.

Pre-paid Expenses: Pro-rated property taxes and homeowner’s insurance premiums due at closing.

Property Taxes: Varies drastically by state, county, and even specific city/school district. These are ongoing, annual costs, often escrowed into your monthly mortgage payment. For example, states like New Jersey or Illinois have significantly higher average property tax rates compared to Hawaii or Alabama. Always research the specific property’s tax history.

Homeowner’s Insurance: Mandatory for mortgage lenders, protecting against fire, theft, natural disasters. Premiums vary based on location (e.g., higher in coastal areas prone to hurricanes), deductible, and coverage.

Homeowners Association (HOA) Fees: If you’re buying a condo, townhouse, or home in a planned community, expect monthly or annual HOA fees. These cover shared amenities (pools, gyms) and maintenance of common areas. They can range from under $100 to over $1000 monthly; understand what’s included and the financial health of the HOA.

Utilities & Connections: Expect to pay for new utility accounts (electricity, gas, water, internet) and potentially connection fees.

Moving Expenses: Professional movers, truck rentals, packing supplies—these add up quickly.

Anticipating Maintenance & Repair Costs (2025 Perspective):

My rule of thumb for maintenance is to budget 1% to 2% of the home’s purchase price annually. With rising labor and material costs, this buffer is more crucial than ever.

Annual Maintenance: Routine upkeep like HVAC servicing, gutter cleaning, and landscaping can cost anywhere from a few hundred to a couple of thousand dollars per year.

Periodic Repairs:

Roofing: A new roof can be $8,000 – $30,000+, lasting 15-30 years.

HVAC System: Replacement can run $5,000 – $15,000, with a lifespan of 10-20 years.

Plumbing/Electrical: Minor repairs might be a few hundred dollars; major overhauls can be several thousand.

Appliance Replacement: Expect to replace major appliances every 10-15 years, costing hundreds to thousands each.

Painting: Exterior painting every 5-10 years can be $3,000 – $10,000+.

Factor these into your long-term financial planning to avoid being caught off guard.

Mistake #3: Neglecting In-Depth Neighborhood Research

A house is more than just four walls; it’s intrinsically tied to its surroundings. Many first-time buyers fall for a house only to discover the neighborhood isn’t a good fit, impacting everything from daily commute to long-term satisfaction and even resale value.

Crucial Factors for Locality Evaluation:

Safety & Crime Rates: Research local police department statistics, online crime maps, and community forums. Drive by at different times of day and night.

Accessibility & Commute: How long is the commute to work, schools, and essential services (grocery stores, pharmacies, doctors)? Evaluate public transportation options, if relevant. “Walk Score” and “Bike Score” can be helpful digital tools.

Schools: Even if you don’t have children, strong school districts significantly bolster property values. Research school ratings and zoning boundaries.

Amenities: Proximity to parks, shopping centers, restaurants, cultural venues, and recreational facilities. Does the neighborhood offer the lifestyle you desire?

Community Demographics & Culture: Spend time in the area. Do you see families, young professionals, retirees? Does the community vibe align with your preferences? Attend local events if possible.

Noise & Traffic: Visit during peak hours and quiet times. Is it under a flight path? Near a busy highway? Close to emergency services?

Future Development Plans: Crucial for 2025. Check with the local planning department for upcoming projects—new highways, commercial developments, public transit expansions, or even potential rezoning. These can dramatically impact property values, traffic, and quality of life, positively or negatively. Are there any gentrification trends you should be aware of?

Mistake #4: Overlooking the Non-Negotiable Home Inspection

In the rush to secure a deal, some buyers are tempted to waive the home inspection contingency, especially in a hot market. This is a gamble I never advise taking. A home inspection is your primary defense against inheriting costly, unforeseen structural or system issues.

What a US Home Inspection Covers:

A professional home inspection is a non-invasive visual examination of the physical structure and major systems of a residential property, from the foundation to the roof. Key areas include:

Structural Components: Foundation, grading, basement/crawl space, walls, ceilings, roof structure.

Exterior: Siding, windows, doors, decks, patios, driveways, drainage.

Roofing: Material, flashing, chimneys, gutters, downspouts.

Plumbing System: Water supply, distribution, drain, waste, vent systems, water heater.

Electrical System: Service entrance, main panel, wiring, outlets, switches.

HVAC System: Heating, ventilation, air conditioning units, ductwork.

Interior: Walls, floors, ceilings, doors, windows, fireplaces.

Appliances: Built-in appliances (oven, dishwasher, microwave).

Attic: Insulation, ventilation, framing.

Common Issues in US Homes:

While every home is unique, common issues often include:

Foundation Issues: Cracks, settling, water intrusion in basements/crawl spaces.

Water Damage: Leaky roofs, plumbing leaks, poor drainage leading to moisture in walls or ceilings.

Electrical Problems: Outdated wiring (knob-and-tube, aluminum), insufficient amperage, improperly grounded outlets, exposed wiring.

HVAC Malfunctions: Old units, poor maintenance, clogged ducts.

Roofing Defects: Missing shingles, damaged flashing, end-of-life material.

Pest Infestations: Termites, rodents, carpenter ants.

Safety Hazards: Unsafe stairs/railings, lack of smoke/carbon monoxide detectors, lead paint (in older homes), asbestos (in older homes), radon gas.

Finding a Reliable Home Inspector (USA):

Unlike some international markets, the US has established professional organizations for home inspectors. Look for inspectors certified by reputable bodies like the American Society of Home Inspectors (ASHI) or the International Association of Certified Home Inspectors (InterNACHI).

Get Referrals: Ask your real estate agent (a good one will have several trusted contacts), friends, or colleagues.

Check Credentials: Verify certifications, licensing (required in many states), and insurance (errors & omissions, general liability).

Review Sample Reports: A detailed report is critical. Ask for an example to see its thoroughness and clarity.

Read Reviews: Online platforms (Google, Yelp, Zillow) offer insights into client experiences.

Communicate: Discuss your concerns. It’s highly recommended to attend the inspection with the inspector, asking questions and learning about your potential new home firsthand.

Mistake #5: Emptying Savings for a Down Payment

While a larger down payment can reduce your monthly mortgage payment and potentially eliminate private mortgage insurance (PMI), completely depleting your savings is a precarious move. In 2025, economic uncertainties underscore the need for a robust financial safety net.

The Down Payment vs. Emergency Fund Balance:

My advice is unwavering: always maintain an emergency fund. At a minimum, aim for 3 to 6 months’ worth of essential living expenses after closing on your home. This cash cushion is vital for:

Unexpected Home Repairs: That new roof or HVAC system won’t wait for your next paycheck.

Job Loss or Income Disruption: Your emergency fund provides critical breathing room during unforeseen employment gaps.

Health Emergencies or Other Life Events: Life happens, and you don’t want your biggest asset to become a liability during a crisis.

Closing Costs & Moving Expenses: Remember, these are separate from your down payment.

Government Programs for First-Time US Buyers:

The US offers several programs designed to make homeownership more accessible:

FHA Loans (Federal Housing Administration): Low down payment (as little as 3.5%), more flexible credit requirements. Ideal for those with less-than-perfect credit or limited savings.

VA Loans (Department of Veterans Affairs): For eligible service members, veterans, and surviving spouses. Often require no down payment and have competitive interest rates.

USDA Loans (United States Department of Agriculture): For low-to-moderate-income buyers in eligible rural and suburban areas. Also often require no down payment.

Conventional Loans with Low Down Payments: Many conventional lenders offer programs with as little as 3% or 5% down, though PMI is usually required until you reach 20% equity.

Down Payment Assistance (DPA) Programs: State and local governments, as well as non-profits, offer grants or second mortgages to help cover down payments and closing costs. These can be significant and are worth researching in your specific area.

Alternative Down Payment Sources (with Caution):

Gifts from Family Members: A common practice, but ensure proper documentation (gift letter) is provided to the lender, confirming it’s not a loan.

Employer Assistance Programs: Some companies offer housing assistance or relocation packages.

401(k) Loans: You can borrow from your retirement account. This offers a low-interest loan to yourself, but carries risks: if you leave your job, the loan may become immediately repayable, and you miss out on market gains. Consult a financial advisor.

Crowdfunding or Personal Loans: Generally considered last resorts due to high interest rates and potential lender scrutiny.

Mistake #6: Ignoring Resale Value – The Long Game

Many first-time buyers get caught up in the excitement of buying a home and overlook the eventual need to sell it. While this might be your “forever home” for now, life changes, and understanding resale value is critical to maximizing your investment.

Factors Dictating Resale Value in the US Market:

Location, Location, Location: This classic real estate mantra holds true. Proximity to desirable schools, major employment centers, public transport, parks, and vibrant downtown areas always commands a premium.

Infrastructure Development: Look for areas with ongoing or planned infrastructure improvements – new roads, updated utilities, public transit expansions. These signal growth and often precede property value appreciation. Conversely, declining infrastructure can hurt value.

Builder Reputation & Construction Quality: Well-known, reputable builders who prioritize quality craftsmanship often see their homes maintain value better. Poor construction can lead to costly repairs down the line, deterring future buyers.

Property Condition & Updates: A well-maintained home with modern, tasteful updates (kitchen, bathrooms) will always fare better than one requiring significant work. Future buyers are often willing to pay a premium for move-in readiness.

Curb Appeal: The first impression matters. A well-landscaped yard, inviting exterior, and good overall appearance add significant perceived value.

Market Trends: Stay aware of broader real estate trends—is the area growing, declining, or stable? Understanding local supply and demand dynamics is key.

Before committing, consider if the home has universal appeal or is highly specialized. A unique, quirky home might appeal to a niche market, but a more conventional layout often has broader appeal and thus a larger pool of potential buyers later.

Mistake #7: Falling in Love with a Home Beyond Your Budget

This is perhaps the most emotionally driven mistake, and one that leads to significant financial strain and buyer’s remorse. It’s easy to get swept away by granite countertops or a killer view, forgetting the harsh realities of your budget.

The Peril of Emotional Overspending:

Falling for a home that pushes you beyond your comfort zone isn’t just about higher monthly payments. It can:

Strain Your Finances: Leaving no room for savings, emergencies, or enjoying life outside your home.

Limit Future Opportunities: Make it harder to save for retirement, your children’s education, or other investments.

Lead to Buyer’s Remorse: The “dream home” quickly becomes a financial nightmare.

Risk Foreclosure: In extreme cases, if unforeseen circumstances arise, an already stretched budget offers no buffer.

Staying Within Budget During Your 2025 House Hunt:

Establish a Strict Budget (and Stick To It): Your pre-approval offers a maximum loan amount, but your budget should be what you’re truly comfortable with, factoring in all homeownership costs, savings goals, and lifestyle choices. Use online affordability calculators.

Prioritize Wants vs. Needs: Create a list. What are your absolute non-negotiables? What are nice-to-haves that you could live without or add later? Be disciplined. A “must-have” often becomes a “wish I hadn’t paid so much for” a few years later.

Leverage Your Real Estate Agent: A good buyer’s agent is your ally. Clearly communicate your budget, and insist on only seeing properties within that range. They should help you analyze comparable sales (comps) to ensure you’re not overpaying.

Utilize Online Tools Wisely: While browsing sites like Zillow or Realtor.com is fun, filter by your actual budget. Don’t let aspirational listings tempt you.

Think Long-Term: Will this payment be comfortable if interest rates rise slightly (for ARMs), or if your income fluctuates?

Remember, there’s always another house. Patience and discipline will serve your financial health far better than impulsive emotional decisions.

Mistake #8: Not Understanding the Legal Aspects of US Real Estate

The US real estate market is governed by a complex web of federal, state, and local laws. Ignorance of these legal intricacies can lead to costly disputes, title issues, or even invalidate your purchase. Don’t rely solely on verbal agreements; everything must be in writing.

Common Legal Issues in US Real Estate:

Unclear or Cloudy Title: Issues like unreleased liens, easements, boundary disputes, or previous undisclosed ownership claims can halt a sale or create future headaches. This is why title insurance is crucial.

Easements & Encroachments: Does a neighbor have the right to use a portion of your property (easement)? Does your fence or structure cross onto a neighbor’s property (encroachment)? A property survey clarifies these.

Zoning Laws & Restrictive Covenants: What is the property zoned for (residential, commercial, multi-family)? Are there restrictive covenants (e.g., HOA rules) that dictate what you can and cannot do with your property (e.g., fence height, parking restrictions, exterior modifications)?

Seller Disclosure Requirements: Most states require sellers to disclose known defects or issues with the property (e.g., lead paint, radon, water damage, structural problems). Review these forms meticulously.

Permit Issues: Were all past renovations or additions properly permitted by the local authorities? Unpermitted work can lead to fines, forced removal, or difficulties selling in the future.

Contractual Disputes: The purchase agreement is a legally binding document. Understanding contingencies (inspection, financing, appraisal), timelines, and default clauses is paramount. Work closely with your agent and, if necessary, a real estate attorney.

Property Line Disputes: Understanding your exact property boundaries prevents disputes with neighbors down the road.

Your Legal Safeguards:

Real Estate Agent: A licensed agent is knowledgeable about local laws and standard contracts.

Title Company/Escrow Agent: They conduct a thorough title search to identify any liens or encumbrances.

Real Estate Attorney: While not always mandatory, in some states (e.g., New York, Massachusetts), attorneys are standard in real estate transactions. Even where not required, consulting one for complex deals or specific concerns can be invaluable. They can review contracts, ensure all documents are legally sound, and represent your interests.

Mistake #9: Rushing the Decision – The Pace of the Market

In a fast-paced 2025 market, the pressure to “act now or lose out” can be intense. While speed is sometimes necessary, rushing a home purchase often leads to overlooking critical details, buyer’s remorse, or accepting unfavorable terms.

The Detriment of Impulsive Buying:

Making such a significant financial and lifestyle decision under duress can result in:

Overpaying: Not having enough time to compare comparable sales or negotiate effectively.

Overlooking Red Flags: Missing critical inspection items, neighborhood issues, or legal complications.

Future Dissatisfaction: Buying a home that doesn’t truly meet your needs or long-term goals.

Increased Stress: The entire process becomes a frantic scramble.

Knowing When to Walk Away from a Deal:

Undisclosed Property Concerns: If the inspection reveals major structural, system, or safety issues that the seller wasn’t transparent about, and they refuse to negotiate repairs or a credit.

Seller’s Lack of Fair Bargaining: If the seller is inflexible, refuses reasonable requests, or acts in bad faith during negotiations.

Altered Personal Financial Circumstances: A job loss, unexpected medical expense, or change in loan terms can make a home suddenly unaffordable. It’s okay to reassess.

Coercive Tactics: If your agent, the seller, or anyone involved is pressuring you to waive contingencies, skip due diligence, or make a decision before you’re ready. Trust your gut.

Appraisal Gap: If the home appraises for significantly less than your offer, and you cannot (or choose not to) cover the difference.

Financing Falls Through: Despite pre-approval, unforeseen issues can arise with your loan.

A good real estate agent will advise you on strategy but never pressure you into a decision. Your long-term satisfaction and financial well-being are paramount.

Mistake #10: Neglecting to Plan for the Future

Your home is a long-term asset and a reflection of your life’s journey. Many first-time buyers focus solely on immediate needs, failing to anticipate how their life might evolve and how their home will fit into that future.

Considering Long-Term Family & Lifestyle Needs:

Family Growth or Shrinkage: Are you planning to have children, or are your children grown and soon to leave the nest? Will elderly parents eventually live with you? Consider the number of bedrooms, bathrooms, and overall living space needed.

Accessibility: As you age or if family members have mobility challenges, features like single-story living, wider doorways, or ground-floor bedrooms become crucial.

School Districts: Even if you don’t have kids now, a home in a strong school district enhances resale value and is a major consideration if children are in your future.

Work-Life Balance & Remote Work: The 2025 landscape sees more flexible work arrangements. Do you need a dedicated home office, or even two? Good internet infrastructure is vital.

Lifestyle Changes: Do you envision taking up new hobbies requiring specific space (e.g., a workshop, art studio)? Do you plan to entertain frequently, needing an open-concept living area or a spacious backyard?

Financial Flexibility: Will your home payment still be comfortable if one spouse decides to stay home with kids, or if you change careers? Does it allow for future investments or retirement savings?

Exit Strategy: While you’re buying, also think about how easy it would be to sell this home in 5, 10, or 20 years.

A home is more than just a place; it’s a foundation for your life. By thinking ahead, you can choose a home that grows with you, minimizing the need for another costly and stressful move down the line.

Avoiding these ten common mistakes doesn’t just save you money and headaches; it empowers you to make a smart, informed investment that supports your lifestyle and financial goals. The 2025 US housing market offers unique opportunities, but also demands diligence and foresight.

Ready to transform your home-buying journey from daunting to definitive? Let’s connect. Share your specific aspirations and concerns, and together, we’ll craft a strategy that secures your ideal home with confidence and clarity.